After a robust run within the first half of the 12 months, know-how shares have come underneath strain lately. Latest inventory value traits counsel traders are taking a extra cautious stance on the financial system whereas the mania round synthetic intelligence (AI) has additionally eased. Even high-flying Nvidia has been affected, with the inventory buying and selling down almost 20% over the previous six months.

However this current sell-off additionally presents some alternatives.

Let us take a look at three tech shares (that are not named Nvidia) that traders ought to take into account shopping for amid this newest market adjustment.

1. Taiwan Semiconductor Manufacturing

Taiwan Semiconductor Manufacturing (NYSE: TSM), or TSMC for brief, is the main semiconductor fabrication contractor on this planet. At this time, many semiconductor firms do not produce their very own chips. As a substitute, they outsource the method to firms specializing in chip manufacturing.

Whereas outsourced manufacturing might not sound like an thrilling enterprise, do not be fooled — it is a extremely complicated course of that’s dominated by the businesses that may do it finest. In actual fact, the contract manufacturing unit of Intel, which was created in 2021 to compete with TSMC, lately suffered a big setback after chip designer Broadcom stated checks it performed confirmed that Intel’s latest course of was not prepared for high-volume manufacturing.

On the similar time, TSMC has been main the way in which in technological improvements, with the corporate set to introduce 2-nanometer manufacturing know-how subsequent 12 months. The smaller the chip density, the higher the efficiency and consumption energy. With demand for AI chips turning into insatiable, the corporate has been growing its capability and constructing new fabrication services.

Given the excessive demand for its companies, TSMC can be set to boost costs on its extra superior applied sciences. Morgan Stanley analysts estimate it can elevate costs this 12 months by 10% for AI semiconductors and chip-on-wafer-on-substrate (CoWoS), 6% for high-performance computing, and three% for smartphones.

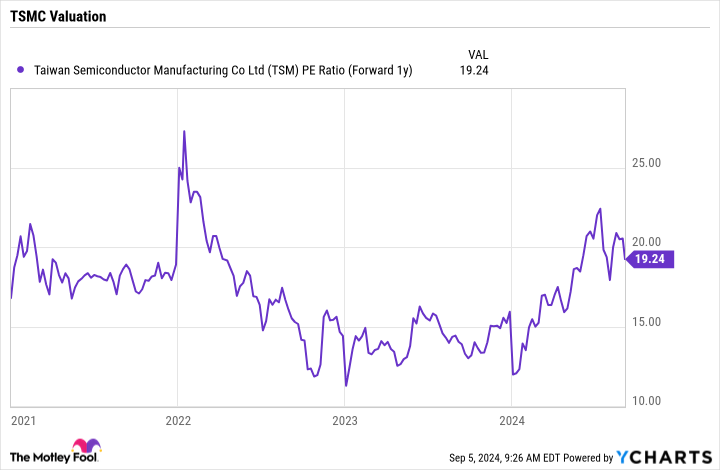

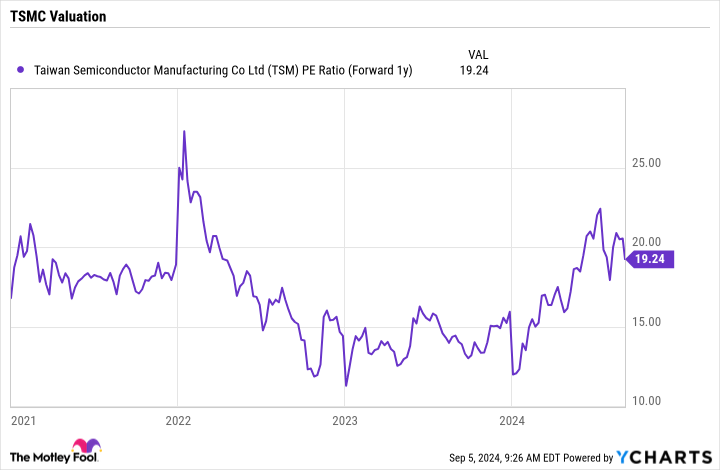

Buying and selling at a ahead price-to-earnings (P/E) ratio of about 19 primarily based on subsequent 12 months’s analyst estimates, the inventory remains to be attractively valued, particularly given the expansion prospects in entrance of it.

2. ASML

Whereas TSMC makes the chips for semiconductor firms, ASML (NASDAQ: ASML) makes the extremely specialised tools utilized by firms like TSMC to fabricate these chips. As TSMC and others broaden their manufacturing to fulfill the growing demand for AI chips, they are going to want extra tools to supply these chips.

Not surprisingly, the semiconductor tools manufacturing enterprise could be lumpy, as these are very costly items of apparatus. These machines have a typical life cycle of about seven years earlier than they have to be changed or refurbished.

