NextEra Power (NYSE: NEE) has a dividend yield of round 2.7% in the present day. Earnings buyers and people with a worth bias in all probability will not wish to purchase its shares, however when you like dividend progress shares, the ten% annualized payout progress NextEra Power has achieved over the previous decade will in all probability get your juices flowing.

And if administration is correct, the longer term appears simply pretty much as good because the previous for dividend progress.

Why some folks will not like NextEra Power

NextEra Power has one main drawback: Wall Avenue is aware of that this can be a very well-run utility. That is why the yield is 2.7%, which is beneath the three% common for the utility sector, utilizing the Vanguard Utilities Index ETF (NYSEMKT: VPU) as a proxy.

Certain, NextEra yields greater than the 1.3% you’ll get from an S&P 500 Index fund, but it surely simply is not a excessive yield inventory. Dividend buyers and people with a worth bias — noting that the yield is at greatest center of the street over the previous decade — will in all probability wish to have a look at utilities with increased yields.

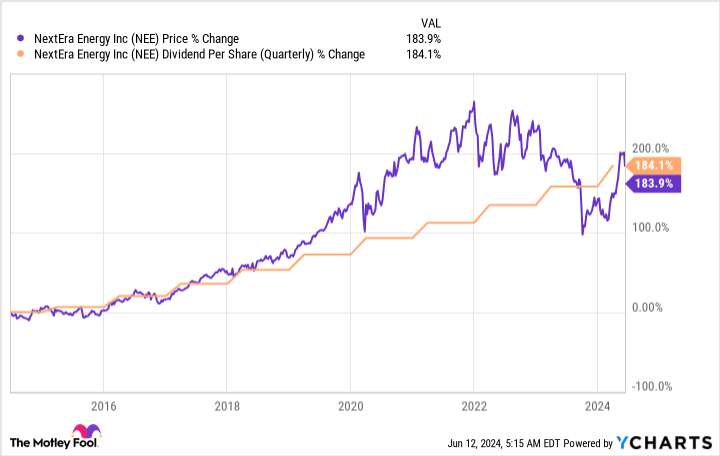

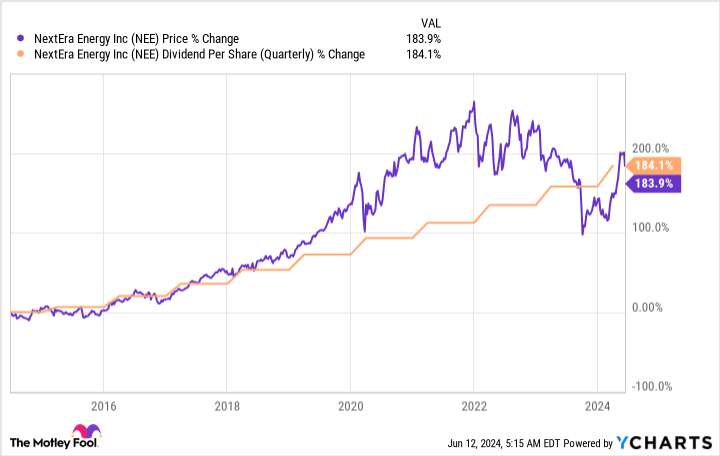

That stated, the present dividend yield is not the explanation to purchase NextEra Power. Dividend progress is the actual story, with the dividend rising by greater than 180% over the previous 10 years.

The inventory has risen by virtually the very same quantity over that span, as effectively, resulting in a fairly spectacular whole return of greater than 260%, with dividend reinvestment. That is higher than the S&P 500 index, which had a complete return of round 225% over the identical span. Step again for a second: NextEra, a utility firm, beat the S&P 500!

However there’s one other determine that you just may discover fascinating: yield on buy worth. If you happen to purchased NextEra Power in 2013 at its costliest level, you’ll have paid $22.4375 per share, adjusted for a 4-for-1 inventory break up in 2020. The annualized dividend within the fourth quarter of 2013 was $0.66 per share, for a yield on buy of roughly 2.9%.

On the finish of the second quarter of 2024, the annualized dividend was $2.06 per share, which might imply your yield based mostly on buy worth rose to an enormous 9.2% or so in a bit of over a decade. If you happen to like dividend progress, you may love NextEra Power.

The longer term appears vivid for NextEra Power

NextEra Power has achieved this dividend progress by constructing a big renewable energy enterprise atop its regulated utility operations in Florida. Clearly the enterprise mannequin has labored effectively based mostly on the dividend progress.

And NextEra thinks the subsequent few years can be simply pretty much as good because the final decade. Proper now, the corporate is looking for earnings progress of between 6% and eight% a 12 months via a minimum of 2027. That can result in dividend progress of 10% a 12 months via a minimum of 2026.

What’s backing that outlook? Administration expects electrical energy demand in the US, pushed by demand for renewable energy, to extend materially within the years forward.

Some numbers will assist: Between 2000 and 2020, electrical energy demand expanded simply 9%, however between 2020 and 2040, NextEra believes demand will improve by 38%. That is a drastic change in what has traditionally been thought-about a fairly sleepy sector.

However the actually essential a part of the story right here is that NextEra Power’s clear power experience, constructed over a long time, positions it effectively to learn from the push for renewable energy that it expects. And when you purchase NextEra in the present day, you may profit together with the corporate.

NextEra Power is at all times costly

If you happen to purchased the inventory in 2013 when it had a 2.9% dividend yield, you’ll in all probability be a fairly blissful dividend-growth investor in the present day. However that yield is fairly near the two.7% yield in the present day, which means that NextEra Power has been an costly inventory to personal for a really very long time. Nonetheless, if dividend progress is what you’re after, this utility has proved that paying up for high quality can work out very effectively over the long run.

Must you make investments $1,000 in NextEra Power proper now?

Before you purchase inventory in NextEra Power, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and NextEra Power wasn’t one among them. The ten shares that made the lower may produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… when you invested $1,000 on the time of our advice, you’d have $808,105!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of June 10, 2024

Reuben Gregg Brewer has no place in any of the shares talked about. The Motley Idiot has positions in and recommends NextEra Power. The Motley Idiot has a disclosure coverage.

Is NextEra Power Inventory a Purchase? was initially revealed by The Motley Idiot