-

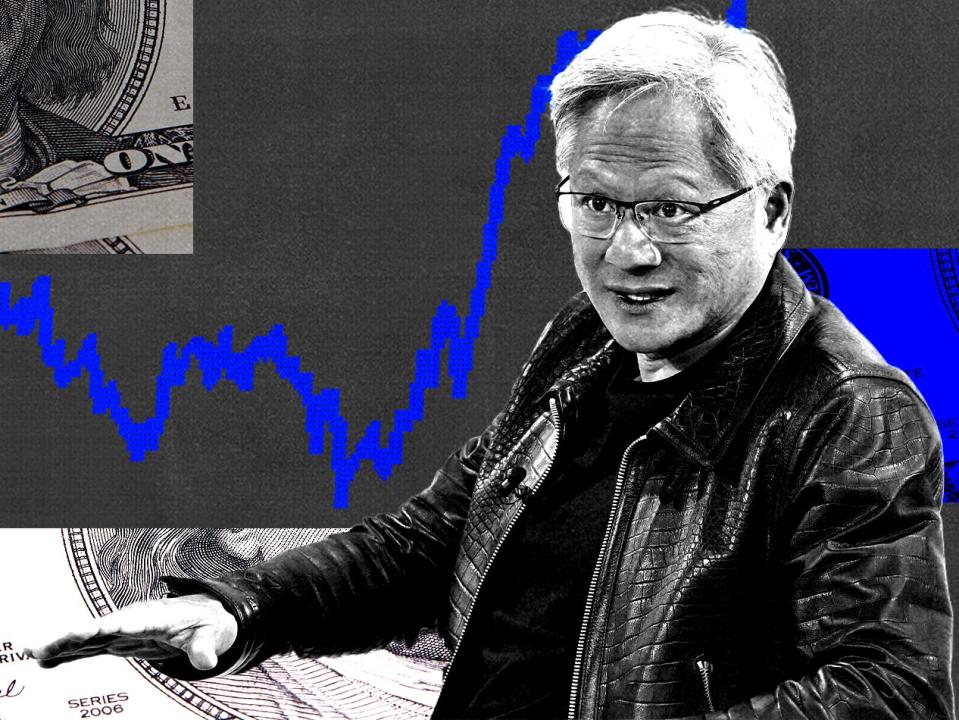

Nvidia’s inventory is flashing a promote sign, says strategist Invoice Blain.

-

Blain cites Nvidia’s excessive valuation and its rich staff as causes to bail.

-

He says the run-up within the chip maker’s inventory marks the height of a decadeslong market cycle.

Nvidia’s inventory is flashing an enormous “promote” signal to traders, in response to the veteran strategist Invoice Blain.

Blain, the founding father of Wind Shift Capital and a longtime monetary strategist, identified in a observe on Tuesday that Nvidia’s sky-high valuation has made lots of its staff very rich. He referred to a current ballot that discovered 40% of those that labored at Nvidia had a web price between $1 million and $20 million, whereas 37% had a web price of over $20 million.

Blain stated that leaves lower than a 3rd of Nvidia’s employees with “any actual every day monetary strain upon them.”

“Do you suppose that poor quarter of Nvidia peons are actually going to bust their guts for guys who’re already wealthy and extremely motivated to guard their wealth and place? Do they suppose Nvidia will rise an extra 700%? Will they be completely satisfied remaining exceedingly poor relative to their friends and managers? Or is it extra possible the large wealth within the workplace means the poorer however nonetheless extremely motivated employees are going to determine their wealth probabilities will probably be higher elsewhere?” Blain wrote.

Nvidia’s huge valuation might additionally sign a peak within the broader inventory market, Blain stated. Whereas traders are pricing in formidable fee cuts over the following 12 months, coverage easing will possible be “restricted” from the Fed, he stated, including that he believed 4%-6% rates of interest would represent the market’s new regular.

“Some folks suppose decrease rates of interest, as promised by the Fed later this month, spell pleasure limitless for markets. (I feel it could nonetheless be a sell-the-fact second.)” Blain stated. “And lots of, together with myself, imagine a brand new long-term financial cycle might reverse the final 40 years of diminished inflationary pressures.”

Markets started their present long-term cycle in Eighties as inflation steadily decreased following a troublesome interval of inflation in the course of the prior decade, Blain stated. He urged that markets might enter a contemporary cycle as quickly as 2025, pointing to inflationary pressures stemming from geopolitical tensions, commodities, and the mounting US debt stability.

“I simply discovered my finest motive to promote Nvidia, confirming we’re on the high of the market. What may come subsequent? How about 20-years of rising inflation, rising charges, and a world commodities super-cycle as nations scrabble to safe future strategic sources?” he added.

Different strategists have warned of continued inflationary pressures, regardless of worth progress trending downward from its peak in 2022. Inflation might see a resurgence, BlackRock strategists beforehand predicted, pointing to the danger of an enormous spike in oil costs, in addition to demand outpacing provide within the US financial system.

Learn the unique article on Enterprise Insider