The dimensions of Chipotle’s (NYSE: CMG) parts has come below scrutiny just lately due to a viral development on social media app TikTok — prospects have been videoing staff making their burrito bowls to ensure they have been filling them correctly.

The beginning of this development will be traced to influencer Keith Lee, who has over 16 million followers, and who criticized the corporate for its shrinking parts. This prompted some Chipotle prospects to start videoing the chain’s staff to incentivize them to provide them extra meals. Increasingly more prospects adopted swimsuit.

This development may impression the corporate’s outcomes and inventory within the quick time period, and will have longer-term implications as nicely.

My latest Chipotle orders

Since these complaints about Chipotle’s parts went viral, I’ve ordered bowls from Chipotle twice from two totally different areas in two totally different states. Instantly following the hoopla, I positioned a steak bowl order for pick-up by way of a drive-thru “Chipotlane” and acquired the fullest bowl I’ve ever gotten. No video was wanted (or doable), and the portion measurement was nice.

Two days later, I ordered two extra bowls at my native Chipotle, and the outcomes have been utterly totally different. One bowl was about half the scale of the one I had gotten two days earlier and the opposite was possibly a 3rd of that measurement. The chips have been additionally stale.

After I reached out to customer support, they gave me two BOGO (purchase one, get one free) provides to make use of within the subsequent 30 days and a free chips and guacamole reward. In addition they stated they’d contact the shop’s supervisor.

Over the previous yr, I’ve constantly had points each with meals high quality and parts at my native Chipotle, which is one cause I’ve prevented the inventory. Nonetheless, given the sturdy gross sales momentum the corporate has seen throughout this time, my perception is that these have been probably remoted points referring to that single location. That is additionally an instance of how anecdotal proof is typically simply that — anecdotal — and will not replicate the massive image.

For the corporate’s half, Chipotle has stated that it has neither altered its portion sizes nor instructed staff to provide fuller bowls to prospects who have been recording them. The corporate did say that it had “strengthened correct portioning” with its staff, however didn’t point out whether or not “correct” means maintaining these parts reasonable or filling the bowls up.

Primarily based on my latest experiences, there are large variations in portion sizes from one Chipotle location to the subsequent.

How this might impression the corporate’s outcomes

Chipotle’s largest expense class is meals, beverage, and packaging — prices on that entrance represented 28.8% of its income in Q1. The corporate has been consistently combating meals inflation by boosting costs. Nonetheless, one other method for meals corporations to maintain earnings up when their prices are rising is by lowering portion sizes. That is generally known as shrinkflation. President Biden even referred to as out shrinkflation in his State of the Union deal with earlier this yr.

Within the close to time period, if Chipotle does certainly enhance its portion sizes to mollify its prospects, that might enhance its meals bills and harm its restaurant-level margins. A ten% enhance in bills within the meals, beverage, and packaging class from bigger parts would add about $330 million a yr in further bills (practically $260 million after taxes), or about $9.40 in annual earnings per share (EPS), based mostly on anticipated gross sales of $11.35 billion this yr. That is not a small quantity, even for an organization on the right track to earn greater than $55 per share this yr.

In the long run, if Chipotle retains its bigger portion sizes, it might have an enduring impression on margins, whereas smaller sizes may have an effect on demand. Proper now, there appears to be a little bit of a battle between Chipotle and its prospects over this concern.

It is a little bit of a weak time for the corporate. Many different quick-service chains have felt stress from customers combating larger menu costs. Chipotle has to this point prevented this, as evidenced by its sturdy same-store gross sales, pricing energy, and visitors.

Skimping on parts and high quality could increase leads to the close to time period, however finally, it may catch as much as the corporate. Chipotle has an excellent repute and has bounced again from worse, together with a lot of meals poisoning incidents associated to E. coli and norovirus, however now, it wants to keep up that good repute.

I feel the corporate missed a possibility when Lee’s grievance and different TikTokers’ response to it went viral. It may have performed into some advertising that might have pushed extra prospects to its eating places, maybe for a restricted time, by selling the scale of its bowls. The corporate’s ambiguous response relating to its portion sizes additionally wasn’t useful.

