In the world of finance, 10 years is the blink of a watch. Need proof? Take an in depth have a look at the desk beneath:

|

Firm |

2014 Market Cap (in billions) |

2024 Market Cap (in billions) |

|---|---|---|

|

IBM |

$182 |

$178 |

|

Nvidia |

$10 |

$2,965 |

In August 2014, IBM‘s market cap was roughly 18 instances bigger than Nvidia‘s (NASDAQ: NVDA). However oh, how the tables have turned. Right now, Nvidia boasts a market cap of about $3 trillion — roughly 17 instances bigger than IBM.

So, looking forward to the subsequent 10 years, what are the businesses that might surpass Apple‘s huge market cap? Listed below are two that might pull it off.

Microsoft

If an organization goes to surpass Apple over the subsequent decade, it should want a big market cap. Even assuming Apple’s market cap holds regular, that may imply an organization would wish to succeed in a market cap of $3.4 trillion to catch Apple.

That is a really tall order, and there are solely so many corporations that might do it. Microsoft (NASDAQ: MSFT) is one in all them.

For starters, Microsoft already has a market cap of $3.1 trillion as of this writing. As lately as June, Microsoft did have a market cap bigger than Apple. What’s extra, Microsoft holds a couple of aggressive benefits that ought to, over time, assist the corporate’s market cap ease previous Apple.

First, Microsoft has a extra diversified enterprise. The corporate has its palms in cloud computing, gaming, promoting, {hardware}, software program, social networking, and synthetic intelligence (AI). Briefly, Microsoft has many pathways to success. Apple, however, has historically benefited from its glorious {hardware} innovation. And whereas Apple providers and AI might enhance the corporate’s income, flagging iPhone gross sales might current an actual problem to Apple over the subsequent decade.

In my e book, meaning a bonus for Microsoft.

Nvidia

I’ve reservations about Nvidia proper now. Its sky-high valuation makes it weak to a nasty correction if the corporate’s gross sales present any indicators of slowing. That mentioned, this text is about what might occur over the subsequent 10 years. And in that case, I feel Nvidia is properly positioned to surpass Apple.

That is as a result of Nvidia’s core enterprise — making the graphics processing items (GPUs) that may energy cutting-edge AI methods for the subsequent decade — is on a long-term progress trajectory that Apple merely cannot match.

