Semiconductor shares have been a profitable theme within the synthetic intelligence (AI) inventory rally. Excessive-flying chip corporations Nvidia (NASDAQ: NVDA) and Broadcom (NASDAQ: AVGO) carried out so effectively that administration cut up their shares to make it simpler for traders and firm workers to purchase or promote shares.

Do not forget that inventory splits decrease the share value however offset that by growing the variety of shares. In different phrases, inventory splits do not essentially change a inventory’s valuation. Nonetheless, a sell-off, like what traders noticed just lately within the Nasdaq, can.

Though the market has bounced again, these two (AI) winners stay under their highs. If the Nasdaq continues to dump, each shares could be wonderful buys for long-term traders. Right here is why.

A sell-off creates a much-needed margin of security for Nvidia inventory

No firm has loved extra AI-driven success than Nvidia, whose graphics processing models (GPUs) have develop into the first selection for knowledge facilities operating complicated AI fashions. Its proprietary CUDA software program helps clients unlock the total energy of its GPU chips, making them good for AI.

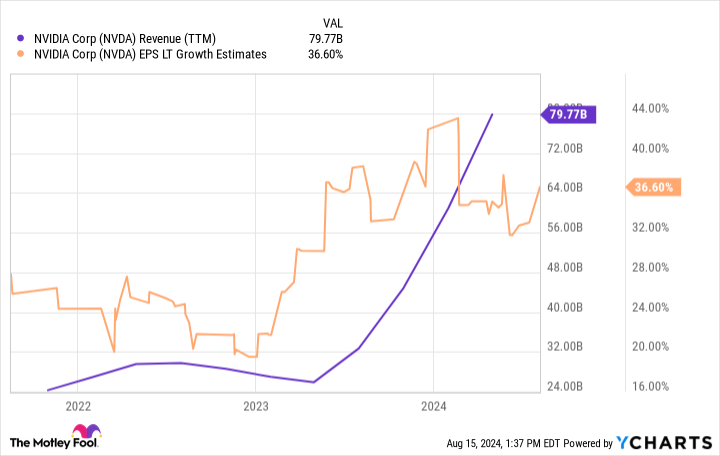

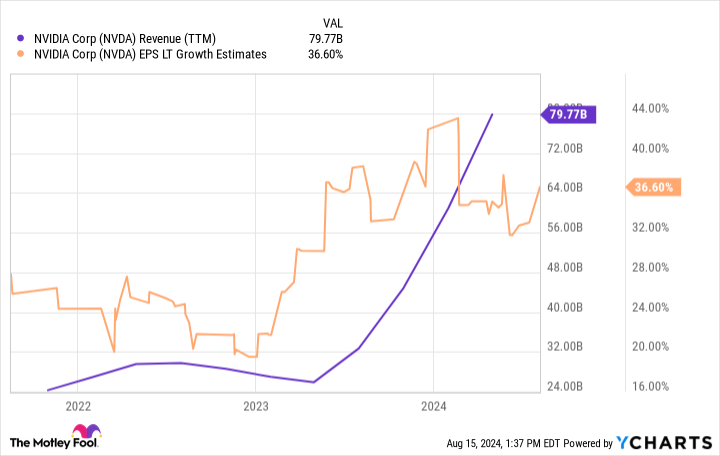

The tech business’s energy gamers are in an arms race to construct the computing assets wanted to help AI progress. That robust demand launched Nvidia’s income to new heights beginning in 2023.

The AI and cloud heavyweights intend to maintain spending. Microsoft mentioned in its newest earnings name that AI demand outstripped its out there computing assets. Meta Platforms CEO Mark Zuckerberg just lately mentioned in a “hearth chat” with Nvidia CEO Jensen Huang that his firm has collected almost 600,000 of the latter’s H100 chips and can make investments extra subsequent 12 months to help AI.

The CEO of Nvidia competitor Superior Micro Gadgets believes the broader AI chip market will develop to $400 billion over the following a number of years. Nvidia, the market chief, solely sells a fraction of that at present. The indicators level to sustained demand, and the corporate needs to guard its market share by often releasing cutting-edge chips to maintain tempo with innovation.

Income in all probability will not proceed rising by triple digits, however analysts consider Nvidia will develop earnings by 36% yearly over the long run.

Assuming Nvidia delivers on estimates, the inventory seems like a discount at present at a ahead price-to-earnings ratio (P/E) of 44, which is enticing for such a fast-growing enterprise. However the firm will face competitors from different chipmakers and big-tech clients that might attempt to construct their very own chips.