Time to purchase, promote, or maintain?

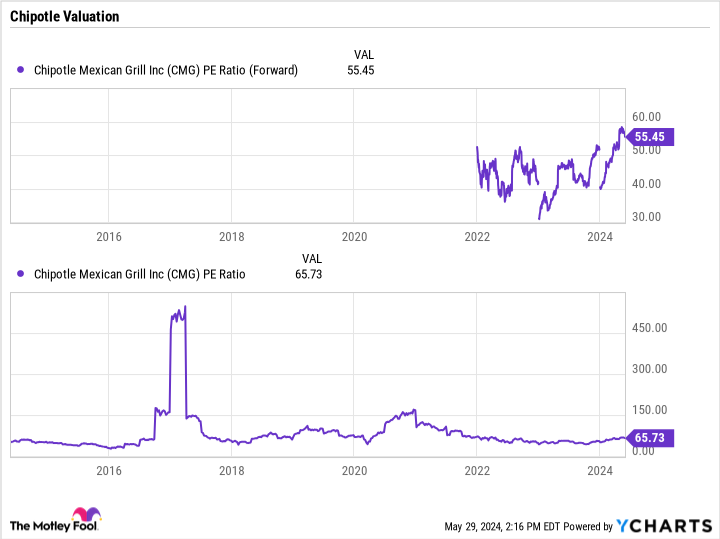

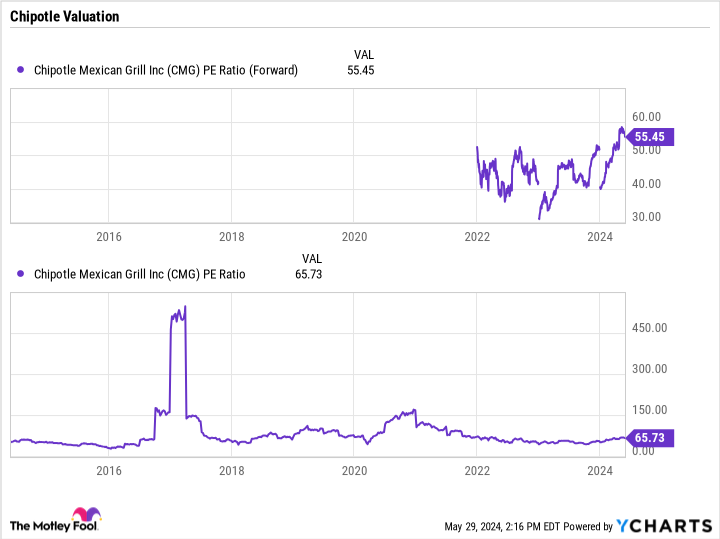

Chipotle inventory now trades at a ahead price-to-earnings (P/E) ratio of 55.5 — a premium valuation relative to its progress and margin profile. It would not fairly have the lengthy growth alternative it has had previously, so same-store gross sales and restaurant-level margins will play a much bigger position in its long-term prospects.

Not way back, an occasion just like the Chipotle portion saga would have probably been forgotten pretty shortly. Traditionally, customers have had quick reminiscences relating to issues like this. Nonetheless, within the period of social media, customers have been gaining extra energy. So I would not 100% write it off as I might have completed a number of years in the past. I by no means thought Bud Gentle gross sales would nonetheless be impacted a yr after calls by some to boycott the model, so that you by no means know.

At this level, given Chipotle’s valuation, I would view the restaurant inventory as extra of a maintain whereas we wait to see whether or not this blows over as anticipated. I feel it is going to, however I would not rush to purchase the inventory at these ranges.

Do you have to make investments $1,000 in Chipotle Mexican Grill proper now?

Before you purchase inventory in Chipotle Mexican Grill, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and Chipotle Mexican Grill wasn’t certainly one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… in case you invested $1,000 on the time of our suggestion, you’d have $671,728!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of Could 28, 2024

Geoffrey Seiler has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Chipotle Mexican Grill. The Motley Idiot has a disclosure coverage.

Chipotle’s Portion Sizes Have Gone Viral. What May That Imply for the Inventory? was initially printed by The Motley Idiot