The inventory market is roaring to this point in 2024. Each the Nasdaq Composite and S&P 500 have gained roughly 11% because of tailwinds within the expertise, power, and pharmaceutical industries.

Whereas regular development and powerful enterprise fundamentals are sometimes correlated with a rising inventory value, there are different issues that may occur to affect shopping for and promoting exercise. As a rule, inventory splits result in irregular, but temporary, volatility in share costs. Many outstanding companies together with Nvidia, Amazon, Alphabet, Tesla, Apple, and Novo Nordisk have accomplished splits lately.

Moreover, in simply the previous few months, many companies within the retail sector have additionally introduced inventory splits. Let’s discover why splits happen and the way they’ll have an effect on a inventory. Furthermore, I will clarify why I see Costco Wholesale (NASDAQ: COST) as a possible inventory cut up candidate.

Why do inventory splits happen?

Inventory splits generally is a little powerful to know. When an organization splits its inventory, the variety of excellent shares rises by the quantity within the proposed cut up. For instance, if an organization introduced a 3-for-1 cut up and also you owned 100 shares in that firm previous to the cut up, you’ll personal 300 after the cut up.

On the identical time, whereas the excellent share rely rises by the ratio within the cut up, the inventory value falls by that very same issue. Following the instance above, to illustrate you owned 100 shares at a value level of $30 earlier than the cut up. As soon as the cut up goes into impact, you’ll personal 300 shares however at a value of $10.

Because the share rely rises and the inventory value decreases by the identical ratio, the general market cap of the corporate stays unchanged.

Typically, inventory splits happen as a result of an organization’s share value has risen exponentially. As such, a rising inventory value may result in depressed buying and selling exercise as shares appear out of attain for the common investor.

Whereas a inventory cut up doesn’t inherently change the worth of the enterprise, many traders will understand the lower cost as a possibility to purchase shares at a greater worth.

In essence, inventory splits theoretically enable a broader base of traders to purchase shares who in any other case have been avoiding the inventory attributable to its unaffordable-looking value.

Why may Costco cut up its inventory?

Previously 12 months, notable inventory splits outdoors of massive tech and healthcare embody beverage maker Celsius and big-box retailer Walmart.

Extra not too long ago, different companies adjoining to the retail sector have proposed inventory splits. Particularly, fast-casual restaurant chain Chipotle Mexican Grill is ready on shareholder approval for a 50-for-1 cut up. In the meantime, Sony additionally not too long ago introduced its intention to pursue a inventory cut up.

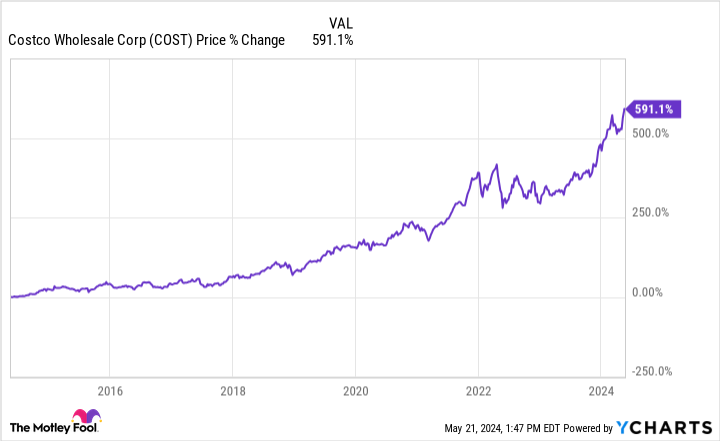

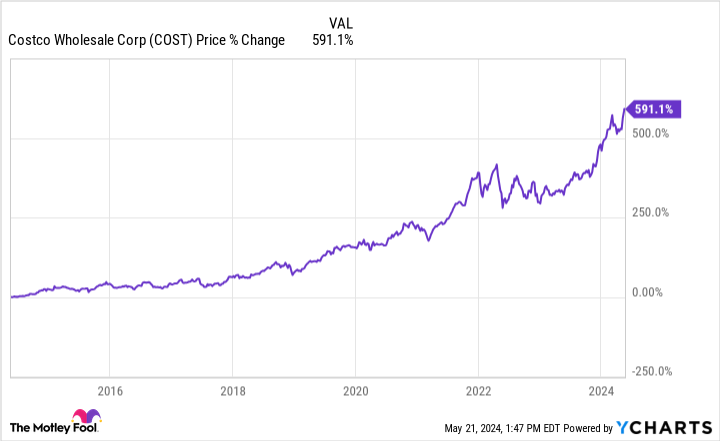

Trying on the chart under, traders can see that Costco has been an amazing inventory over the past decade. Shares have soared practically 600%, reaching a present value of $795, close to its all-time excessive.

