Holding a portfolio of high quality dividend shares that deposit money in your account makes the occasional market dip a lot simpler to tolerate. Three Motley Idiot contributors not too long ago chosen three stable corporations with lengthy information of paying common dividends to shareholders. Here is why Philip Morris Worldwide (NYSE: PM), Williams-Sonoma (NYSE: WSM), and Realty Revenue (NYSE: O) may arrange you for years with passive revenue.

This traditional Dividend King is delivering stunning progress

Jeremy Bowman (Philip Morris Worldwide): Philip Morris Worldwide would possibly appear to be a stunning alternative for a dividend inventory for all times, however the firm is extra than simply an strange tobacco inventory throughout a time of declining cigarette consumption.

Philip Morris has the chops to compete with any dividend inventory. Together with the time when it was mixed with Altria, Philip Morris has raised its dividend yearly for greater than 50 years straight. The worldwide Marlboro vendor additionally at the moment affords a dividend yield of 5.1%, sufficient to make it a high-yield inventory, however what actually makes the inventory engaging for long-term dividend buyers is the way in which the corporate has efficiently pivoted to next-gen merchandise like Iqos heat-not-burn tobacco sticks and Zyn nicotine pouches.

Actually, smoke-free merchandise now make up roughly 40% of its income and that enterprise is rising shortly. Total cargo quantity was up 3.6%, pushed by 21% progress in heated tobacco items and 36% progress in oral smoke-free merchandise.

That efficiency helped drive natural income up 11% to $8.8 billion and adjusted currency-neutral earnings per share (EPS) was up 23% to $1.50. The corporate additionally demonstrated confidence within the Iqos model by shopping for again the rights to promote it within the U.S. from Altria for $2.7 billion, and it is now constructing out its presence in that market.

Whereas cigarette consumption is falling, demand for nicotine merchandise nonetheless exists and Philip Morris is forward of its rivals in capturing it. That ought to ship ample rewards for dividend buyers over the approaching years.

Worth positive aspects plus dividends

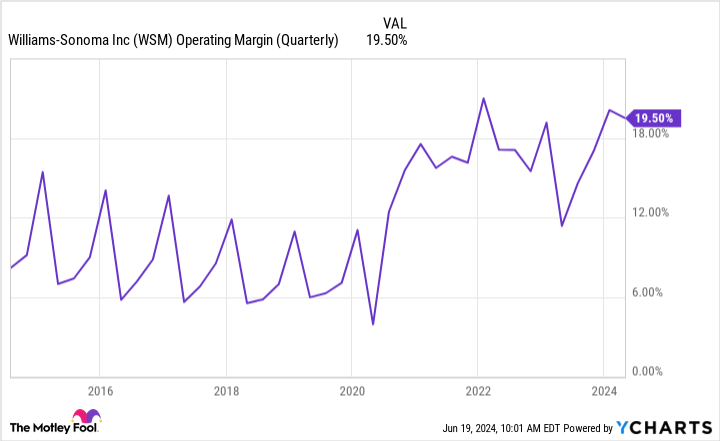

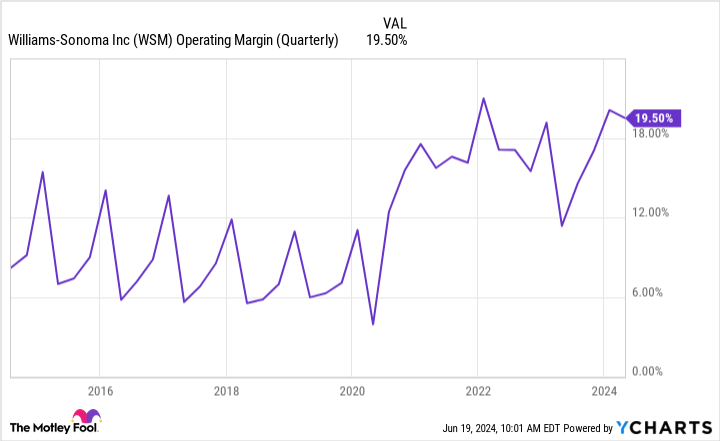

Jennifer Saibil (Williams-Sonoma): Williams-Sonoma is a high worth inventory struggling by inflation however demonstrating resilience. Gross sales have been declining, however the firm is extremely worthwhile and sustaining a powerful working margin regardless of inflationary strain.

