Few corporations are as confirmed and sturdy as meals and beverage large PepsiCo (NASDAQ: PEP). The corporate has carried out for many years, showering traders with dividends and constructing wealth over generations. The inventory has steadily pale in latest weeks and is approaching 52-week lows.

Years of inflation have customers grappling with increased grocery costs, and sentiment is dropping. Traders have already seen corporations like McDonald’s cite weaker client spending as a headwind to their enterprise.

So, ought to traders keep away, or is now the time to purchase the inventory?

Listed here are 4 causes long-term traders can buy the inventory like there isn’t any tomorrow.

1. Finest-in-class manufacturers

PepsiCo’s world-class meals and beverage manufacturers have been its pillar of power, creating many years of progress and wealth for its shareholders. The inventory value has appreciated greater than 10,000% over its lifetime, and the dividend has grown over 5,300%. PepsiCo’s manufacturers embody beverage headliners like Pepsi, Mountain Dew, Gatorade, and Lipton, whereas its meals merchandise embody names like Doritos, Cheetos, Lay’s, Quaker, and plenty of extra.

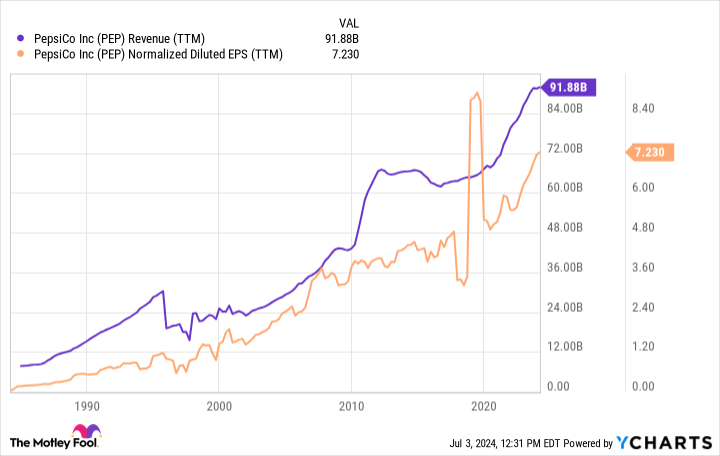

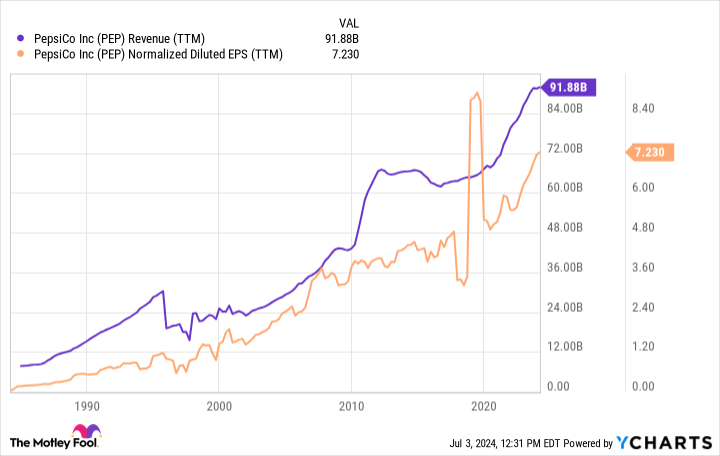

Dominating the grocery aisle implies that PepsiCo merchandise get top-tier shelf area in supermarkets and pricing energy as a result of customers typically will purchase what they know and love. Moreover, meals and beverage merchandise are small ticket gadgets; PepsiCo can get away with bumping the worth just a few cents as a result of it would not dramatically influence customers’ budgets. A long time of inhabitants progress and value will increase have steadily pushed income to over $91 billion yearly.

2. Nonetheless a superb dividend grower

PepsiCo is a dividend dynamo as a result of it provides yield and progress. Traders shopping for right now get a stable beginning yield of three.3%. On high of that, PepsiCo has raised its dividend by a median of 6.6% for the previous 5 years. Its most up-to-date 7.1% enhance exhibits that administration is assured within the firm’s outlook. Bear in mind, PepsiCo has raised its dividend for 52 consecutive years (a Dividend King), so to take care of inflation-beating dividend progress in spite of everything this time is spectacular.

Notably, the dividend is properly secured by a payout ratio that is 66% of PepsiCo’s estimated 2024 earnings. Earnings are excessive sufficient that PepsiCo can comfortably afford the dividend and nonetheless spend money on the enterprise or repurchase shares. This constant progress outpacing inflation is how the inventory has carried out so properly for therefore lengthy.