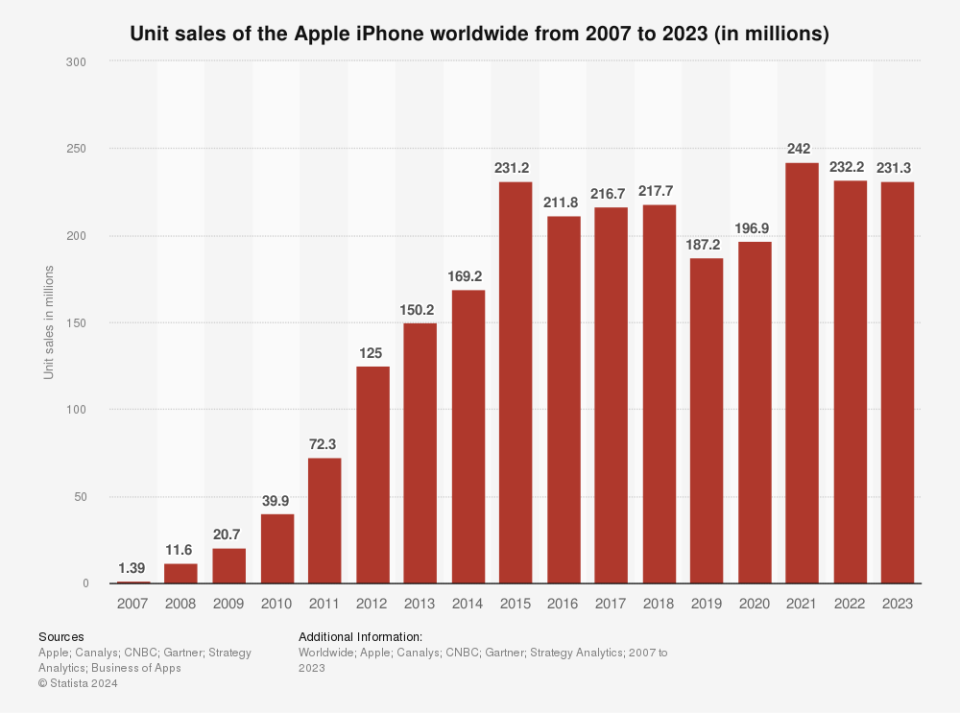

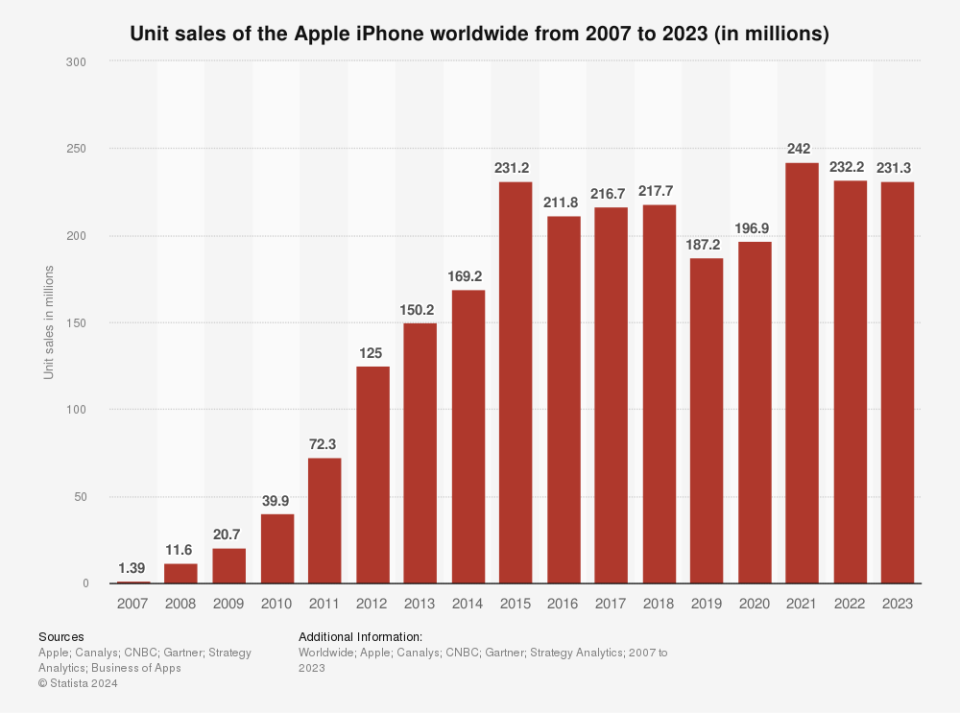

Gross sales of Apple’s signature product — the iPhone — grew yearly between 2007 and 2015, however they have been flat since then.

Nvidia, however, remains to be rising. Over the past two years, the corporate has tripled its income as GPUs have bought like hotcakes. That progress is not prone to gradual within the subsequent few years. Most analysts count on Nvidia’s gross sales to double once more to round $160 billion by 2026.

Positive, there are prone to be some bumps within the street because the opponents take some market share from Nvidia within the red-hot AI chips market. However even when Nvidia’s gross sales progress slows, it might simply shut the $500 billion market cap distinction between it and Apple over the subsequent decade.

Do you have to make investments $1,000 in Microsoft proper now?

Before you purchase inventory in Microsoft, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 finest shares for buyers to purchase now… and Microsoft wasn’t one in all them. The ten shares that made the lower might produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $758,227!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of August 22, 2024

Jake Lerch has positions in Worldwide Enterprise Machines and Nvidia. The Motley Idiot has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Idiot recommends Worldwide Enterprise Machines and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

Prediction: 2 Shares That’ll Be Value Extra Than Apple 10 Years From Now was initially printed by The Motley Idiot