Regardless of its spectacular efficiency in 2020 and 2021, it is no secret that Pfizer (NYSE: PFE) is within the strategy of reinventing itself. With out a lot of the windfall from its coronavirus merchandise propping up the highest line, it might be years till income can high its current peak.

However that simply means the corporate has an incentive to make large performs and take large dangers to please its shareholders. On that entrance, this is my prediction for what its subsequent main transfer will likely be.

There is a large incentive to amass a sure type of biotech proper now

In the meanwhile, Pfizer’s grand plan is to put the groundwork for its development via 2030 and past. As a part of that plan, it expects so as to add $20 billion in income from gross sales of latest medicines produced with its personal analysis and growth (R&D) capabilities, and $25 billion from acquisitions of different biopharmas and their most promising pharmaceutical belongings.

When it not too long ago purchased Seagen, a most cancers biotech with superior therapeutic expertise, it was prepared to tackle $31 billion of debt to make the acquisition. Most cancers will stay one in all Pfizer’s new main focuses, per administration. However there’s one other space that it is eyeing the place it hasn’t made a equally large transfer: weight reduction.

Although medicines made by Eli Lilly and Novo Nordisk have been wildly profitable, Pfizer’s personal weight reduction applications have not precisely labored out as supposed. Some candidates have been canceled completely, and its most superior applications are nonetheless in part 1 scientific trials — a few years away from being commercialized, assuming they ever are. With a market that may very well be price as a lot as $130 billion by 2030 on the road, slogging forward, then coming into lengthy after the present contenders have had years to safe market share, merely will not do.

Due to this fact, my prediction is that Pfizer’s subsequent large transfer will likely be to amass a promising biotech with late-stage weight reduction applications, or to amass such applications instantly and end the event course of in-house. Here is why this transfer is an actual risk.

First, the corporate has loads of cash. As of the primary quarter, it has greater than $11.9 billion in money, money equivalents, and short-term investments available. It additionally has simply over $68.7 billion in debt, giving it a debt-to-equity ratio of 0.7. In different phrases, it has some huge cash available, and whereas it is beginning to look a bit indebted, it most likely nonetheless has greater than sufficient flexibility to borrow important volumes of money if vital.

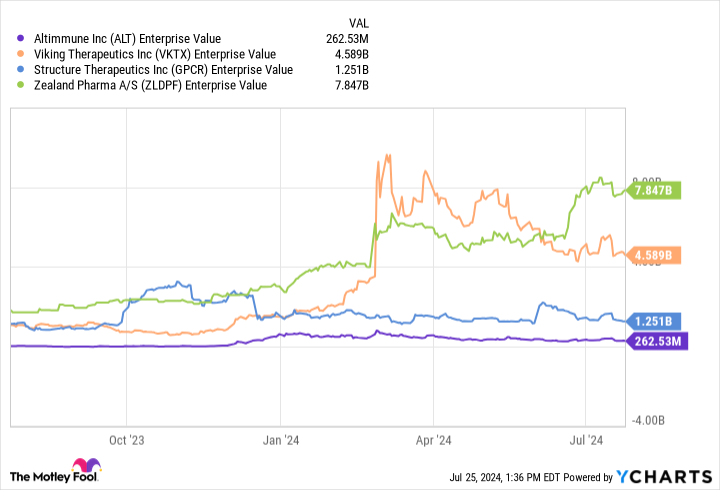

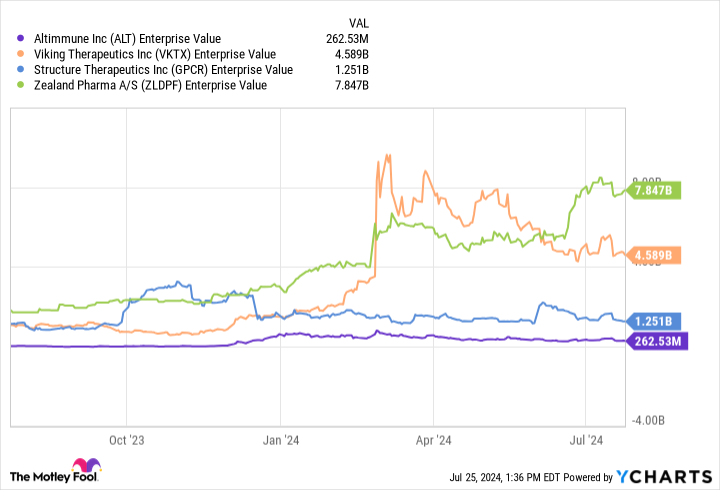

Pfizer is so well-capitalized, the truth is, that it might afford to purchase greater than one of many main biotechs growing anti-obesity medicines. Try this chart describing the enterprise worth (EV) of gamers like Viking Therapeutics, Altimmune, Construction Therapeutics, and Zealand Pharma:

The precise acquisition value of those companies is perhaps greater than their EVs indicate. However they’re properly inside what Pfizer can afford at the moment — assuming it is a quicker entry into the marketplace for weight reduction medicine that the corporate is aiming to do.

Nonetheless, shopping for these biotechs completely, or shopping for their lead belongings, may not even be vital for Pfizer to get the publicity it desires. It might simply choose to forge a growth collaboration as a substitute, taking over a smaller value burden in alternate for a decrease ceiling on attainable earnings from future gross sales. If something, it is stunning that Pfizer hasn’t accomplished extra collaborations on the burden loss entrance already.

Do not rely the eggs till they hatch

It is possible that Pfizer’s inventory would see a major bump on the day it had been to announce an acquisition of a weight reduction biotech, assuming this prediction comes true.

However till that day comes, do not buy this inventory with the expectation that an announcement is true across the nook. Likewise, acknowledge that typically scientific trials fail, even within the late-stage applications which are the juiciest targets for buying. There is a danger that an acquisition might finish with little to point out for the expenditure.

As well as, take into account that it may very well be a greater transfer to put money into one in all these biotechs than in Pfizer itself for the time being. If the larger enterprise makes a bid to purchase it, you may profit that means too.

Do you have to make investments $1,000 in Pfizer proper now?

Before you purchase inventory in Pfizer, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Pfizer wasn’t one in all them. The ten shares that made the lower might produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… when you invested $1,000 on the time of our advice, you’d have $692,784!*

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of July 22, 2024

Alex Carchidi has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Pfizer. The Motley Idiot recommends Novo Nordisk. The Motley Idiot has a disclosure coverage.

Prediction: This Will Be Pfizer’s Subsequent Huge Transfer was initially printed by The Motley Idiot