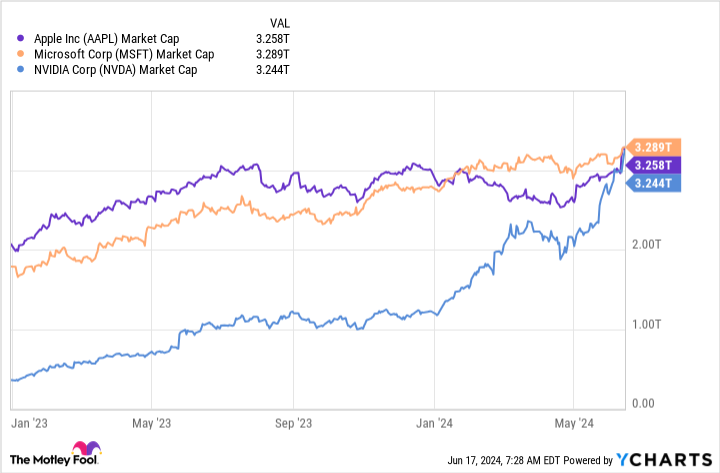

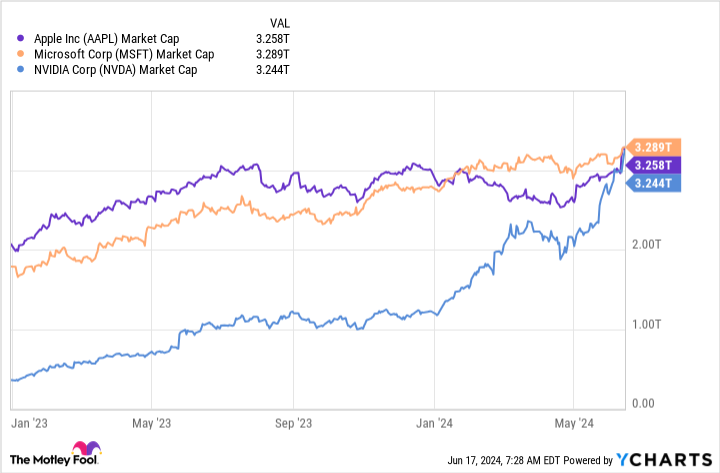

Though Microsoft (NASDAQ: MSFT) held the title for a couple of months, Apple (NASDAQ: AAPL) briefly regained its crown because the world’s largest firm by market cap this month. However then this week, Nvidia (NASDAQ: NVDA) handed it for the primary time. As of Thursday, the Home windows maker was again in first place once more, however with all three corporations holding market caps of round $3.2 trillion, within the close to time period, their rankings inside the high three may shift typically.

However what is going to matter extra to buyers is the place shares are heading over the medium and lengthy phrases. So which ones is almost certainly to carry the title a 12 months from now?

The case for Apple

Apple was considerably trailing Microsoft till its Worldwide Developer Convention a few weeks in the past. Though it introduced a number of issues through the occasion, the most important launch by far was Apple Intelligence — basically, Apple’s tackle synthetic intelligence (AI). These options will not immediately generate extra income for Apple, however the factor to notice is the generative AI options will solely be accessible on its newest mannequin smartphones, the iPhone 15 Professional and 15 Professional Max — and naturally, on the generations that comply with.

That is enormous. The present estimates are that greater than 90% of energetic iPhones are older fashions. So, if Apple Intelligence seems to be a sport changer, it can drive an improve cycle stronger than any Apple has skilled since early within the pandemic.

If that new demand wave arrives, Apple’s gross sales and income will rocket. That is a compelling argument for the proposition that it’ll as soon as once more be the world’s largest firm a 12 months from now.

The case for Microsoft

Microsoft overtook Apple because the world’s largest firm as a consequence of its heavy involvement with generative AI. As soon as Microsoft realized the impression this know-how may have, it rapidly developed an integration with the market chief, OpenAI’s ChatGPT, for its Microsoft Workplace merchandise. To entry these options, companies or shoppers must pay an additional charge, which has boosted Microsoft’s income stream.

Along with Copilot, Microsoft’s cloud computing wing has been on hearth. Most corporations haven’t got the in-house capability to run AI workloads, and would fairly not lay our a fortune to construct out that infrastructure. As a substitute, they lease computing energy from cloud computing suppliers like Microsoft Azure, which provides them entry to the {hardware} they want.

The wave of demand this has generated has been enormous for Microsoft and can probably proceed. Nevertheless, the impact it is having is already obvious to buyers, and it is unlikely to get any higher from this level on.

The case for Nvidia

Nvidia has been an absolute rocket ship because the begin of 2023. The huge demand for AI has pushed a parallel surge in demand for probably the most highly effective graphics processing models (GPUs), which might present the high-speed computational energy that software program requires. This has brought about a surge in income and income for Nvidia — the main maker of these cutting-edge chips — taking it from an organization price lower than $500 million to one of many world’s largest in a 12 months and a half.

Nevertheless, there are some considerations about Nvidia’s skill to take care of its valuation. Chipmaking is a cyclical enterprise, and a few buyers are frightened that demand for these GPUs will drop, and that the underside will fall out of the inventory.

That is, in my opinion, a misguided notion. Nvidia continues to be seeing demand for its GPUs develop. Moreover, it not too long ago launched the H200 GPU, which supersedes the extremely widespread H100 with higher effectivity and efficiency. Moreover, the lifespan of an information middle GPU is estimated to be between three and 5 years. As such, buyers ought to count on a refresh cycle will probably kick off comparatively quickly, driving continued demand for Nvidia’s GPUs.

This argument could also be a bit extra shaky than the opposite two, however there’s nonetheless a powerful case to count on {that a} 12 months from now, Nvidia would be the world’s largest firm.

The decision

The reply to the query of which of those three would be the greatest will depend on how “must-have” shoppers deem the Apple Intelligence options to be. I might guess Apple will maintain the No. 1 spot a 12 months from now until Apple Intelligence is an absolute flop. Its income streams have remained regular regardless of sliding demand for its iPhones. This new catalyst may kick-start their gross sales and the inventory to new ranges.

If it is not Apple, I might say Microsoft is a extra probably chief than Nvidia. Nevertheless, Nvidia is the most important wildcard right here, because it may see the already unimaginable demand for its GPUs go increased, which may ignite one other run-up within the inventory.

Microsoft can be probably the most conservative decide, however it will nonetheless be a very good one if the AI buzz wears off.

Must you make investments $1,000 in Apple proper now?

Before you purchase inventory in Apple, think about this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Apple wasn’t one among them. The ten shares that made the reduce may produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $775,568!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of June 10, 2024

Keithen Drury has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

Apple, Microsoft, or Nvidia: Which Will Be the World’s Most Priceless Firm a Yr From Now? was initially revealed by The Motley Idiot