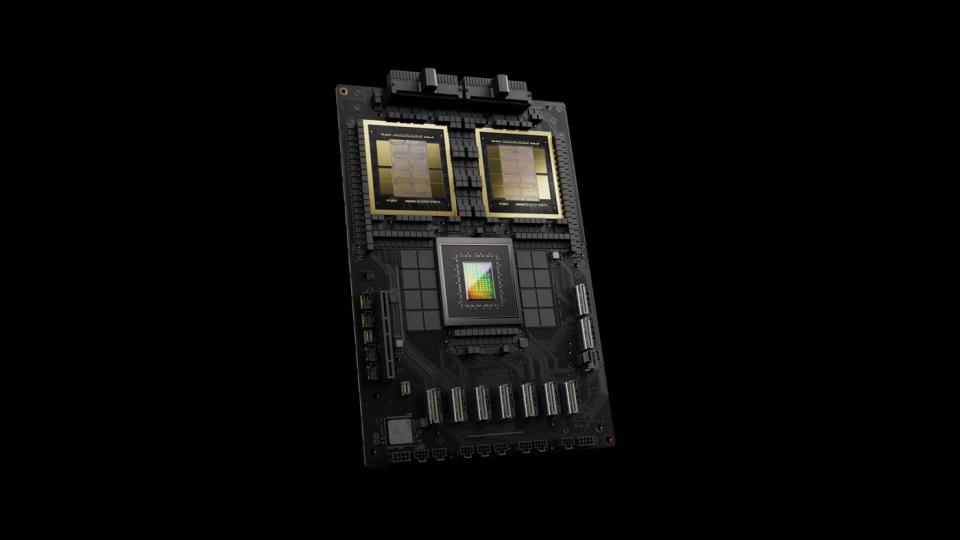

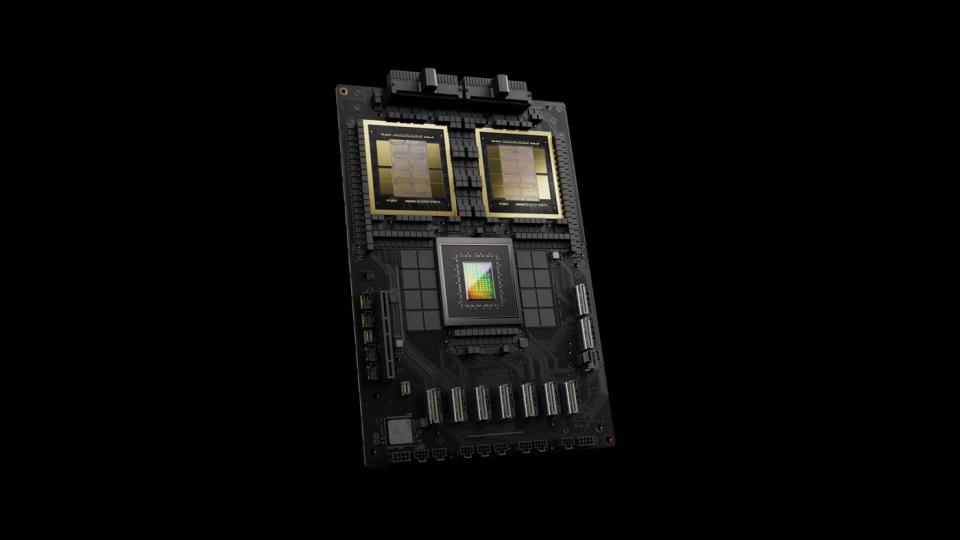

There is not any getting round it: The appearance of synthetic intelligence (AI) early final yr has been a boon to chipmaker Nvidia (NASDAQ: NVDA). The corporate’s graphics processing items (GPUs) have lengthy been the gold customary for video video games, knowledge facilities, and early branches of AI.

The uptake of generative AI kicked off in earnest in early 2023, making Nvidia the most popular ticket on the town. Shares are up practically 700% throughout that point as the corporate controls an estimated 92% of the data- heart chip market — the place most generative AI lives — in response to IoT Analytics. These positive factors have not all been in a straight line, nonetheless, as Nvidia inventory plunged as a lot as 23% over the past three weeks of July.

