Folks put money into dividend shares for varied causes. Some need the passive earnings; others reinvest the money to spice up long-term returns; nonetheless others discover that firms that may dish out common (and rising) payouts are price investing in. However few such traders would come with dividend cuts on their want checklist — most need the payouts to go for so long as attainable.

Although many earnings shares will finally need to droop or lower their dividends, some appear stable sufficient to pay traders for a lifetime. Let’s take into account two examples: AbbVie (NYSE: ABBV) and Visa (NYSE: V).

1. AbbVie

AbbVie was initially a subdivision of Abbott Laboratories. The drugmaker cut up from its former mother or father firm in 2013. Since then, AbbVie has been identified for no less than two issues: its blockbuster rheumatoid arthritis drug Humira, and its constant dividend will increase.

Nonetheless, issues are altering. Humira has been off-patent within the U.S. since final yr. Contemplating that the drug was AbbVie’s largest development driver for the previous decade, it is regular for shareholders to fret a bit about what is going to occur to its payouts.

However AbbVie is exhibiting that it is a sturdy firm with or with out Humira. Although income and earnings fell after the immunology medication misplaced exclusivity, AbbVie can rely on two different medication on this space to fill the hole finally: Skyrizi and Rinvoq truly compete with Humira in a number of indications. Mixed income from these two medicines ought to hit $27 billion by 2027, based on administration. That is properly above Humira’s peak annual gross sales.

AbbVie is an progressive firm that ought to often proceed delivering brand-new medicines. The drugmaker deliberate forward for Humira’s lack of patent exclusivity; it’ll virtually definitely do the identical for Skyrizi and Rinvoq, and no matter different key development drivers it depends upon after these two additionally lose patent safety. That is what makes AbbVie a inventory price shopping for and holding onto for good. Particular person medication will finally cease driving top-line development in a decade or so, however a tradition centered round innovation can final a lifetime — a number of, truly.

In the meantime, AbbVie has continued to extend its dividends even after the Humira patent cliff. And because of being a former unit of Abbott Laboratories, AbbVie qualifies as a Dividend King that has raised its payouts for 52 consecutive years. The dividend is up by 288% for the reason that firm’s inception — that is spectacular.

The drugmaker provides a powerful ahead yield of three.6%, whereas its money payout ratio appears to be like cheap at just below 49%. All this makes the inventory an incredible decide for long-term, income-seeking traders.

2. Visa

Carrying round money and checks is cumbersome, and these cost strategies additionally include different downsides. Chief amongst them is that they are poorly tailored to a lot of recent retail exercise, which occurs on-line. Money and verify utilization has been declining for years.

One of many corporations serving to transfer that development alongside is Visa, which runs one of many main cost networks on this planet. It helps facilitate bank card transactions — with out incurring the danger that folks will default on their debt, for the reason that firm would not concern the playing cards. It merely serves as an middleman between issuing banks and retailers.

Visa advantages from the community impact. The extra retailers be part of its ecosystem, the extra enticing it’s to shoppers, and vice versa. At this level, few accountable companies in developed nations would dare to not settle for the corporate’s playing cards as a cost technique.

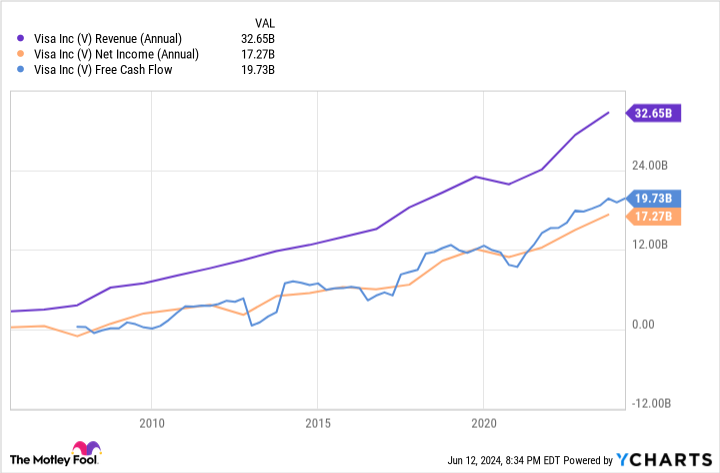

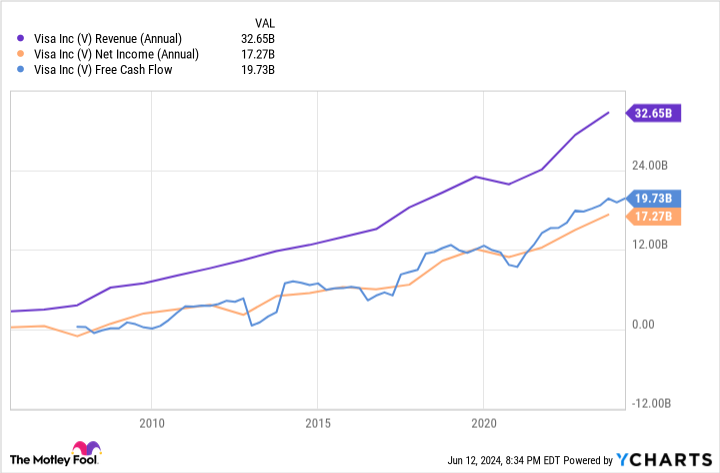

And Visa pockets a payment for each single transaction carried out with certainly one of them. That is an incredible enterprise mannequin. Naturally, the corporate’s monetary outcomes have been glorious over time:

The longer term stays brilliant for Visa regardless of the progress it has already made; the corporate sees a $20 trillion addressable market. About half of that’s in money and checks, as a result of regardless of appearances, these modes of funds have not disappeared — removed from it. There is a lengthy runway for development forward.

However what in regards to the dividend? Whereas the yield is not spectacular at simply 0.8%, Visa has elevated its dividend by an unimaginable 420% prior to now decade. But its money payout ratio stays modest at nearly 20%.

Visa has miles of room left to spice up the dividend additional. That, mixed with the corporate’s sturdy underlying enterprise and enticing long-term alternatives, makes it a stable long-term dividend inventory.

Must you make investments $1,000 in AbbVie proper now?

Before you purchase inventory in AbbVie, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 finest shares for traders to purchase now… and AbbVie wasn’t certainly one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $808,105!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of June 10, 2024

Prosper Junior Bakiny has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Abbott Laboratories and Visa. The Motley Idiot has a disclosure coverage.

2 Dividend Shares That May Pay You for Life was initially revealed by The Motley Idiot