Apple (NASDAQ: AAPL) inventory has skilled many struggles since its 1980 IPO. After its board fired Steve Jobs in 1985, the corporate spent years within the wilderness. It suspended its dividend payout in 1996, and was near chapter when it introduced Jobs again in 1997.

Shortly after that, Apple inventory started a run that made it one of the vital profitable shares in historical past, illustrating how innovation can dramatically enhance an organization’s fortunes.

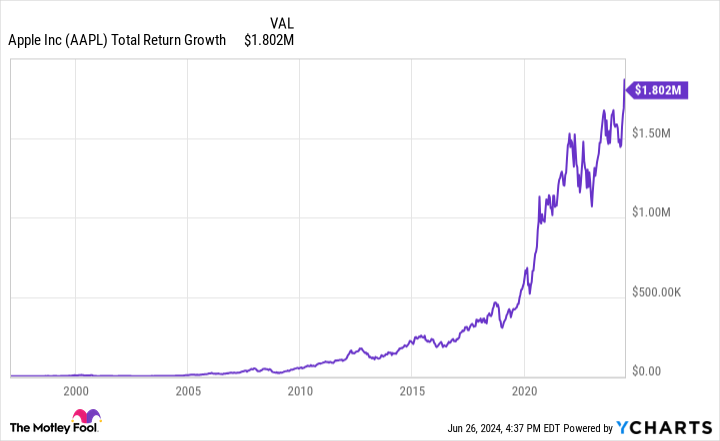

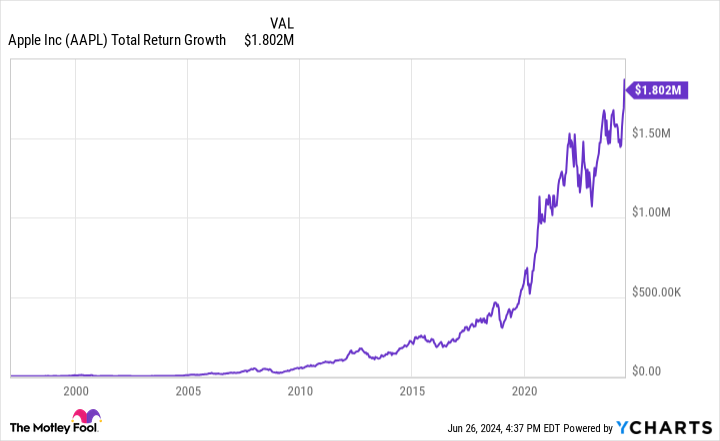

Apple’s inventory development since Jobs’ return

If one had purchased $1,000 in Apple inventory when Jobs returned in February 1997 and held on till right this moment, that place can be value round $1.8 million. That determine assumes this hypothetical investor would have reinvested their earnings from the dividend, which Apple reinstated in 2012.

Jobs’ first main transfer after returning was to combine the Mac ecosystem with the broader tech world, convincing Microsoft to take a position $150 million in Apple and develop and assist a Mac-compatible model of its well-liked Workplace software program.

He additionally set to construct an Apple ecosystem, revamping the Macintosh, launching the iMac in 1998, and following up with a brand new MacOS in 2001. The corporate gained further traction by launching the iPod music participant in 2001, and opening Apple Shops and the iTunes Retailer quickly after.

Nonetheless, the innovation that actually remodeled Apple was the iPhone, which it launched in 2007. It pioneered the trendy smartphone trade, and finally eradicated many individuals’s have to personal a PC. So profitable was the iPhone that it drives the vast majority of Apple’s income to at the present time.

Apple’s tempo of innovation slowed with the passing of Jobs in 2011. Now, it extra instantly competes with gadgets and apps utilizing Alphabet‘s Android working system and with most of its mega-tech opponents within the synthetic intelligence discipline.

Nonetheless, its continued improvements have at instances made it the world’s largest firm by market cap, and positioned it within the high three right this moment. Due to merchandise such because the iPhone and its intensive ecosystem, Apple’s inventory worth ought to proceed to develop.

Must you make investments $1,000 in Apple proper now?

Before you purchase inventory in Apple, think about this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Apple wasn’t certainly one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $759,759!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of June 24, 2024

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Will Healy has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Alphabet, Apple, and Microsoft. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

If You’d Invested $1,000 in Apple Inventory 27 Years In the past, This is How A lot You’d Have At this time was initially printed by The Motley Idiot