Behind the droop are fears that the adoption of AI may quickly path off. After the corporate generated triple-digit income and revenue progress over the previous yr, traders have begun to surprise if the top was in sight. The proof has begun to pile up and offers a transparent reply to the quintessential investor query: Is it too late to purchase Nvidia inventory?

The query of demand

Generative AI requires quite a lot of computational horsepower to run the massive language fashions (LLMs) that underpin the know-how. That, mixed with the huge quantities of information vital, makes AI largely the purview of the world’s largest tech corporations, that are additionally Nvidia’s largest prospects. These tech giants have begun to report their quarterly outcomes, offering traders with perception into the state of AI adoption — and the proof is compelling.

Throughout Alphabet‘s (NASDAQ: GOOGL) (NASDAQ: GOOG) second-quarter earnings name, CEO Sundar Pichai stated of AI, “We’re at an early stage of what I view as a really transformative space … aggressively investing upfront in a defining class.” Certainly, the corporate’s capital expenditures (capex) of $13.2 billion have been increased than many anticipated, and Alphabet plans capex spending of roughly $12 billion per quarter for the rest of the yr. The spending was “overwhelmingly” spent on the servers and knowledge facilities wanted for AI.

For its fiscal 2024 This fall (ended June 30), Microsoft (NASDAQ: MSFT) additionally admitted to happening an AI-centric spending spree, with capex of $19 billion. CFO Amy Hood famous that “cloud and AI-related spending represents practically all of our complete capital expenditures.” Hood went on the say that fiscal 2025 capex is “anticipated to be increased than fiscal yr 2024.”

Meta Platforms (NASDAQ: META) spent greater than $8.1 billion on capex in Q2 and is now predicting full-year spending of $37 billion to $40 billion, with “important capex progress in 2025 to help our AI analysis and product improvement efforts,” accoring to CFO Susan Li.

Nvidia’s largest prospects

These capex spending numbers and the accompanying administration commentary clarify that Large Tech plans to proceed spending massive on AI. Moreover, the truth that a lot of this spending can be dedicated to servers and knowledge facilities means that Nvidia would be the beneficiary of a lot of this spending.

Whereas Nvidia would not present the identities of its largest prospects, Wall Avenue has achieved some sleuthing. Analysts at Bloomberg and Barclays parsed the numbers and concluded that Nvidia’s 4 largest prospects — chargeable for roughly 40% of its income — are:

-

Microsoft: 15%

-

Meta Platforms: 13%

-

Amazon: 6.2%

-

Alphabet: 5.8%

Three of the 4 have been clear about their AI spending, and by the point you learn this, Amazon’s outcomes can be out, and I’ve little question its spending on AI can be equally strong.

The proof is within the pudding

The previous yr has been a whirlwind for Nvidia traders. After producing triple-digit progress final yr, the corporate adopted that up with document outcomes to kick off the present yr. For fiscal 2025’s Q1 (ended April 28), Nvidia delivered document income that grew 262% yr over yr to $26 billion, fueled by document data-center income of $22.6 billion, up 427%. Income additionally exploded increased as diluted earnings per share (EPS) of $5.98 surged 629%.

Nvidia is scheduled to report its Q2 outcomes after the market shut on Aug. 28, and if the commentary offered by its Large Tech prospects is any indication, Nvidia ought to have one other sturdy exhibiting up its sleeve.

The corporate’s forecast is looking for income of $28 billion, which might signify year-over-year progress of 107%, with a commensurate uptick in profitability. It is price noting that Nvidia has a historical past of eclipsing its personal steering, so the outcomes might conceivably be increased.

Lastly, at roughly 38 time ahead earnings, Nvidia trades at a slight premium, however given the corporate’s triple-digit progress, that is not shocking.

In my thoughts, the preponderance of the proof is evident: Nvidia inventory remains to be a purchase.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Nvidia wasn’t one among them. The ten shares that made the minimize might produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… if you happen to invested $1,000 on the time of our advice, you’d have $669,193!*

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of July 29, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Danny Vena has positions in Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

Is It Too Late to Purchase Nvidia Inventory? Proof Is Piling Up That Offers a Clear Reply was initially revealed by The Motley Idiot