So, whereas the inventory may look low cost in hindsight if issues go effectively, traders ought to welcome any sell-off that can construct a margin of security to account for the unknowns.

A shaky market makes Broadcom a buy-the-dip alternative

Broadcom has been a superb inventory for AI traders in search of diversification. It focuses on semiconductors for networking and communications and has one other enterprise unit that gives infrastructure software program to enterprises. Whole income is cut up roughly 2-to-1 between its semiconductor options and infrastructure software program.

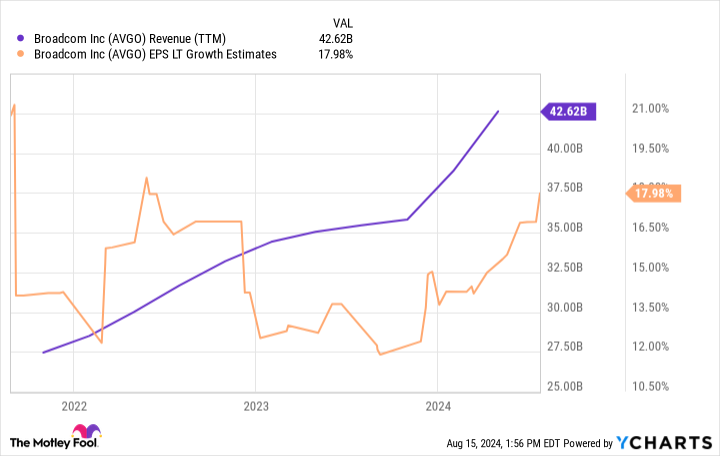

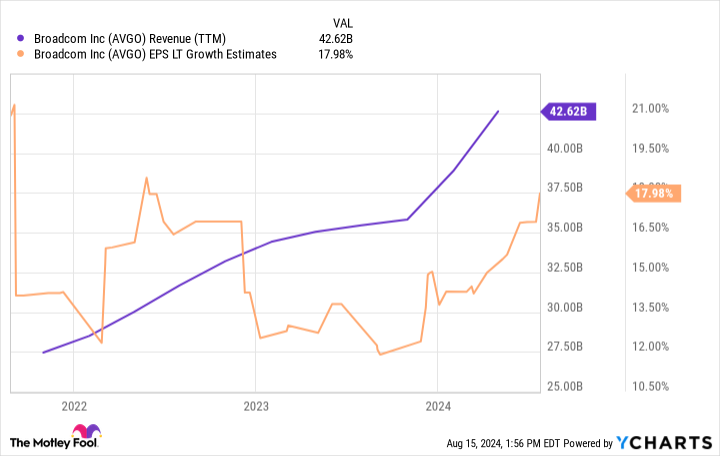

Semiconductor shares are cyclical. AI has created a increase in chip spending, however that can probably gradual in some unspecified time in the future as AI capability catches as much as demand. Broadcom is not rising as quick as Nvidia is, however the software program enterprise generates recurring income that might make the corporate much less risky over the long run.

That mentioned, Broadcom is getting a giant push from AI; similar to how AI fashions require highly effective processing chips, additionally they create heavy networking hundreds that want equally AI-specialized {hardware}. The corporate initially guided that AI would contribute 25% of its semiconductor options income in 2024 however elevated that to 35% within the second quarter.

In the meantime, including VMware to the software program enterprise helped Broadcom’s complete income develop 43% 12 months over 12 months within the second quarter. Natural income progress (excluding the acquisition) was nonetheless 12%. That is not explosive, however analysts consider the corporate will develop earnings by 18% yearly over the long run, and that is nothing to sneeze at.

Broadcom doubles as a superb dividend inventory, separating it from most AI investments. The beginning yield is not big, simply 1.3%, however administration has raised its payout by a mean of 19% yearly over the previous 5 years.

The inventory provides traders a little bit of all the things: AI upside, dividends, and a diversified enterprise which may maintain up higher throughout a sell-off. Shares commerce at a ahead P/E of 33 at present, which is not shockingly costly, but it surely’s not low cost, both. Buyers can confidently purchase and maintain Broadcom if the Nasdaq sells off and takes the inventory decrease with it.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 finest shares for traders to purchase now… and Nvidia wasn’t one among them. The ten shares that made the lower may produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… in the event you invested $1,000 on the time of our advice, you’d have $796,586!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of August 12, 2024

Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Justin Pope has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot recommends Broadcom and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

2 Current Synthetic Intelligence (AI) Inventory-Cut up Shares to Purchase Through the Nasdaq Promote-Off was initially printed by The Motley Idiot