Intel (NASDAQ: INTC) has change into a inventory to look at in latest months. The corporate’s hyperfocus on synthetic intelligence (AI) and chip manufacturing has doubtlessly spelled out a brilliant future for it.

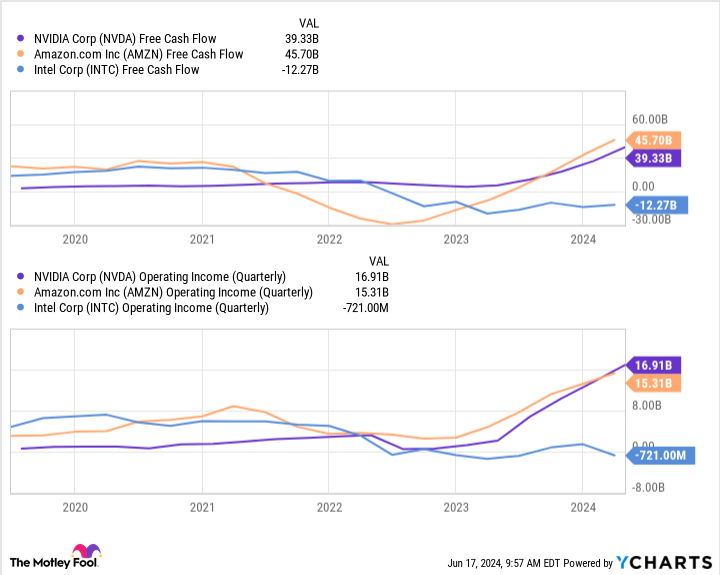

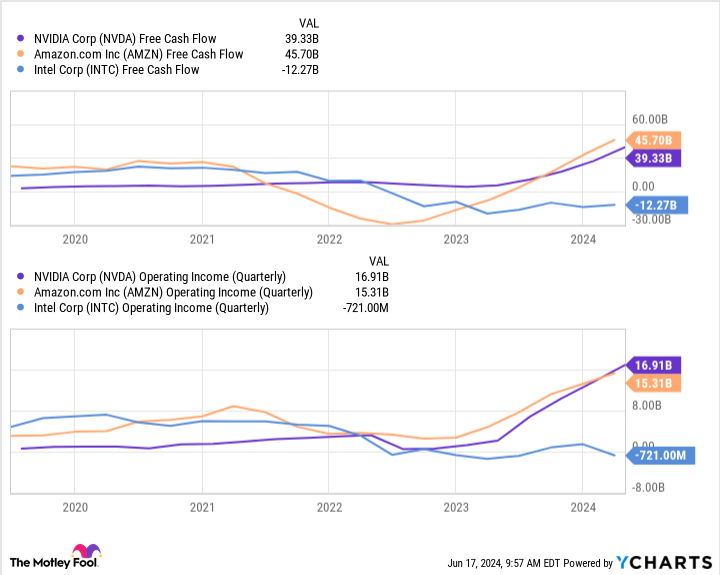

Nevertheless, with its damaging $12 billion in free money stream — together with quarterly income and working revenue which have plunged 35% and 112%, respectively, since 2021 — it may take a few years for Intel to regain a number one place in tech.

Whereas Intel stays a wonderful purchase for these with the time, traders with fewer years till retirement would possibly wish to think about various firms with more money within the financial institution to spend money on their future.

The chart above reveals Nvidia (NASDAQ: NVDA) and Amazon (NASDAQ: AMZN) are doubtlessly swimming in money in comparison with Intel. Each firms have loved main monetary progress during the last 5 years, indicating that they might be higher geared up to increase their attain in tech at a sooner fee than Intel. Consequently, Nvidia and Amazon are doubtlessly extra dependable investments within the close to time period.

So, neglect Intel for now and think about shopping for these two tech shares as an alternative.

1. Nvidia

Nvidia’s enterprise has exploded during the last decade, with its fill up 27,000%. The corporate has profited from hovering demand for graphics processing items (GPUs), the chips crucial for intensive computing duties like coaching AI fashions, working video video games, video enhancing, cryptocurrency mining, and extra.

Nvidia’s success has seen it change into one of many world’s most-valuable firms and the primary chipmaker to attain a market capitalization above $3 trillion. The corporate’s chips have allowed it to safe profitable positions in a number of sectors of tech. It has change into greatest identified for its dominant position in AI, beating out rivals like Intel and Superior Micro Gadgets in market share.

However the firm has additionally spent years supplying its chips to cloud platforms, online game consoles just like the Nintendo Change, self-driving automobiles, and custom-built computer systems that many shoppers use to run high-powered gaming PCs.

Consequently, Nvidia has progress catalysts throughout tech that can seemingly maintain its enterprise increasing for years. In response to Grand View Analysis, the AI market hit $196 billion final yr and is increasing at a fee that will see that determine attain near $2 trillion by the tip of the last decade. And that is only one avenue of progress.

Nvidia additionally has an automotive section, which incorporates revenue from promoting its chips to the self-driving automobile market. This trade is forecast to have a compound annual progress fee of 13% by way of 2030, which might see it triple in worth from its 2021 determine.

Shares have climbed 206% during the last 12 months but appear nowhere close to their ceiling due to important potential throughout tech. A ten-for-1 inventory cut up earlier this month has made the inventory extra accessible. In the meantime, its value/earnings-to-growth ratio is lower than one, indicating Nvidia’s inventory might be buying and selling at a discount and is price contemplating over Intel proper now.

2. Amazon

Like Nvidia, Amazon has expanded to a number of areas of tech and might seemingly do no fallacious. The corporate is the largest title in e-commerce with its on-line retail web site. Current quarterly earnings present Amazon additionally has a budding digital advert enterprise by way of its streaming service Prime Video and is residence to a extremely worthwhile cloud platform, Amazon Net Providers (AWS).

The corporate is on a progress trajectory that’s simply too good to go up. Within the first quarter of 2024, the corporate proved that its retail enterprise (which accounts for 80% of income) remains to be going sturdy, with gross sales rising 12% yr over yr between its North American and worldwide segments.

Nevertheless, the brightest spot within the quarter was AWS, which posted income positive factors of 17% yr over yr as working revenue almost doubled to over $9 billion (outperforming its total retail enterprise). Its cloud platform has rapidly change into essentially the most worthwhile a part of the enterprise and is not executed but because it invests closely in an AI enlargement.

Amazon shares have exploded over the previous yr however seemingly have rather more to supply traders as the corporate continues to develop and use its large money reserves. The inventory’s price-to-sales ratio is presently hovering round 3, making it a greater worth than lots of its rivals and doubtlessly price shopping for over Intel.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Nvidia wasn’t one in all them. The ten shares that made the minimize may produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $801,365!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of June 10, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Dani Prepare dinner has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Amazon, Apple, Microsoft, and Nvidia. The Motley Idiot recommends Intel and Nintendo and recommends the next choices: lengthy January 2025 $45 calls on Intel, lengthy January 2026 $395 calls on Microsoft, brief August 2024 $35 calls on Intel, and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

Neglect Intel: 2 Tech Shares to Purchase As a substitute was initially revealed by The Motley Idiot