Since changing into CEO at Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) in 1965, Warren Buffett has delivered 19.8% compound annual returns to buyers, or sufficient to show a $100 funding into $4.4 million in the present day. Buffett’s prolonged observe document of success is one motive buyers eagerly await the discharge of Berkshire’s quarterly report displaying the shares the conglomerate purchased and bought through the quarter.

Over the previous three quarters, Berkshire Hathaway has purchased shares of Chubb (NYSE: CB) inventory hand over fist and saved its shopping for confidential for 2 quarters. Berkshire owns 26 million shares of the insurer as of March 31, price roughly $7.2 billion in the present day. This is why Chubb is a great purchase for buyers in the present day.

Why Buffett is drawn to insurance coverage investments

Buffett loves the insurance coverage trade, going again to his days as a pupil at Columbia Enterprise Faculty. On the time, Buffett discovered beneath Benjamin Graham, who invested in GEICO in 1948. It was one of many best-performing property throughout Graham’s profession.

When Buffett acquired Berkshire Hathaway in 1965, it was a failing textile firm that was barely staying afloat. In 1967, Berkshire acquired the insurer Nationwide Indemnity, which Buffett credit as a turning level in Berkshire Hathaway’s historical past.

Insurance coverage corporations’ money flows make them interesting investments, which is why Buffett continues to speculate closely in them. Just a few years in the past, Berkshire Hathaway acquired Alleghany for $11.6 billion, including to its checklist of insurance coverage corporations owned by Berkshire Hathaway, together with GEICO, Nationwide Indemnity, Berkshire Hathaway Major Group, and Berkshire Hathaway Reinsurance Group.

Chubb is likely one of the largest and greatest at managing threat

Chubb is likely one of the world’s largest property and casualty insurance coverage corporations and underwrites varied insurance policies, together with private automotive, owners, accident and well being, agriculture, and reinsurance.

The corporate has a wonderful threat administration historical past, which you’ll observe by its mixed ratio. This important insurance coverage metric is the sum of claims prices (how a lot an insurance coverage firm pays out on a coverage) and bills (like worker compensation or mounted overhead) divided by the premiums the corporate collects.

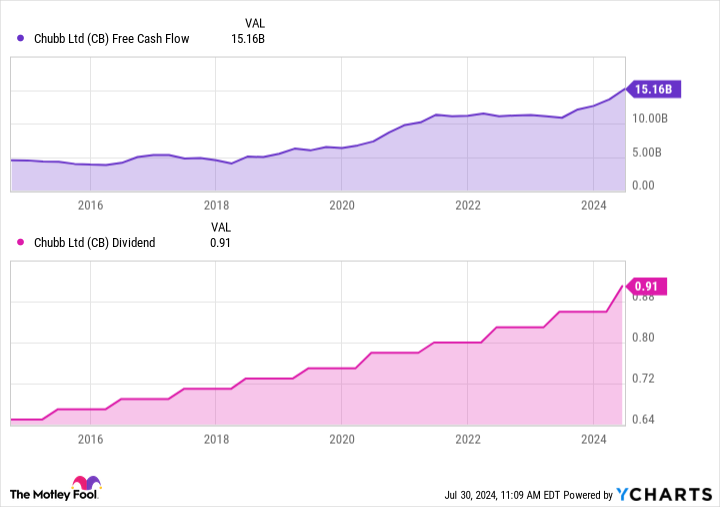

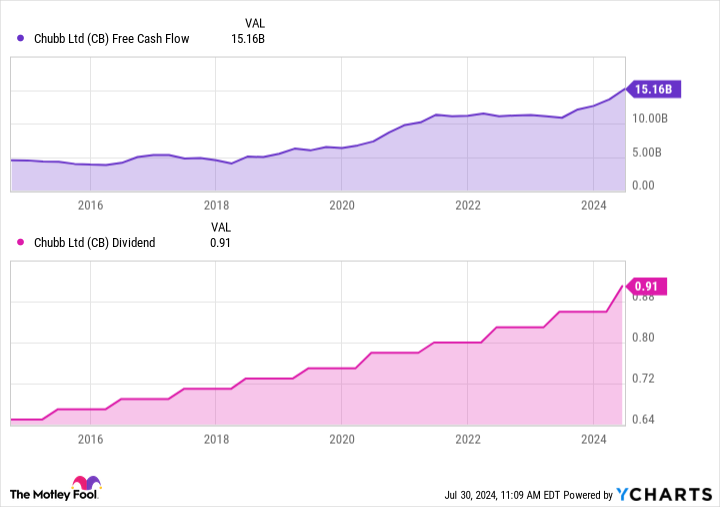

Over the previous twenty years, Chubb’s common mixed ratio was 90.8%, effectively under the trade common of 100%. This issues as a result of it interprets into free money circulate, which the corporate makes use of to pay dividends, purchase again shares, or put money into issues like bonds and shares. Chubb’s stable progress is why it has raised its dividend payout for 31 consecutive years.

One other good thing about investing in insurance coverage is the timing of money flows. Insurers accumulate premiums upfront and pay out claims down the highway. Within the time between, the corporate can make investments this cash, generally known as “float,” often in short-term Treasury payments. As insurance policies expire, corporations maintain their income and may construct an in depth funding portfolio over time.

Chubb has a $113 billion funding portfolio primarily invested in fixed-income securities. Final yr, it earned $4.9 billion in funding revenue, up 32% yr over yr, and its yield on common invested property improved from 3.4% to 4.2% because it benefited from rising rates of interest. By the primary six months of 2024, Chubb’s internet funding revenue has elevated one other 27% from final yr.

Chubb is effectively positioned

The Federal Reserve is projected to chop rates of interest someday this yr and into subsequent, which might negatively influence Chubb’s funding portfolio within the quick time period. Nevertheless, some longtime market individuals suppose rates of interest might keep elevated.

For instance, Howard Marks of Oaktree Capital Administration has described a “sea change,” saying, “For varied causes, the Fed just isn’t going to return to the ultra-low rates of interest during the last 13 years” in a 2023 interview on the Motley Idiot Cash podcast. If that is the case, insurers like Chubb will profit by incomes extra curiosity revenue than was attainable within the decade and a half prior.

JPMorgan Chase CEO Jamie Dimon additionally cautioned that “there are nonetheless a number of inflationary forces in entrance of us” resulting from fiscal deficits, rising rates of interest, and stubbornly excessive inflation. Chubb is already a stable firm to personal, and if inflationary pressures persist, it has the pricing energy to adapt to rising prices, giving it stellar potential for the following decade and past.

Must you make investments $1,000 in Chubb proper now?

Before you purchase inventory in Chubb, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Chubb wasn’t one in every of them. The ten shares that made the minimize might produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $657,306!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of July 29, 2024

JPMorgan Chase is an promoting associate of The Ascent, a Motley Idiot firm. Courtney Carlsen has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Berkshire Hathaway and JPMorgan Chase. The Motley Idiot has a disclosure coverage.

Berkshire Hathaway Added 26 Million Shares of This Inventory within the Previous 3 Quarters: This is Why It is a Good Purchase Right this moment was initially revealed by The Motley Idiot