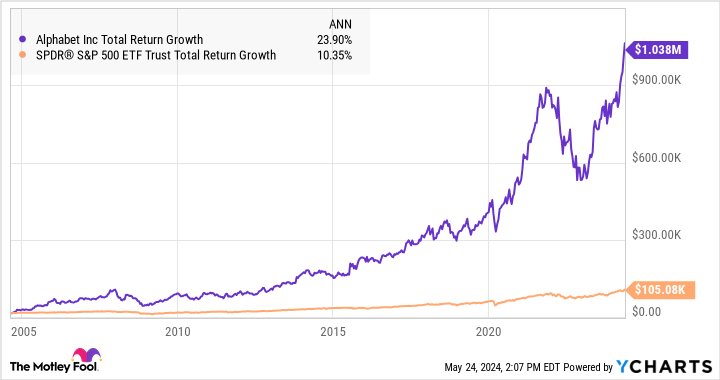

On-line companies big Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) has made loads of millionaires through the years. You’d have greater than one million {dollars} within the Google dad or mum’s inventory right this moment if you happen to invested simply $15,000 when it entered the general public inventory market in 2004. Should you put the identical money to work in a broad market tracker just like the SPDR S&P 500 ETF Belief (NYSEMKT: SPY) as a substitute, you’d have a complete return of simply $105,000:

The key sauce in million-dollar portfolios: Time and persistence

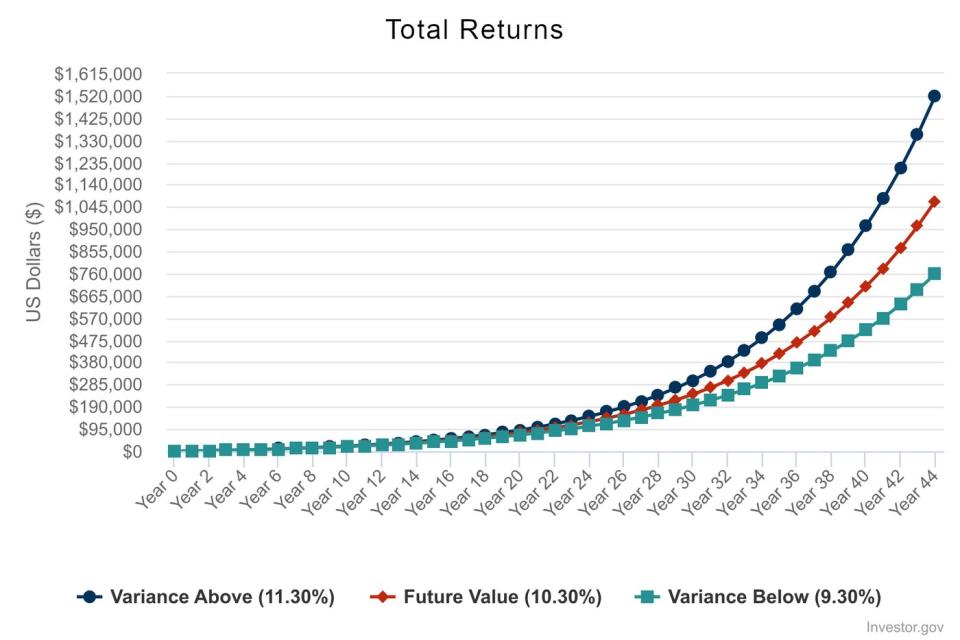

However you’ll be able to construct a million-dollar portfolio with out market-crushing stars. Take the index tracker’s compound common returns of 10.3% over that 20-year interval, commit to creating a modest funding each month, and let it run for a couple of extra years.

For instance, think about organising an computerized funding of $100 monthly on the age of 20. There is not any seed cash to begin that portfolio, no contribution will increase over time, and also you’re sticking with that S&P 500 (SNPINDEX: ^GSPC) index tracker, routinely reinvesting its dividends in additional shares of the exchange-traded fund (ETF) alongside the way in which.

$100 a month is not nothing, however the dedication is arguably sufficiently small to work for most individuals with a day job. 44 years later, on the cheap retirement age of 64, you’ll have invested a grand whole of $52,800 in a easy index ETF. And because of the magic of compound returns, you’d have about $1.07 million in your retirement account.

The larger they’re, the more durable they fall

Many diversified mutual funds or ETFs can deal with a long-term funding like the instance above. Set it, neglect it, and snicker all the way in which to the financial institution after a couple of a long time.

However only a few single shares can carry that load. Oceans rise, empires fall, and even essentially the most strong giants aren’t proof against sudden downturns, shifting client tastes, and technological progress. Let’s take a look at a few examples.

-

On the flip of the millennium, Common Electrical (NYSE: GE) boasted the second-largest market cap of all at $508 billion. By now, the commercial empire has break up into three separate firms whose market caps add as much as about half of the January 2000 footprint.

-

Enron or Lehman Brothers are extra dramatic examples of crumbling empires, and the listing is lengthy. Among the many 1,925 shares within the Russell 2000 index, solely 640 have a inventory market historical past of not less than 25 years.

-

As soon as, I purchased a sofa with a lifetime guarantee from what had as soon as been the most important division retailer of all. Six months and a foul vacation season later, Montgomery Ward filed for chapter and liquidated the entire enterprise. the corporate could not deal with the one-two punch of big-box retailers and the early years of on-line procuring. A lot for lifetime warranties.

Why Alphabet is constructed to final

In gentle of those examples, it is clear that only a few firms might be anticipated to thrive over a number of a long time. Nevertheless, there are exceptions to the rule — and I imagine Alphabet is a type of uncommon survivors.

Constructed to thrive in a wide range of financial environments due to the ultra-flexible Alphabet umbrella group, Alphabet has the flexibility to increase and discover in many alternative industries. If the web search and promoting revenues dry up, Alphabet would depend on the Android smartphone, YouTube video platform, and Google Cloud decentralized computing service within the brief time period. In the meantime, promising facet gigs just like the Waymo self-driving taxi service, Calico medical analysis group, or Verily well being information unit might choose up the long-term baton. Or perhaps Google Cloud will simply run with it as a substitute, powered by its synthetic intelligence experience.

Alphabet’s portfolio of potential enterprise stars will change over time, and I in all probability have not even seen their greatest concepts but. And that is precisely why I believe the corporate is able to run for many years to return. I do not advocate placing your complete nest egg in a single basket, until that basket holds a diversified fund — however if you happen to completely need to do it, Alphabet’s inventory is on the prime of my candidates listing.

A versatile enterprise mannequin and confirmed success in constructing sturdy expertise options place Alphabet to match and even exceed the S&P 500’s long-term returns. And if the inventory can certainly outperform the common S&P 500 returns in the long term, you may attain your million-dollar retirement objective even quicker.

And a small enhance to the return fee would make an enormous distinction in 44 years — beating the Road’s common returns by a single proportion level provides you a $1.5 million portfolio ultimately:

Must you make investments $1,000 in Alphabet proper now?

Before you purchase inventory in Alphabet, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Alphabet wasn’t one among them. The ten shares that made the minimize might produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $652,342!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of Could 13, 2024

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Anders Bylund has positions in Alphabet. The Motley Idiot has positions in and recommends Alphabet. The Motley Idiot has a disclosure coverage.

Might Alphabet Inventory Assist You Retire a Millionaire? was initially revealed by The Motley Idiot