Microsoft (NASDAQ: MSFT) is a king of reliability, identified for its constant monetary and inventory development. Over the past 5 years, the corporate’s share worth has risen 200%, whereas free money circulation has climbed 92%.

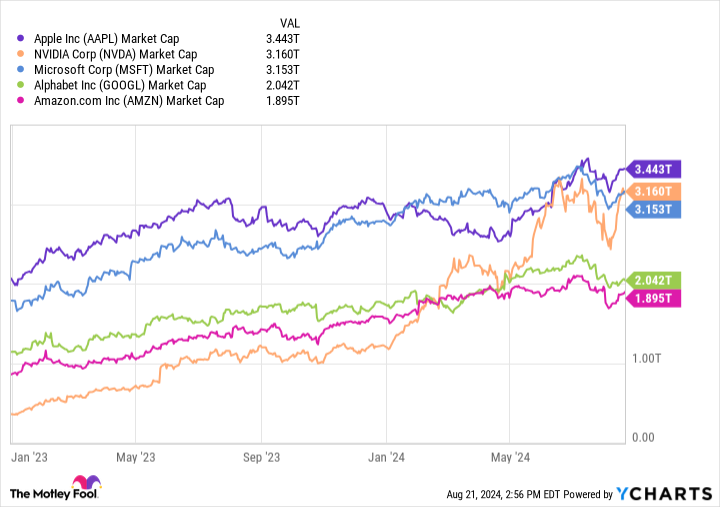

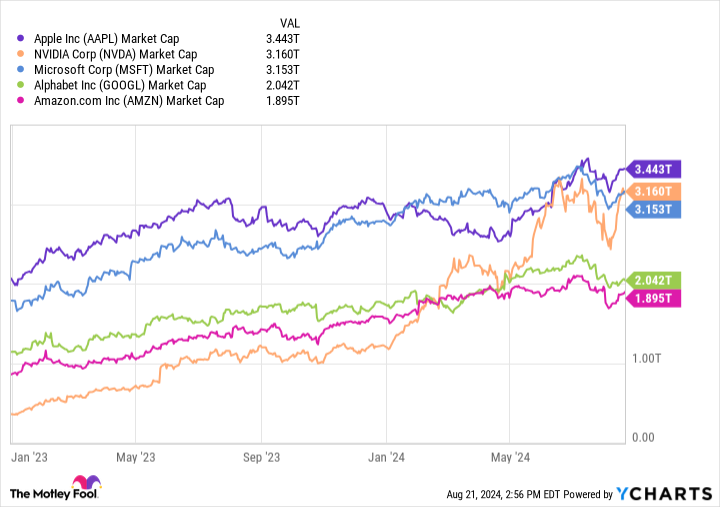

Microsoft’s regular development has secured it a market cap above $3 trillion, permitting it to stay on this planet’s prime three most useful firms. In actual fact, from about February to June of this yr, Microsoft briefly surpassed Apple and Nvidia (NASDAQ: NVDA) in market cap, taking the highest spot.

Market fluctuations have seen the world’s prime 5 most useful firms reshuffle a number of occasions in 2024. Even all through August, Nvidia and Microsoft have been duking it out for second place on an virtually weekly foundation. In the meantime, Amazon (NASDAQ: AMZN) seems to be on a bull run that might surpass the Home windows firm within the coming years.

Nvidia and Amazon have been on thrilling development paths because of skyrocketing earnings. These firms dominate their respective industries and are taking advantage of constant funding within the profitable synthetic intelligence (AI) market.

Whereas Microsoft is understood for consistency, Nvidia and Amazon are increasing at a fee that might enable them to overhaul the corporate. So, listed here are two development shares I predict might be value greater than Microsoft in 5 years.

1. Nvidia: A meteoric rise that’s unlikely to gradual any time quickly

Nvidia’s enterprise has delivered file development for the reason that begin of 2023, with its fill up 779%. Its meteoric rise has seen it steadily climb via the ranks of the world’s most useful firms, as seen within the chart beneath.

As of this writing, Nvidia’s market cap is above Microsoft’s. Their positions switched a number of occasions this month, suggesting may swap once more by the point you learn this. Nevertheless, Nvidia is included on this listing as I might argue that it’s going to have surpassed Microsoft for good and gained a stable lead throughout the subsequent 5 years.

Nvidia massively outperformed Microsoft in 2024, with its fill up 159% in comparison with Microsoft’s 10% rise. In the meantime, Nvidia’s quarterly income is up 18% yr to this point, with Microsoft’s up 4%. At this fee, Nvidia may even safe its spot forward of Microsoft a lot before 5 years.

Nvidia’s stellar positive aspects are primarily because of its dominance in AI. The corporate is chargeable for between 70% and 95% of all AI graphics processing models (GPUs), the chips essential for coaching AI fashions. Opponents like Superior Micro Units and Intel are working to catch up, launching rival GPUs this yr. Nevertheless, Nvidia’s head begin and $39 billion in free money circulation (in comparison with AMD’s $1 billion and Intel’s unfavourable $13 billion) suggests it will not have an excessive amount of hassle sustaining its lead.

In AI, Microsoft has a outstanding position in cloud computing. Nevertheless, fellow cloud giants Amazon and Alphabet are a lot nearer opponents than Nvidia’s rivals within the GPU market.

