Excessive-quality corporations with sturdy earnings progress might be wealth-building powerhouses that elevate a portfolio over time. Most individuals who retire with excessive internet worths have seemingly loved stellar returns from their inventory investments.

Importantly, buyers should not wager too closely on one horse — a diversified portfolio is crucial to managing your dangers. That mentioned, there are some shares that you may purchase and maintain for the subsequent decade that would make a notable distinction within the progress of your nest egg.

Listed below are two such names. Contemplate investing $10,000 into every of those shares, and so they may assist you to retire a millionaire.

Amazon will proceed having fun with e-commerce and cloud tailwinds

What a enterprise Amazon (NASDAQ: AMZN) is. The corporate began by promoting books on-line within the mid-Nineties and is at the moment’s dominant e-commerce retailer, with a roughly 38% market share in the USA. Maybe much more spectacular is that Amazon adopted up this whopper of a gap act with Amazon Net Providers, which has change into the world’s largest cloud infrastructure platform with a 31% world market share.

The corporate has been a really profitable long-term funding. A $10,000 funding into Amazon inventory in its early days could be value over $18 million now. In fact, Amazon is now value practically $2 trillion, so there’s simply no room within the world economic system for it to extend in measurement and worth by that magnitude once more. Nonetheless, the corporate does nonetheless have sufficient upside to justify a $10,000 funding at the moment. Amazon’s bread-and-butter segments, e-commerce and cloud computing, have loads of room to develop. E-commerce remains to be simply 16% of retail in America. In the meantime, the surge in synthetic intelligence investments worldwide ought to imply massive issues for Amazon and different cloud platforms.

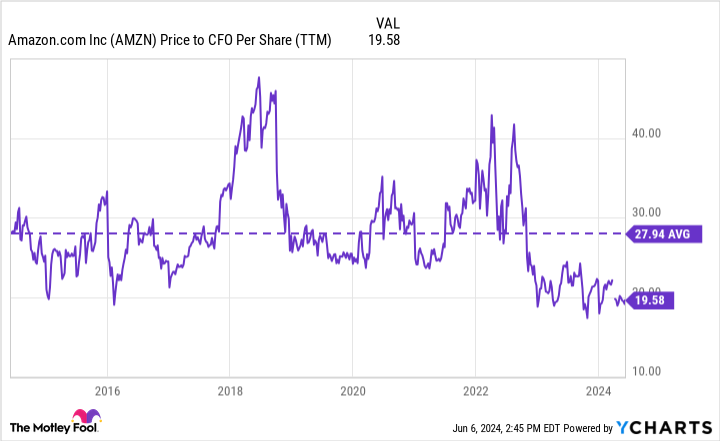

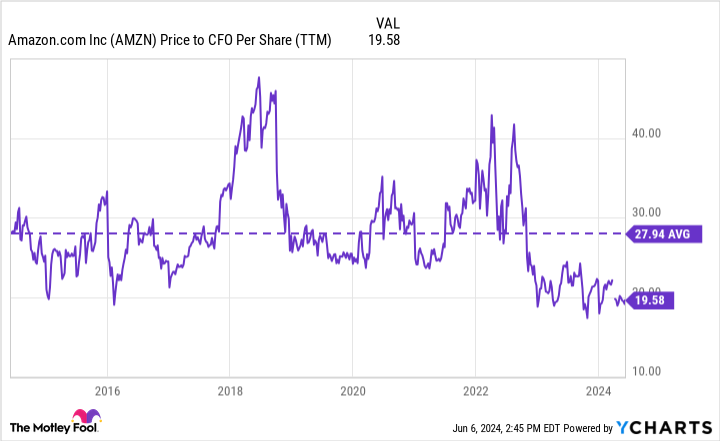

A large firm like Amazon should even be buying and selling on the proper valuation in an effort to have the potential to generate further massive returns. Let’s test that field off. In case you worth Amazon based mostly on its working money move — in different phrases, the money it generates from its regular enterprise actions earlier than investing in itself in pursuit of future progress — shares are about as low-cost as they have been prior to now decade (because the chart above reveals). This winner is poised to maintain profitable, so do not shrink back from together with it in your long-term funding plans.

