Utilities function very boring companies. They distribute electrical energy and pure fuel to prospects below government-regulated price constructions. There is not numerous upside on this enterprise (demand and charges are comparatively regular), however there’s additionally not a lot draw back. Due to that, utilities generate fairly secure returns, a big portion of which comes from their high-yielding dividend funds.

Buyers looking for so as to add extra stability to their portfolio ought to take into account shopping for a boring utility inventory. Black Hills (NYSE: BKH), Consolidated Edison (NYSE: ED), and Duke Power (NYSE: DUK) stand out to some Idiot.com contributors as nice choices for these looking for a high-yielding and sustainable dividend.

Black Hills is the mouse that roared

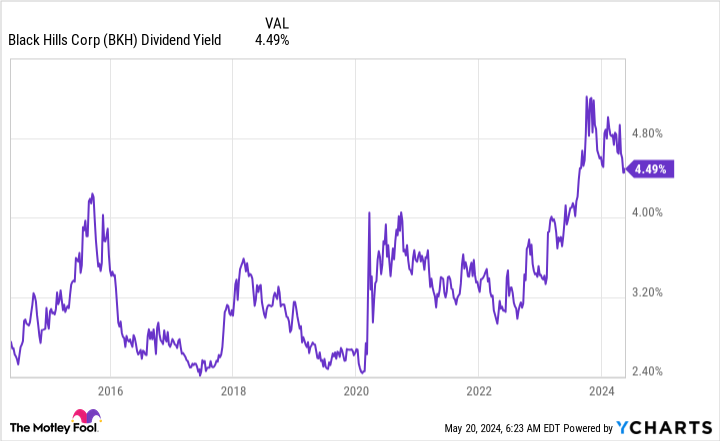

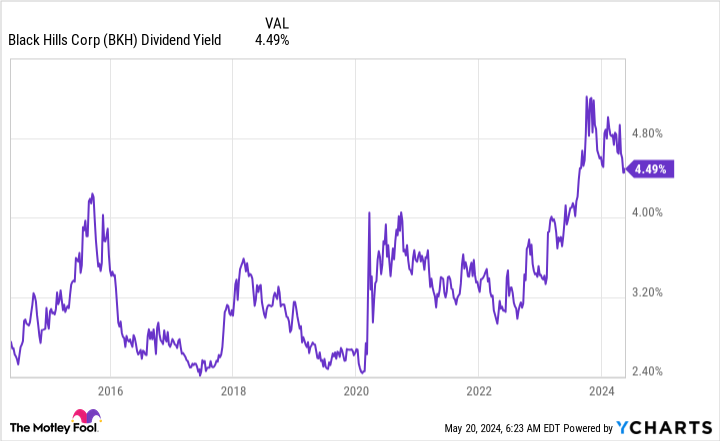

Reuben Gregg Brewer (Black Hills): Relating to utility shares, Black Hills, with a $3.9 billion market cap, is one that always slips below the radar display screen. That is a disgrace as a result of the regulated pure fuel and electrical utility is a Dividend King with 54 consecutive years of annual dividend will increase behind it. The typical dividend improve over the previous three-, five-, and 10-year durations are throughout 5%, displaying unbelievable consistency. In the meantime, the yield is at present round 4.5%, which is towards the excessive finish of the yield vary over the previous decade.

In different phrases, Black Hills seems to be like it’s a Dividend King that is been placed on the sale rack. There is a good purpose for that, nevertheless, as a result of working a utility is a capital-intensive enterprise. The sharp rise in rates of interest will improve Black Hills’ prices going ahead. There is not any approach round that, noting additionally that the utility tends to make use of extra leverage than a few of its bigger friends.

That stated, Black Hills’ buyer development has elevated at almost thrice the speed of U.S. inhabitants development. It operates in very engaging markets in Arkansas, Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming. And that means that regulators will, in time, alter the corporate’s price construction to account for the change in rates of interest. In case you have the persistence to attend for that to occur, you may acquire a traditionally excessive dividend yield from a reasonably boring Dividend King utility.

The king of consistency

Matt DiLallo (Consolidated Edison): Consolidated Edison supplies electrical energy and pure fuel to prospects within the New York Metropolis metro space. Whereas utilities are boring companies, they generate very predictable money movement backed by regular demand and government-regulated price constructions. That gives Consolidated Edison with secure revenue to pay dividends and put money into sustaining and increasing its utility infrastructure.

The utility hit a serious dividend milestone earlier this yr. It delivered its fiftieth consecutive annual dividend improve. That is the longest interval of consecutive dividend will increase amongst utilities listed within the S&P 500. It additionally ushered the corporate into the elite group of Dividend Kings. Consolidated Edison’s elevated payout at present yields rather less than 3.5%, which is greater than double the S&P 500’s dividend yield (round 1.3% primarily based on dividend funds over the previous yr).