3. Stable progress outlook

What’s most necessary for traders is whether or not PepsiCo can proceed to develop at this tempo. In spite of everything, this firm, which sells snacks and bottled drinks, is now a $225 billion behemoth. Luckily, PepsiCo’s progress components nonetheless seemingly has mojo left.

The great thing about PepsiCo is its many progress levers. It chugs alongside because it raises costs, sells extra merchandise to a rising world inhabitants, and acquires and launches new product manufacturers. A few of PepsiCo’s latest hits embody newer beverage manufacturers comparable to Bubly and Starry. It has additionally invested within the vitality drink business by buying Rockstar in 2020 and coming into into a serious collaboration with Celsius in 2022.

Administration is at the moment guiding for 4% year-over-year natural income progress in 2024 and a 7% enhance in earnings per share over 2023. Analysts wanting additional out anticipate extra of the identical. Consensus estimates name for earnings progress averaging over 7% yearly for 3 to 5 years.

4. Stellar enterprise at a good value

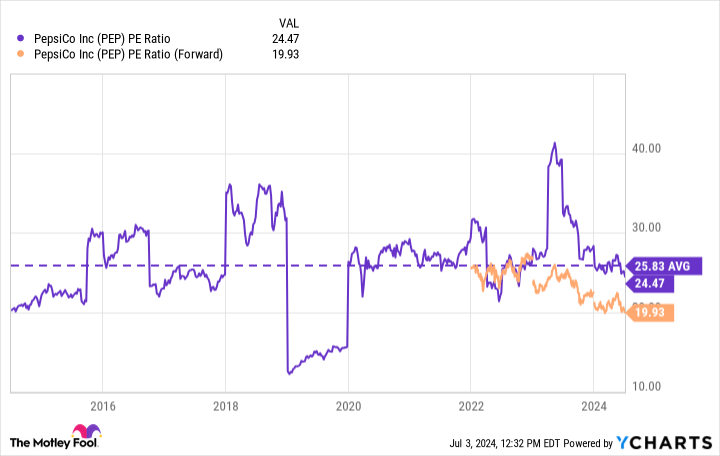

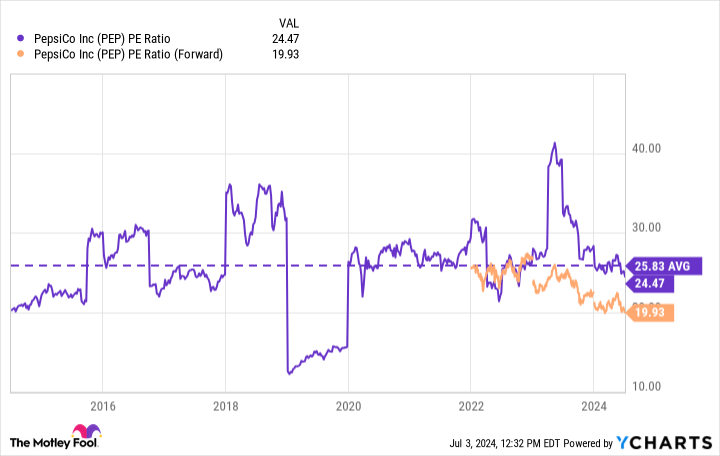

The market does foolish issues typically. Weaker client spending might put some pricing strain on PepsiCo, and the inventory market is seemingly pricing that into the inventory. Shares have now fallen over 17% from their excessive. PepsiCo has averaged a P/E ratio of just about 26 over the previous decade, and shares have now fallen beneath 20 occasions this 12 months’s estimated earnings:

Does the inventory need to be traded at a reduction? Whereas PepsiCo would possibly really feel some strain whereas customers are struggling, it is onerous to argue that the enterprise is essentially worse, particularly when the outlook stays in step with the corporate’s previous efficiency. Do you wish to low cost the inventory? That is already occurred. Barring an unexpectedly unhealthy collapse within the enterprise, PepsiCo inventory looks like a implausible enterprise buying and selling at a good value right now.

To use Buffett’s recommendation, traders should not hesitate to purchase a beautiful enterprise like PepsiCo at a good value.

Do you have to make investments $1,000 in PepsiCo proper now?

Before you purchase inventory in PepsiCo, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 finest shares for traders to purchase now… and PepsiCo wasn’t one in every of them. The ten shares that made the reduce might produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $771,034!*

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of July 2, 2024

Justin Pope has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Celsius. The Motley Idiot has a disclosure coverage.

4 Causes to Purchase PepsiCo Inventory Like There’s No Tomorrow was initially printed by The Motley Idiot