Netflix has confirmed itself within the rising streaming trade

It isn’t straightforward breaking new floor or creating new industries. Firms that attempt to are sometimes beset by a whole lot of doubters, and Netflix (NASDAQ: NFLX) has undoubtedly had its share of them over time. Nonetheless, the streaming pioneer is the worldwide king of streaming at the moment, with over 270 million paid subscriptions as of the top of the primary quarter. Memberships grew 16% 12 months over 12 months in Q1, which reveals there may be nonetheless loads of room for it to develop as individuals worldwide steadily shift from cable tv to streaming.

And when an organization turns into as giant as Netflix has, there are many methods it may well use to squeeze earnings progress out of the enterprise. Along with merely rising its subscriber base, Netflix can elevate costs, crack down on password sharing (which has been vastly profitable), and department out into new content material and media codecs. The corporate has steadily waded into reside sports activities content material and is testing out video video games now that expertise has superior sufficient for it to stream video games via the cloud.

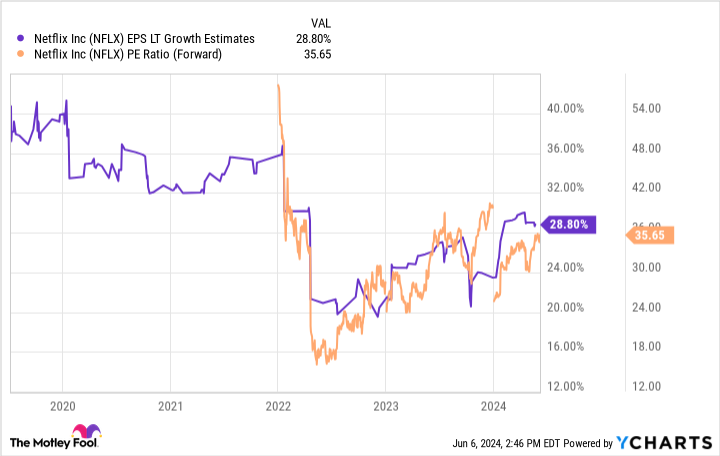

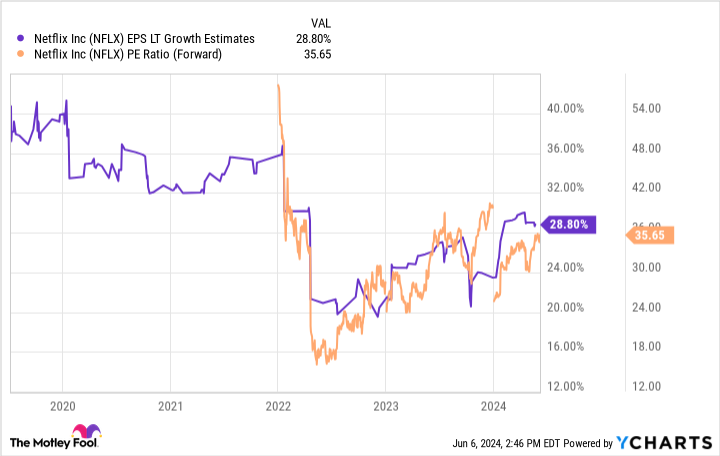

Netflix shares have handily outperformed the broader marketplace for the previous decade. However the firm appears poised to ship extra years of sturdy earnings progress. Shares commerce at 35 instances earnings at the moment, however analysts consider that its earnings will develop at an annualized charge of greater than 28% for the subsequent three to 5 years. That ought to make the inventory engaging for buyers.

Do you have to make investments $1,000 in Amazon proper now?

Before you purchase inventory in Amazon, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and Amazon wasn’t one in every of them. The ten shares that made the reduce may produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $740,688!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of June 3, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Justin Pope has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon and Netflix. The Motley Idiot has a disclosure coverage.

Need $1 Million in Retirement? Investing $10,000 in Every of These 2 Shares for the Lengthy Time period Might Assist You on Your Means was initially printed by The Motley Idiot