Chipotle Mexican Grill (NYSE: CMG) is having a second. The corporate’s inventory has been red-hot this 12 months, gaining about 70% since final November. And now, buyers are wanting ahead to its upcoming 50-to-1 inventory break up. When markets open on June 26, shareholders will personal 50 occasions as many shares as they did on the shut of buying and selling on June 25, however the worth of every one can be about one-fiftieth of what it was earlier than. The inventory break up will not change the worth of individuals’s investments or the valuation of the corporate — at the very least, not in and of itself.

It’ll, nonetheless, make the shares considerably extra accessible to smaller retail buyers, together with Chipotle’s staff. Chief Monetary Officer and Chief Administrative Officer Jack Hartung mentioned the transfer would assist the corporate “reward our group members and empower them to have possession in our firm.” And as shares turn into extra accessible, demand for them might enhance, which might add to the momentum behind the inventory.

Whatever the direct and oblique impacts of a break up, the query stays: Is Chipotle a very good funding at its present valuation?

Spectacular progress

Rising revenues persistently, particularly at double-digit proportion charges, is without doubt one of the surest methods to get Wall Road to like an organization. Chipotle has been doing simply that at a time when a lot of its opponents are struggling. Check out this desk, which reveals Chipotle’s top-line progress for the final 5 years in comparison with McDonald’s (NYSE: MCD) and Yum! Manufacturers (NYSE: YUM), the father or mother firm of KFC, Taco Bell, Pizza Hut, and The Behavior Burger Grill.

|

Firm |

2019 Income Progress |

2020 Income Progress |

2021 Income Progress |

2022 Income Progress |

2023 Income Progress |

|---|---|---|---|---|---|

|

Chipotle |

14.8% |

7.1% |

26.1% |

14.4% |

14.3% |

|

McDonald’s |

(0.5%) |

(10.1%) |

20.9% |

(0.2%) |

10% |

|

Yum! Manufacturers |

(1.6%) |

1% |

16.5% |

3.9% |

3.4% |

Knowledge sources: Firm filings.

The one 12 months Chipotle did not submit double-digit proportion progress was 2020. (I feel we would know why.) Nonetheless, regardless of pandemic lockdowns, it achieved progress of greater than 7% throughout a 12 months when McDonald’s income shrank by greater than 10%.

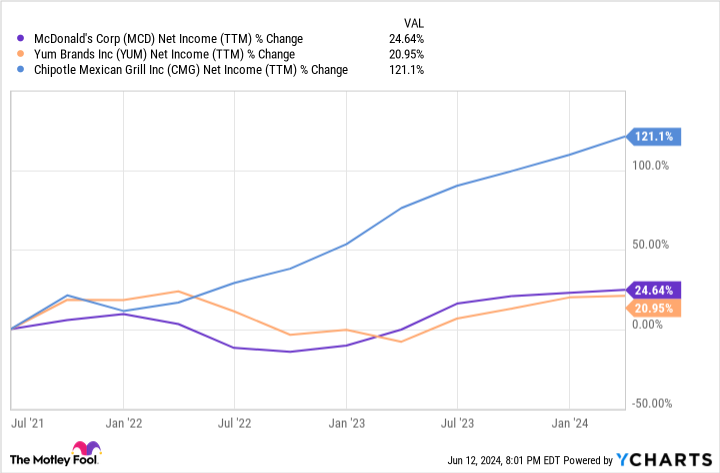

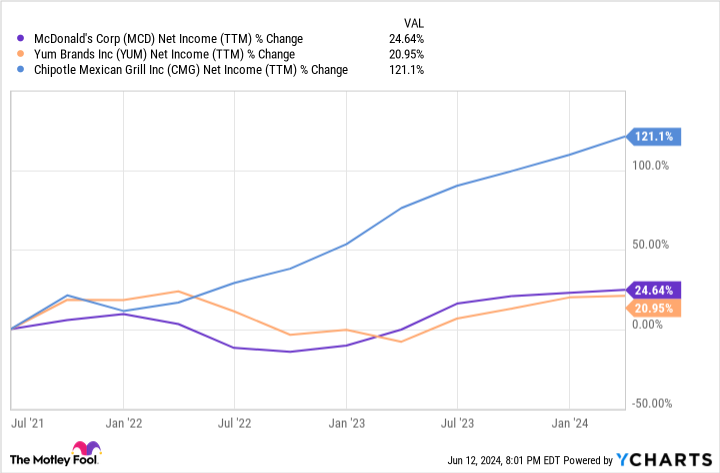

The story is comparable for web earnings. Chipotle has greater than doubled its earnings since 2021, nicely outpacing its friends.