Whereas the corporate expects to proceed rising its dividend, development will possible be reasonable. Consolidated Edison plans to focus on a dividend payout ratio of 55%-65% of its adjusted earnings to fund greater ranges of funding amid the clear power transition. That is down from its prior goal of 60% to 70%. It plans to retain extra of its earnings to internally fund development. This technique ought to allow Consolidated Edison to develop its earnings per share sooner sooner or later. That positions it to probably produce greater whole returns when including its dividend revenue to the inventory worth appreciation it ought to ship as its earnings develop.

Consolidated Edison’s dividend ought to turn into extra sustainable over the long term because it lowers its payout ratio and invests in supporting the clear power transition. These options make it a horny choice for these looking for a very bankable revenue stream.

This utility’s narrowing focus ought to pay massive dividends

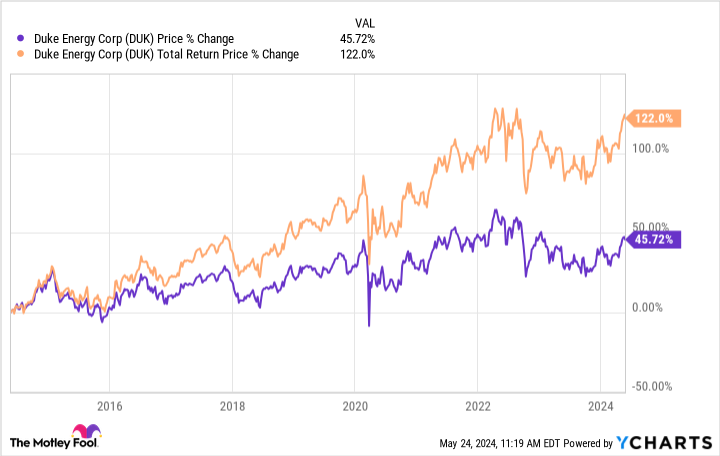

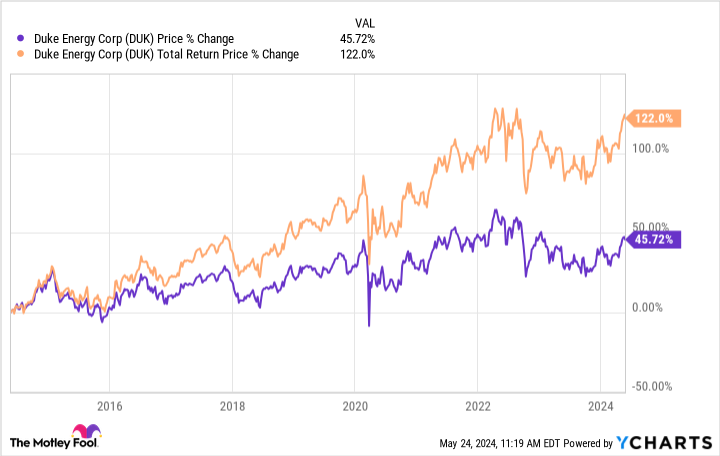

Neha Chamaria (Duke Power): Duke Power is likely one of the largest regulated utilities within the U.S. and operates in rising locations like Florida and the Carolinas, amongst others. In actual fact, the corporate bought its unregulated business renewable power enterprise in 2023 for $2.8 billion and have become a completely regulated utility. The corporate stated it’s going to use the web proceeds of roughly $1.1 billion from the sale to pare down debt and strengthen its steadiness sheet.

2023 was additionally a robust yr for Duke Power because it added the biggest variety of prospects in its historical past and boosted its five-year capital funding plan to $73 billion to drive its transition to wash power. The utility large is focusing on net-zero carbon emissions from energy era by 2050 and has, subsequently, deliberate huge investments to improve its electrical energy grid and broaden its power storage, renewables, pure fuel, and nuclear power belongings within the coming years.

Backed by a completely regulated portfolio of belongings in rising jurisdictions, Duke Power expects to develop its adjusted earnings per share by 5% to 7% by 2028. When coupled with a dividend yield of 4%, administration believes buyers in Duke Power may earn almost 10% annualized returns. Duke Power can also be a bankable dividend inventory. It has paid a dividend each quarter for 98 years and has grown its dividend over time. That dividend development has massively boosted shareholder returns to date. Prior to now 10 years, Duke Power inventory has greater than doubled buyers’ cash when factoring in dividends.

With Duke Power now absolutely pivoting to regulated companies and fortifying its steadiness sheet, revenue buyers have stable purpose to think about this boring utility inventory

Do you have to make investments $1,000 in Duke Power proper now?

Before you purchase inventory in Duke Power, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 finest shares for buyers to purchase now… and Duke Power wasn’t one in all them. The ten shares that made the lower may produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $652,342!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of Could 13, 2024

Matt DiLallo has no place in any of the shares talked about. Neha Chamaria has no place in any of the shares talked about. Reuben Gregg Brewer has positions in Black Hills. The Motley Idiot recommends Duke Power. The Motley Idiot has a disclosure coverage.

3 Excessive-Yield Shares to Purchase in This Boring Sector was initially printed by The Motley Idiot