Contemplating Costco hasn’t had a inventory cut up since 2000, mixed with its hovering returns and seemingly expensive shares, I’d not be stunned to see administration announce a cut up someday.

Costco is a purchase it doesn’t matter what occurs

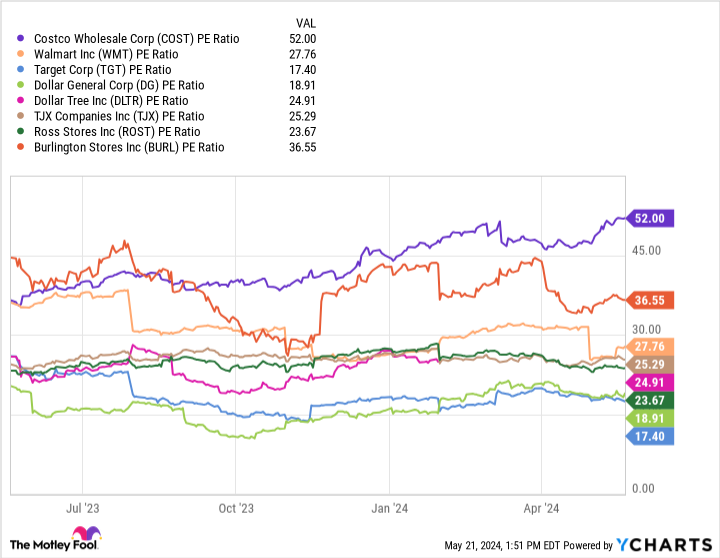

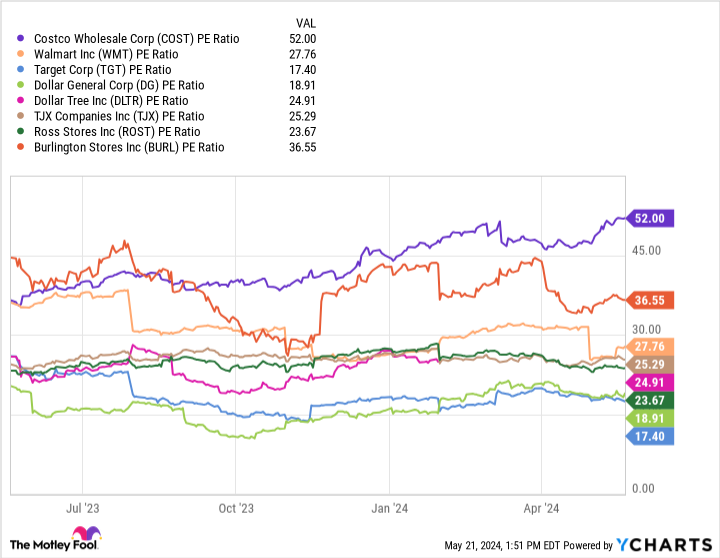

As I expressed beforehand, wanting on the share value alone will not do a lot to assist traders decide if a inventory is overvalued or not. To be able to actually get a glimpse of a inventory’s relative worth, traders ought to benchmark the corporate in opposition to a peer set.

The chart above compares Costco to a cohort of different big-box retailers in addition to cost-conscious brick-and-mortar shops by their price-to-earnings (P/E) ratio. With a P/E of 52, Costco is the costliest inventory amongst its friends based mostly on this valuation metric. Regardless of the expensive nature of its shares, I nonetheless view Costco as a compelling alternative.

Whereas bodily retail faces stiff competitors from e-commerce and on-line marketplaces, Costco is exclusive. The corporate boasts an unlimited quantity of shopper staples — the sorts of products and companies that folks will want no matter financial situations.

Regardless of lingering inflation and excessive borrowing prices, Costco’s enterprise remains to be able of energy. Furthermore, the notable valuation premium above its competitors may sign that traders see the corporate as a superior inventory amongst main retailers.

Though a inventory cut up may make numerous sense, traders should not sit on the sidelines and look ahead to one. It’d by no means occur. As a substitute, given Costco’s place amongst big-box and cost-conscious retail, mixed with its capacity to truly profit throughout inflationary environments and in any other case, I feel scooping up shares proper now and holding for the long run makes numerous sense.

Do you have to make investments $1,000 in Costco Wholesale proper now?

Before you purchase inventory in Costco Wholesale, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Costco Wholesale wasn’t certainly one of them. The ten shares that made the lower may produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $652,342!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of Might 13, 2024

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Alphabet, Amazon, Apple, Novo Nordisk, Nvidia, and Tesla. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Celsius, Chipotle Mexican Grill, Costco Wholesale, Nvidia, Goal, Tesla, and Walmart. The Motley Idiot recommends Novo Nordisk and Tjx Corporations. The Motley Idiot has a disclosure coverage.

Prediction: This Large-Field Retailer Will Observe Walmart and Cut up Its Inventory in 2024 was initially revealed by The Motley Idiot