It companies an upscale clientele, so it is much less prone to prospects pinching pennies. Nevertheless, a few of its house items manufacturers, which embody its personal identify, Pottery Barn, and West Elm, goal a mid-to-affluent inhabitants, and these prospects are switching down or holding again. Regardless of the gross sales downturn, the corporate’s rigorous value effectivity is conserving money flowing in. That interprets right into a stable enterprise and a dependable dividend, even underneath these situations.

Within the 2024 first quarter (ended April 28), gross sales dropped 4.9% from final yr. However EPS rose from $2.35 final yr to $3.48 this yr, or $4.07 with a one-time adjustment. Working margin jumped from 11.4% final yr to 16.6% this yr, or 19.5% with the adjustment. Working margin has elevated to ranges method greater than earlier than the COVID-19 pandemic, and it exhibits no indicators of sliding again.

CEO Laura Alber mentioned administration is planning to spend 75% of capital expenditures this yr on e-commerce capabilities, provide chain efficiencies, and giving again extra money to shareholders by dividend funds and share repurchases. It has $1.3 billion in money and no debt, and it is going to purchase again $44 million in inventory and spend $63 million in dividends.

Williams-Sonoma has a little bit of an inconsistent dividend historical past, some years elevating it greater than as soon as. Nevertheless it has paid a dividend since 2006 and raised it a minimum of yearly since 2010, and it is grown 850% since then.

Wall Road is giving Williams-Sonoma an enormous thumbs-up for its dealing with of a tough time, and the corporate’s inventory is up 58% this yr. The flip aspect of that’s that the dividend yield is far decrease than regular proper now at 1.2%. However that illustrates why Williams-Sonoma is a profitable inventory that gives worth appreciation and a gentle and rising dividend.

A high quality REIT with a excessive yield

John Ballard (Realty Revenue): Investing in actual property funding trusts (REITs) when they’re on sale is one technique to considerably increase your portfolio’s common yield. REITs are required to distribute a minimum of 90% of their taxable revenue to shareholders. Realty Revenue has a protracted file of paying month-to-month dividends, and primarily based on its present month-to-month dividend fee price, the inventory pays a ahead yield of 5.94%.

Rising borrowing charges have been a headwind for the actual property market over the previous yr. However that is why buyers can purchase this high REIT at such an awesome yield. Realty Revenue has targeted on producing secure free money flows to help returns to shareholders by all market environments over its historical past.

Even throughout the pandemic, it maintained excessive occupancy charges on its closely diversified portfolio of greater than 15,000 industrial properties. These excessive occupancy charges are the results of partnering with comparatively robust and wholesome companies which have stood the take a look at of time. For instance, a few of its largest retail shoppers are trade stalwarts Walmart, Greenback Basic, and Walgreens.

Realty Revenue has paid a month-to-month dividend for 55 years. Following the current merger with Spirit, the corporate has $825 million of annualized free money movement to make new investments to develop the enterprise and pay rising dividends to shareholders with out the necessity for exterior financing by the debt market.

With rates of interest up, this is a perfect time to think about shopping for shares, as a result of as soon as rates of interest stabilize or come down, the inventory may rise sharply.

Must you make investments $1,000 in Philip Morris Worldwide proper now?

Before you purchase inventory in Philip Morris Worldwide, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Philip Morris Worldwide wasn’t one among them. The ten shares that made the reduce may produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… in the event you invested $1,000 on the time of our advice, you’d have $801,365!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of June 10, 2024

Jennifer Saibil has no place in any of the shares talked about. Jeremy Bowman has no place in any of the shares talked about. John Ballard has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Realty Revenue, Walmart, and Williams-Sonoma. The Motley Idiot recommends Philip Morris Worldwide. The Motley Idiot has a disclosure coverage.

3 Dividend Shares That May Assist Set You Up for Life was initially revealed by The Motley Idiot