For those who’re an investor who would not have already got entry to billions in capital, you might in all probability be taught a number of issues from the parents who do. Fortunately, protecting tabs on the world’s most profitable buyers is not very arduous to do.

Each three months, individuals managing a portfolio value $100 million or extra should report their buying and selling exercise to the Securities and Trade Fee. A fast take a look at the newest disclosures exhibits a handful of billionaire buyers purchased thousands and thousands of shares of two dividend-paying shares that presently supply ultra-high yields.

Shares of Pfizer (NYSE: PFE) and Annaly Capital (NYSE: NLY) supply yields which might be a number of occasions the common inventory within the benchmark S&P 500 index. Sadly, shares not often supply yields this excessive except there is a good cause to fret about their skill to keep up their payout.

Let’s take a look at their latest efficiency to search out out if following the lead of billionaire fund managers is smart to your portfolio.

Annaly Capital

Annaly Capital is an actual property funding belief (REIT) that buys mortgage-backed securities (MBSes) as an alternative of actual property. It earns a residing within the margins between its short-term borrowing bills and the curiosity it receives from the hopefully higher-yielding MBS in its portfolio.

At latest costs, Annaly shares supply a mind-blowing 13.6% yield. The large yield is attracting funds run by billionaires. Citadel Advisors, which is run by Ken Griffin, and Millennium Administration, which is run by Israel Englander, purchased shares within the first quarter.

Annaly Capital would not personal actual property, so it has to make use of its MBS portfolio to safe loans. It would not occur typically, however infrequently, the worth of its MBS can dip. When this occurs, lenders demand extra capital, and the corporate can find yourself promoting off parts of its portfolio at hearth sale costs.

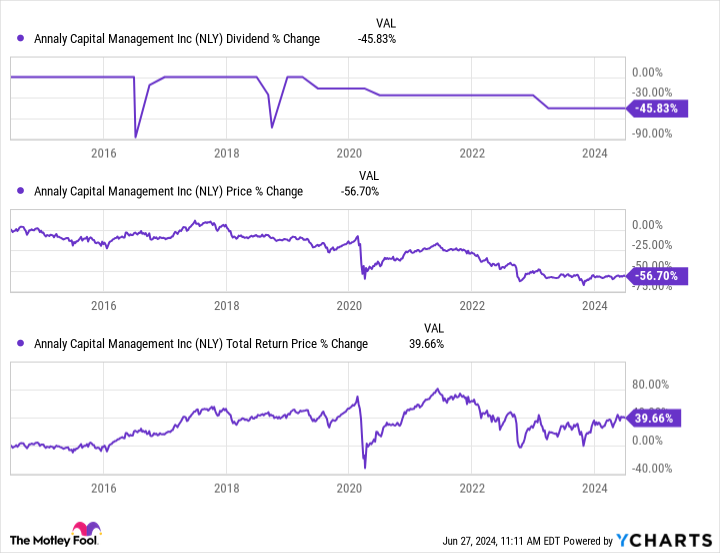

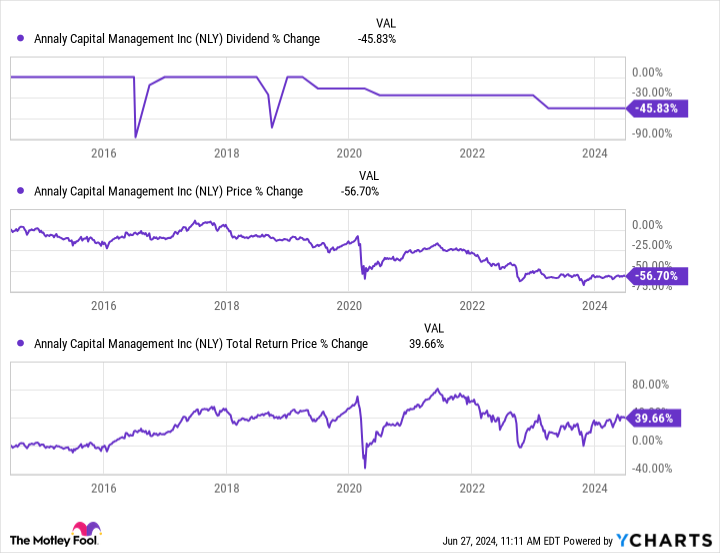

Earlier than you soar as much as fill your portfolio with shares of Annaly Capital, it is vital to appreciate the corporate has lowered its dividend by 45.8% since 2019. Buyers who purchased the inventory and reinvested all of the dividends have gained solely about 39% over the previous decade.

Whereas there is a good likelihood that purchasing Annaly Capital now and holding over the long term additionally results in optimistic positive aspects, the unpredictability of its dividend makes it a nasty selection for many income-seeking buyers.

Pfizer

Through the first three months of 2024, John Overdeck and David Siegel of Two Sigma purchased 18.9 million shares of Pfizer. The inventory has fallen by greater than half since its peak in late 2021.

Pfizer’s been dropping as a result of record-breaking gross sales of its COVID-19-related merchandise evaporated quicker than the market anticipated. Now that the worst is over, although, the inventory seems like a terrific discount.

Pfizer’s inventory dropped, however the firm nonetheless raised its dividend payout for the fifteenth consecutive yr final December. The inventory presents a 6.2% yield at latest costs, which is about 4.6 occasions greater than you’d obtain from the common dividend payer within the S&P 500.

At latest costs, you should buy Pfizer for round 11.6 occasions forward-looking earnings expectations. That is an inexpensive valuation for a enterprise you anticipate to develop at a snail’s tempo. A take a look at this drugmaker’s latest efficiency and ahead outlook suggests it would develop a lot quicker than the market is anticipating.

Pfizer invested heaps of COVID-19-related income into new medication, lots of that are already available on the market. If we exclude COVID-19-related gross sales and the adverse results of a stronger U.S. greenback, first-quarter gross sales rose 11% yr over yr.

Pfizer has the longest record of revolutionary new medication within the pharmaceutical business, and it is nonetheless rising comparatively shortly. The FDA authorised 9 new medicines from the corporate in 2023, they usually’re poised to drive development within the decade forward. Including some shares to a diversified portfolio seems like a comparatively secure manner for income-seeking buyers to spice up their passive revenue stream.

Must you make investments $1,000 in Annaly Capital Administration proper now?

Before you purchase inventory in Annaly Capital Administration, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and Annaly Capital Administration wasn’t one in every of them. The ten shares that made the reduce might produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $757,001!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of June 24, 2024

Cory Renauer has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Pfizer. The Motley Idiot has a disclosure coverage.

2 Extremely-Excessive-Yield Dividend Shares Billionaires Are Shopping for Left and Proper: Might They Be Sensible Buys for You in July? was initially printed by The Motley Idiot