Spot bitcoin ETFs fell nicely into damaging territory in early Friday buying and selling as the worth of their underlying asset plunged to its lowest ranges since February.

The BlackRock Bitcoin Belief (IBIT), the most important fund within the class with greater than $19 billion in belongings, was lately down about 6.5%, in keeping with etf.com knowledge. The second and third largest spot bitcoin ETFs, the Grayscale Bitcoin Belief (GBTC) with $17.5 billion in AUM and Constancy Smart Origin Bitcoin Fund (FBTC) with $10.6 billion in AUM, have been down equally.

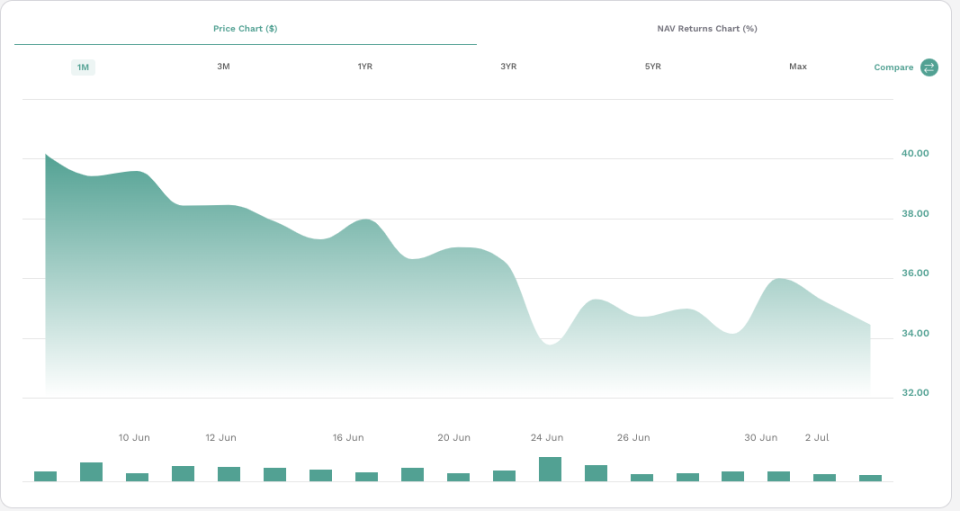

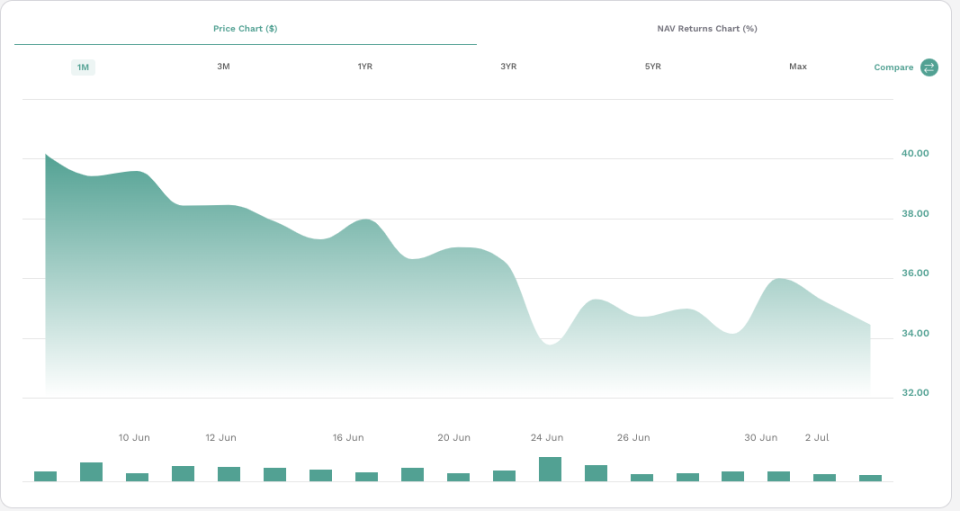

Spot Bitcoin ETF Flows Observe BTC Worth

GBTC had greater than $34 million in outflows the 2 buying and selling days previous to the July 4 U.S. vacation, whereas internet flows to IBIT and FBTC, and the opposite eight spot bitcoin ETFs that began buying and selling earlier this 12 months, have been tepid, in keeping with analysis from U.Ok.-based asset supervisor Farside Traders.

Learn Extra: Spot Bitcoin ETF Outflows Surpass $1.1B in 7-Day Streak

Bitcoin dipped to about $53,600 on July 4, the primary time since Feb. 25 that the most important crypto by market worth has fallen under $54,000, in keeping with crypto markets knowledge present CoinMarketCap. The asset regained some misplaced floor to extra lately change arms at roughly $56,750 however is off 23% from its all-time excessive above $73,000 in March.

“Bitcoin is breaking vital technical and psychological ranges at $60,000,” wrote crypto analysis group 10X in a July 4 notice. “This can be a key stage for Bitcoin miners and Bitcoin Spot ETF patrons, and it additionally broadly marks the underside (assist) of the three-month buying and selling vary. Worth declines might speed up as assist will get damaged and sellers scramble to search out liquidity.”

The newest decline comes amid continued liquidations by miners and different massive bitcoin holders, together with Germany and the U.S., which have lately despatched greater than $700 million bitcoin seized to exchanges. Spot bitcoin ETFs handle about $50 billion in belongings, with the whole fluctuating in keeping with bitcoin’s worth.

In a notice to etf.com, Mark Connors, managing director, head of worldwide macro technique at Onramp, a Dallas-based, crypto companies agency, questioned how buyers would react to the months-long bitcoin worth stoop.

Learn Extra: Pantera Eyes $100M of Spot Ether ETF Shares

BTC Worth Tailwinds Stay

“Whereas the spot ETF flows have slowed and reversed a bit, this new class [of investors] has held tight for probably the most half,” Connors wrote. “Nonetheless, if BTC breaches $50K, the resolve of the ‘class of 2024’ could also be examined as the bulk” of the greater than $15 billion of spot BTC ETF inflows occurred at in regards to the $40K to $60K BTC (ranges).”

Nonetheless, Connors stated that an bettering regulatory framework for crypto, favorable utterances by doubtless Republican Presidential nominee Donald Trump stay tailwinds supporting his agency’s year-end worth goal of $110,000 for bitcoin.

Permalink | © Copyright 2024 etf.com. All rights reserved