Whereas top-line progress is necessary to buyers, although, it isn’t the whole lot.

Chipotle’s valuation ought to provide you with pause

Chipotle presently trades at a price-to-earnings (P/E) ratio of 67.7. That is fairly excessive for the restaurant business. McDonald’s and Yum! each commerce at ratios simply above 20.

Nonetheless, buyers are sometimes keen to pay a premium for a inventory primarily based on the expectation of earnings progress.

To weigh that, they give the impression of being to its worth/earnings-to-growth (PEG) ratio, which you get by dividing the corporate’s P/E by its anticipated progress fee over a given interval. This offers a greater concept of an organization’s worth relative to its forecast future earnings. On this case, decrease (however not damaging) is best, and a inventory with a PEG ratio under 1 is mostly seen as being undervalued.

Chipotle’s PEG ratio is 2.5, which is consistent with McDonald’s 2.9 and Yum! Manufacturers’ 2.2. So on a forward-looking foundation, possibly it isn’t as overvalued as it’d seem like.

But one weak point of the PEG ratio is its reliance on earnings progress forecasts — there is not any assure these predictions will show correct. If, for instance, the financial system turns and shoppers pull again on their discretionary spending, restaurant gross sales will dip. Though in that circumstance, all three of those firms would probably endure, a dip in gross sales might hit Chipotle’s inventory tougher as a result of it might expose its present overvaluation. Why purchase a inventory buying and selling at a premium if there is not an expectation that future earnings will justify it?

It is also price contemplating that Chipotle’s revenues have been boosted by the corporate’s aggressive growth. It opened 271 new areas final 12 months alone. Nonetheless, comparable-store gross sales — which do not issue within the affect of including extra shops — grew by simply 7.9%. That fee was decrease than McDonald’s 9% comps progress.

Regardless of TikTok pushback, Chipotle nonetheless appears to be on observe

At present, Chipotle is catching some warmth from social media customers who’ve been accusing it of lowering its portion sizes to maximise earnings. In response, some clients have been utilizing their smartphones to file the shop employees getting ready their burritos and bowls in an try to both show the assertion or to induce the staff to be extra beneficiant with their scoops.

The corporate, in the meantime, has acknowledged categorically, “There have been no adjustments in our portion sizes,” and added that administration has “strengthened correct portioning with our staff.”

Whether or not portion sizes have truly modified could also be much less related than client notion — and client response. The kerfuffle hasn’t appeared to affect the chain’s numbers but, but when it continues, it might. Chipotle constructed its model, partially, on burritos that had been bursting on the seams.

No matter these issues, Chipotle nonetheless appears to be doing a complete lot proper. Given the expansion it’s delivering quarter after quarter and 12 months after 12 months, I am inclined to look previous its excessive valuation, however I might additionally suggest exercising warning. Keep watch over the TikTok protests, the corporate’s response to them, and whether or not or not the problem has a fabric affect on revenues within the coming quarters. However outdoors of that concern, Chipotle continues to appear like a very good wager.

Do you have to make investments $1,000 in Chipotle Mexican Grill proper now?

Before you purchase inventory in Chipotle Mexican Grill, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 finest shares for buyers to purchase now… and Chipotle Mexican Grill wasn’t certainly one of them. The ten shares that made the lower might produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… in case you invested $1,000 on the time of our suggestion, you’d have $808,105!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of June 10, 2024

Johnny Rice has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Chipotle Mexican Grill. The Motley Idiot has a disclosure coverage.

Chipotle’s Inventory Cut up Is Nearly Right here: Time to Purchase Now Earlier than It Occurs? was initially revealed by The Motley Idiot