The time has come: Nvidia‘s (NASDAQ: NVDA) long-awaited first-quarter report rounded out an thrilling earnings season for synthetic intelligence (AI) buyers.

Certainly, income is hovering due to surging demand for Nvidia’s H100, A100, and new Blackwell graphics processing items (GPUs). Even higher? The corporate’s pricing energy helps Nvidia obtain constant margin growth and profitability.

Nvidia is at present driving a once-in-a-generation development wave. There’s a lot info packed into their earnings report, it is simple to develop into distracted by the most recent file the corporate posted.

Whereas the monetary efficiency is undoubtedly spectacular, there was one a part of the earnings report that actually caught my eye: Nvidia introduced a 10-for-1 inventory break up.

In accordance with the earnings launch, buyers proudly owning shares of Nvidia as of market shut on June 6 shall be eligible for split-adjusted shares.

Let’s break down how inventory splits work, and discover why scooping up shares of Nvidia now could possibly be a good suggestion.

How do inventory splits work?

Inventory splits are a type of monetary engineering. When an organization splits its inventory, two essential issues occur.

First, the variety of excellent shares will increase by the ratio proposed within the break up. Second, because the variety of excellent shares rises, the inventory value subsequently drops by the identical ratio.

If Nvidia’s 10-for-1 break up have been to enter impact at this time, anybody proudly owning Nvidia inventory would obtain 9 extra shares for each one share that they personal. However on the identical time, your common price per share can be diminished by an element of 10.

Because the share rely and the inventory value change by the identical ratio, the market cap for Nvidia theoretically stays unchanged.

Nonetheless, that is seldom the case. Let’s check out Nvidia’s stock-split historical past.

Has Nvidia break up its inventory earlier than?

Nvidia has accomplished 5 inventory splits since going public. The final time Nvidia break up its inventory was July 20, 2021.

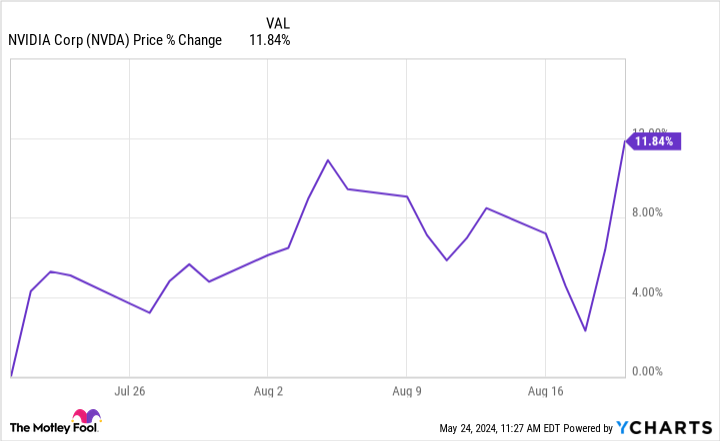

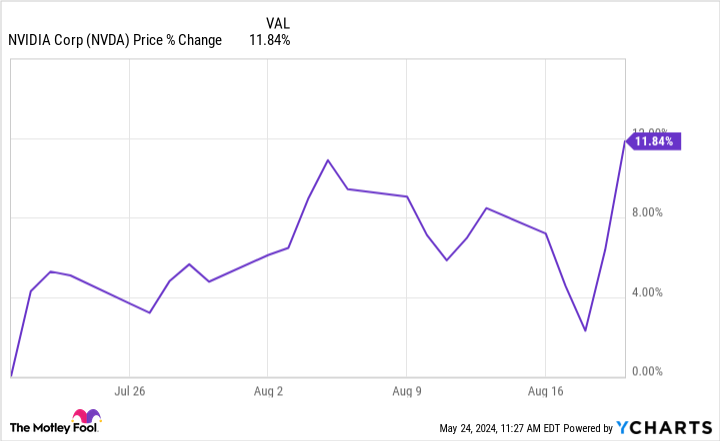

The chart under illustrates actions in Nvidia inventory 30 days after finishing its 4-for-1 break up in July 2021.

The final time Nvidia break up its inventory, buyers loved practically a 12% return in only one month following the break up. By the top of December 2021, Nvidia inventory had rallied an eye-popping 58% from the day it break up in July.

Is now a great time to purchase Nvidia inventory?

Typically talking, buying and selling exercise will increase when an organization conducts a inventory break up. The reason being as a result of although the break up doesn’t inherently change the valuation of the corporate, shares are perceived as inexpensive.

In different phrases, since a break up forces the inventory value to go down, many buyers assume the inventory is on sale and that they’re benefiting from a less expensive value. This isn’t the case, and it is all psychological.

Now, with Nvidia inventory buying and selling over $1,000 per share, it is probably that many retail buyers view the inventory as costly. However take into account, although the post-split value for Nvidia inventory can be roughly $100, the charts above level out that stock-split shares can expertise outsize momentum. This implies costs can rise sharply in a brief time frame, and buyers are literally shopping for shares at a larger valuation in comparison with pre-split ranges.

Since Nvidia’s final break up in July 2021, shares have rallied greater than 450%. This abnormally excessive return has catapulted Nvidia to the world’s third most respected enterprise — solely behind Microsoft and Apple.

That is the place valuation evaluation turns into essential. Proper now, Nvidia inventory trades at a price-to-free-cash-flow a number of of 66. This might sound excessive, even for a development inventory. Nonetheless, that is truly materially decrease than Nvidia’s common during the last three and 5 years.

Furthermore, Nvidia’s closest rival, Superior Micro Units, trades at a price-to-free-cash-flow ratio of 230x. Contemplating AMD is not rising anyplace close to commensurate charges to that of Nvidia, I would say that Nvidia inventory seems extra enticing.

Whereas Nvidia inventory would possibly seem dear, the analyses above illustrate that the corporate is definitely buying and selling at a extra normalized degree in comparison with its largest competitor. Furthermore, given the historic traits from Nvidia’s final inventory break up, I am pretty assured that the inventory may witness some newfound consideration following the break up.

For these causes, I would encourage buyers to contemplate scooping up shares in Nvidia inventory earlier than June 6. Whereas it might be tempting to flip shares for a fast revenue following the break up, the return over the previous couple of years speaks for itself.

Traders ought to make use of a long-term time horizon and permit the day merchants to enter and exit across the time of the break up. The longer-term themes showcase that purchasing shares earlier than a break up and holding them for a number of years is the superior technique.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Nvidia wasn’t considered one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… when you invested $1,000 on the time of our advice, you’d have $671,728!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of Might 28, 2024

Adam Spatacco has positions in Apple, Microsoft, and Nvidia. The Motley Idiot has positions in and recommends Superior Micro Units, Apple, Microsoft, and Nvidia. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

Ought to You Purchase Nvidia Inventory Earlier than June 6? was initially revealed by The Motley Idiot