The arrival of synthetic intelligence into the mainstream is a boon for the cloud computing business. AI wants huge quantities of knowledge and computing energy to execute duties, each of that are available in a cloud surroundings.

Two distinguished companies benefiting from AI and its impression on the cloud computing market are Alphabet (NASDAQ: GOOGL)(NASDAQ: GOOG) and Tremendous Micro Laptop (NASDAQ: SMCI), generally generally known as Supermicro.

This is how these two tech firms are reaping the rewards from the AI-driven cloud computing increase, and should you had to decide on only one to spend money on, which could show the higher long-term funding.

Alphabet’s multifaceted cloud enterprise

Alphabet is probably greatest identified for its ubiquitous Google search engine. However it additionally has a thriving cloud computing enterprise known as Google Cloud.

This division is experiencing speedy development. Within the first quarter, Google Cloud generated $9.6 billion, which is a 28% enhance from 2023’s $7.5 billion. It’s now the third-largest cloud vendor on the planet.

Google Cloud gives a number of advantages to its enterprise shoppers. Like all cloud choices, clients can use it to enhance or substitute current IT infrastructure, corresponding to servers.

Furthermore, Alphabet makes its proprietary AI platform obtainable to shoppers by means of Google Cloud, to allow them to create their very own AI methods and apps. Instacart makes use of this characteristic to enhance its customer support workflows.

As well as, in accordance with CEO Sundar Pichai, “Our Cloud enterprise is now extensively seen because the chief in cybersecurity.” Its AI-powered cybersecurity options are why Pfizer adopted Google Cloud.

Tremendous Micro Laptop’s centered strategy to cloud computing

Supermicro offers laptop servers and storage options, the precise elements essential to cloud computing. It focuses on high-performance computing merchandise to cater to the wants of AI-optimized clouds specifically.

Supermicro gives clients an array of choices utilizing a modular strategy the corporate calls its “Constructing Block Structure.” This strategy permits it to rapidly customise merchandise to fulfill the technical necessities of its clientele.

The sudden AI-spurred demand for Supermicro’s choices led to huge gross sales development for the corporate. In its fiscal Q3, ended March 31, Supermicro achieved income of $3.9 billion, a 200% enhance 12 months over 12 months.

The corporate expects its outsized gross sales to proceed. Supermicro is forecasting income of at the very least $5.1 billion for its fiscal fourth quarter. That is greater than double the $2.2 billion in This autumn gross sales generated within the earlier fiscal 12 months.

Supermicro added to its means to develop income by means of an expanded product line. Its choices now embody further IT infrastructure wants, corresponding to energy and liquid cooling methods.

Deciding between Alphabet and Tremendous Micro Laptop

The cloud computing market is predicted to see multiyear development due to AI, rising from $588 billion final 12 months to $2.3 trillion by 2032. This development makes each Alphabet and Supermicro compelling investments for the long run.

Nonetheless, deciding which inventory is the higher purchase might be difficult. On this duel of cloud firms, a number of components favor Alphabet.

The Google mother or father gives a extra diversified enterprise. It has a thriving digital promoting operation, the place it is a market chief. Advert gross sales comprised $61.7 billion of the corporate’s $80.5 billion in Q1 income.

Alphabet can be a market chief in on-line search. Because of Google’s recognition, Alphabet has a trove of knowledge to feed into and strengthen its AI platform.

Additionally, Supermicro battles in a aggressive area with rivals together with Dell Applied sciences and Hewlett Packard Enterprise.

Competitors has led to pricing stress, inflicting a decline in Supermicro’s gross margin to fifteen.6% in fiscal Q3 from 17.7% within the prior 12 months. Supermicro expects its gross margin to say no additional in fiscal This autumn.

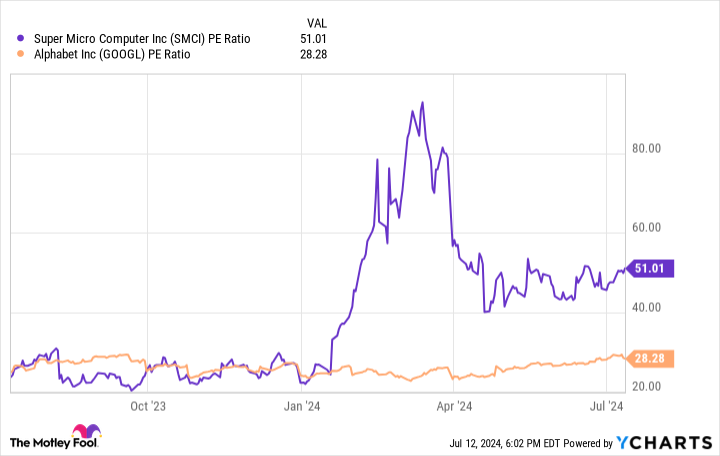

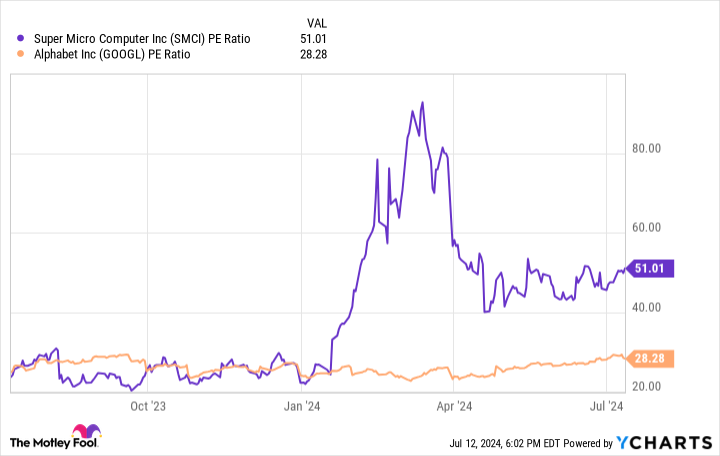

One other issue to contemplate is valuation. Utilizing the price-to-earnings ratio (P/E ratio), a extensively used metric to evaluate a inventory’s worth, Alphabet is the winner. This chart exhibits that Supermicro’s valuation has soared in 2024.

Whereas Supermicro’s P/E ratio has come down in latest months, shares stay pricier than Alphabet’s.

As well as, Supermicro will not be cash-flow optimistic. It spent $2.7 billion over the previous three quarters build up its product stock. This resulted in detrimental free money stream (FCF) of $1.6 billion in fiscal Q3.

Alphabet is not burdened with sustaining a listing of products to promote, serving to it to generate prodigious FCF of $16.8 billion in Q1. Over the trailing 12 months, the corporate’s FCF was $69.1 billion.

Its large FCF permits Alphabet to comfortably afford a dividend. Supermicro would not supply a dividend.

Whereas each firms are having fun with rising income due to development within the cloud computing sector, given Alphabet’s market-leading merchandise, robust FCF, extra diversified enterprise, and higher inventory valuation, Alphabet is the superior funding right now.

Must you make investments $1,000 in Tremendous Micro Laptop proper now?

Before you purchase inventory in Tremendous Micro Laptop, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Tremendous Micro Laptop wasn’t certainly one of them. The ten shares that made the lower might produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $791,929!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of July 15, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Robert Izquierdo has positions in Alphabet. The Motley Idiot has positions in and recommends Alphabet and Pfizer. The Motley Idiot recommends Instacart. The Motley Idiot has a disclosure coverage.

Higher Cloud Computing Inventory: Alphabet vs. Tremendous Micro Laptop was initially revealed by The Motley Idiot