Within the battle for chip supremacy, two of the highest firms battling it out are Nvidia (NASDAQ: NVDA) and Superior Micro Units (NASDAQ: AMD). Over the previous 5 years, each shares have been robust performers. AMD is up over 433% throughout that stretch, which is excellent. Nevertheless, that return pales compared to the over 3,000% acquire in Nvidia’s inventory.

Nvidia has been the higher inventory throughout the previous 5 years, however which inventory will doubtless outperform over the subsequent 5?

Nvidia vs. AMD

In the meanwhile, the buildout of synthetic intelligence (AI) infrastructure advantages each firms, given the demand for the graphic processing items (GPUs) wanted to energy massive language mannequin (LLM) coaching and synthetic intelligence (AI) inference. This insatiable demand for GPUs led Nvidia’s information heart phase to submit $22.6 billion in fiscal 2025 Q1 income (for the quarter ending April 28, 2024), an unbelievable 427% year-over-year improve. AMD’s information heart phase, in the meantime, noticed its fiscal 2024 first-quarter income soar greater than 80% yr over yr to $2.3 billion.

Nvidia has grow to be the clear chief within the AI chip house, which will be seen with its information heart phase producing practically 10 occasions the quantity of income that AMD’s information heart phase produced. The corporate’s GPUs have grow to be the first ones used, on account of its CUDA (Compute Unified Gadget Structure) software program platform, which builders have lengthy been skilled on to program the chips. This, in flip, has helped create a large moat for the corporate’s GPUs, giving it greater than about 80% market share.

Nevertheless, the phase continues to be rising properly for AMD as its GPUs grow to be a substitute for Nvidia’s chips, that are in tight provide. Enterprises usually wish to have a number of suppliers so they do not grow to be depending on only one.

AMD is making some inroads. Final month, Microsoft (NASDAQ: MSFT) introduced that it will provide clusters of AMD’s MI300X chips via its Azure cloud computing service as a Nvidia various. As well as, AMD not too long ago mentioned it has had severe inquiries about constructing an AI cluster with over 1 million GPUs. Provided that AI coaching clusters are usually constructed with a couple of thousand GPUs, this might be an enormous win for AMD if it ever got here to fruition.

Whereas Nvidia’s outcomes are dominated by its GPU merchandise and information heart phase, the information heart solely accounted for 43% of AMD’s whole income, whereas it was 87% of Nvidia’s income. On the similar time, a few of AMD’s different segments struggled, which led to whole year-over-year income development within the quarter of solely 2%, in comparison with 262% for Nvidia.

Which inventory is the higher purchase?

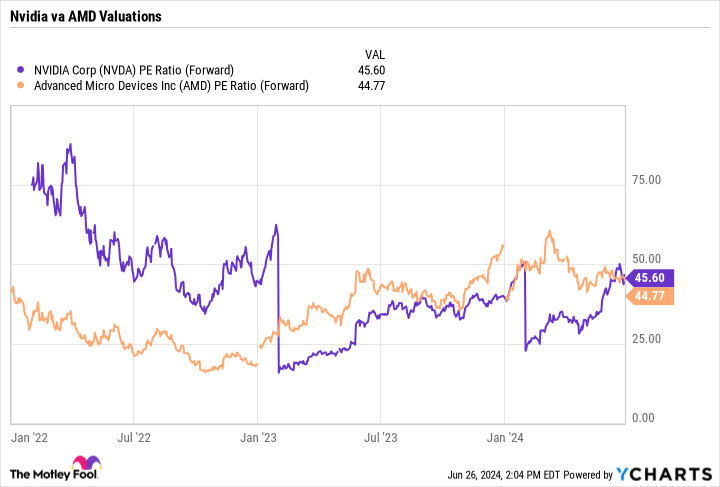

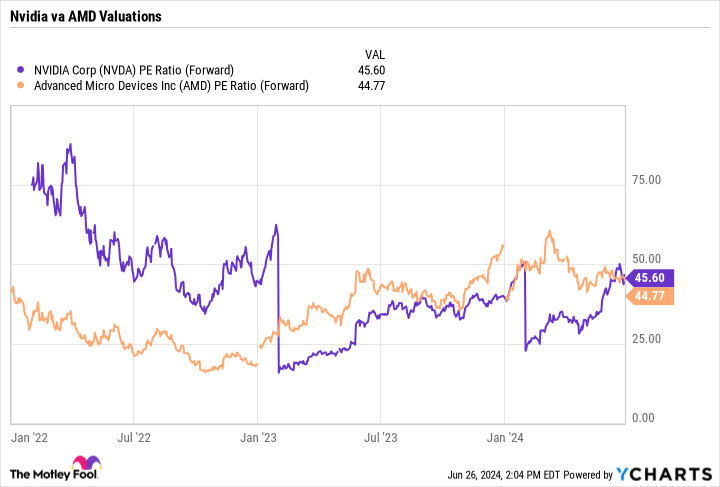

Regardless of Nvidia’s robust inventory efficiency, the 2 shares really commerce at practically similar ahead price-to-earnings (P/E) valuations. Nvidia trades at a ahead P/E of 45.6, in comparison with AMD at 44.8.

With the valuations so related, the query of which is the higher inventory to personal going ahead ought to come right down to which firm will carry out higher operationally over the subsequent few years.

Working in AMD’s favor is that its information heart phase has a a lot smaller base, in comparison with Nvidia. Because the smaller firm, it has the chance to take market share away from Nvidia. If the corporate can grow to be a viable second supply of GPU chips, it ought to see loads of continued development within the phase.

In the meantime, trying 5 years out, the corporate’s gaming phase, which has been a giant drag, ought to see an enormous enchancment beginning in 2027 or 2028. Microsoft is reportedly planning to launch its next-generation gaming console in 2028, whereas Sony is anticipated to launch its PlayStation 6 console in 2027 or 2028.

Again in 2022, AMD income associated to the Sony PlayStation 5 (PS5) was practically $3.8 billion, representing 16% of its income. Console gross sales usually peak their third yr after launch, and the PS5 was launched in 2020.

Working in Nvidia’s favor is the moat it has created with its CUDA platform. Builders have already discovered on its platform, and it takes time and coaching to work with different GPUs, which prices cash. This could permit the corporate to maintain its lead.

In the meantime, AMD has began quickly pushing innovation by growing next-generation structure GPU platforms that might be backward appropriate with its present structure. This could assist drive enormous demand from clients trying to keep on the reducing fringe of AI capabilities.

If AI continues to be in its early innings and the information heart buildout is simply starting, then Nvidia is my most popular inventory to purchase between the 2 chipmakers, given the moat it has created. Nevertheless, I believe AMD may be a really stable funding, particularly forward of a gaming console refresh cycle within the subsequent few years.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Nvidia wasn’t one among them. The ten shares that made the reduce might produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $757,001!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of June 24, 2024

Geoffrey Seiler has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Units, Microsoft, and Nvidia. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

Higher Semiconductor Inventory: Nvidia or Superior Micro Units was initially revealed by The Motley Idiot