Nvidia will report its second quarter of fiscal 2025 earnings on Aug. 28. After over a yr of beating quarterly earnings, the corporate will doubtless proceed current tendencies and ship one other quarter of spectacular development. Its inventory may soar, furthering its lead on Microsoft.

2. Amazon: Hovering earnings and the money to surpass its rivals

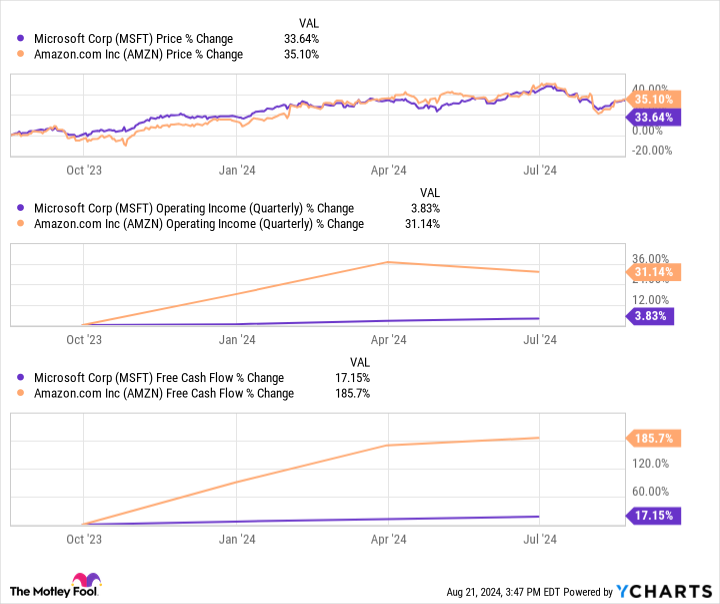

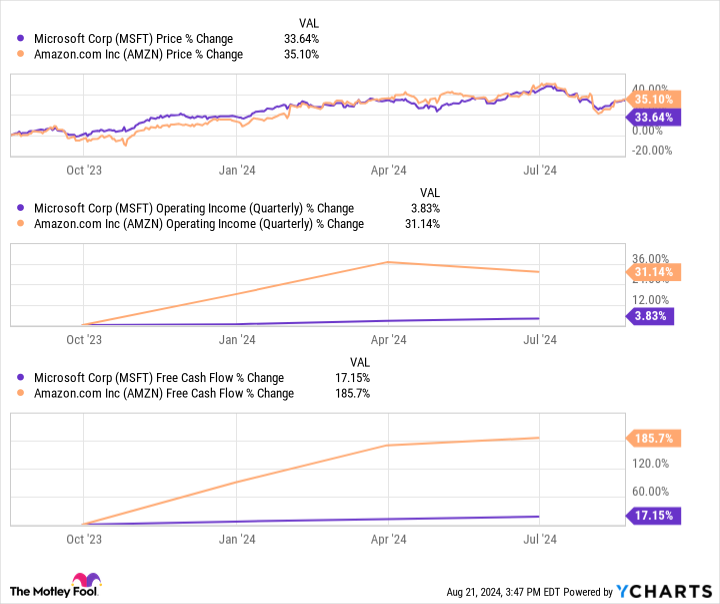

Amazon and Microsoft are in steep competitors within the cloud business. As of Q2 2024, Amazon Net Companies (AWS) cloud market share stood at 31%, whereas Microsoft Azure’s was at 25%. Nevertheless, Amazon ramped up its cloud funding over the past yr, which may enable it to carry onto its lead within the business and ultimately push its market cap above Microsoft’s.

Amazon constantly outperformed Microsoft over the past yr. Strong development in retail and AWS has seen Amazon’s earnings soar, permitting it to sink billions into its AI efforts.

In March, Bloomberg reported that Amazon plans to spend practically $150 billion on knowledge facilities over the following 15 years to broaden AWS’ attain. The corporate anticipates an explosion of demand for AI purposes and different digital companies, requiring a extra intensive cloud community. The information aligns with a number of experiences in current months that introduced Amazon’s knowledge heart funding in U.S. places together with Ohio, Indiana, and Virginia, in addition to worldwide spots corresponding to Singapore, Spain, Saudi Arabia, India, and Taiwan.

The growth will improve Amazon’s cloud and AI capabilities. In the meantime, an unlimited community will enable it to spice up different areas of its enterprise with the generative know-how, corresponding to e-commerce, grocery, digital promoting, and extra.

Amazon’s market cap at present sits at $1.8 trillion. Nevertheless, its earnings and inventory are increasing at a fee that may doubtless see it overtake Microsoft within the coming years.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Nvidia wasn’t one in all them. The ten shares that made the lower may produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… should you invested $1,000 on the time of our suggestion, you’d have $792,725!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of August 22, 2024

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Dani Prepare dinner has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Units, Alphabet, Amazon, Apple, Microsoft, and Nvidia. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2026 $395 calls on Microsoft, brief August 2024 $35 calls on Intel, and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

Prediction: 2 Progress Shares That Will Be Value Extra Than Microsoft in 5 Years was initially revealed by The Motley Idiot