In the meantime, 2024 is a little bit of a transitional 12 months for ASML because it introduces its latest know-how: a excessive numerical aperture excessive ultraviolet lithography system, or excessive NA EUV. The corporate says the brand new machines will enhance chip manufacturing productiveness whereas reducing manufacturing prices and bettering chip performance.

The corporate has shipped two of its excessive NA EUV programs up to now, with one operating qualification wafers. With a price ticket of $380 million per unit, these new programs are dear and may assist drive income for ASML subsequent 12 months and past as chip producers transfer to the most recent know-how to assist meet demand for AI chips. That, mixed with the variety of new fabs set to come back on-line over the following few years, bodes nicely for ASML’s long-term prospects.

At a previous analyst day, ASML administration set targets to develop income to between 30 billion to 40 billion euros ($33.3 billion to $44.4 billion) in 2025 and to 44 billion to 60 billion ($48.8 billion to $66.6 billion) by 2030. The corporate produced 27.6 billion euros ($30.6 billion) in income final 12 months, and it expects comparable income this 12 months.

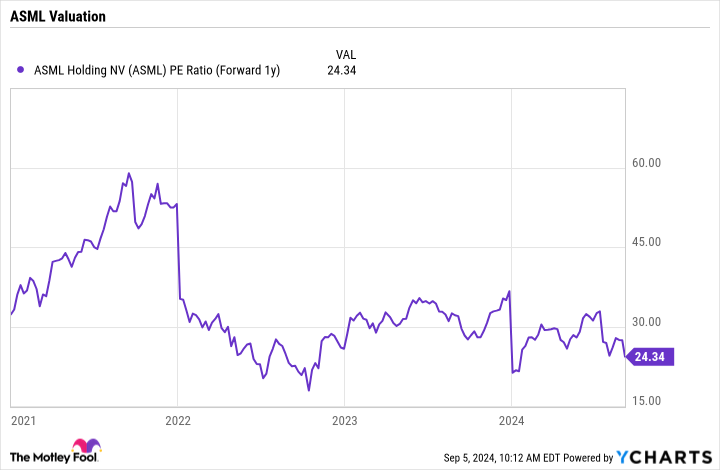

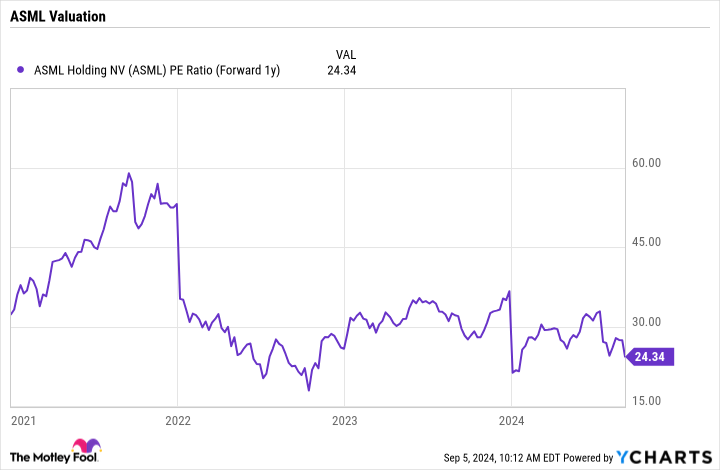

Buying and selling at a ahead P/E of simply over 24 instances primarily based on 2025 analyst estimates, ASML’s inventory seems to be enticing, given the expansion inflection in entrance of it.

3. Arm Holdings

Arm Holdings (NASDAQ: ARM) is the main semiconductor firm for central processor items (CPUs), which are sometimes described because the mind for gadgets. The corporate has a dominant place within the smartphone market, with its know-how in nearly all smartphones across the globe.

In the meantime, Arm is taking intention on the private laptop (PC) market as nicely. The corporate’s know-how is at present in all Apple computer systems and laptops, however its objective now could be to be in 50% of Home windows-based PCs within the subsequent 5 years. Whereas not as massive of a market as smartphones, that is nonetheless a pleasant alternative for the corporate. Arm has additionally been making strong inroads within the automotive market. It reported year-over-year income progress of 28% within the sector in Q2.

Arm advantages from AI as nicely. Final quarter, Arm famous that it noticed elevated licensing within the AI knowledge middle as a result of want for personalization, whereas it collaborated on a brilliant chip with Nvidia that mixes an Arm-based CPU with an Nvidia graphics processing unit (GPU). Its know-how can be the premise for CPU knowledge middle chips from Amazon and Alphabet.

Whereas semiconductor firms like Nvidia and Broadcom design their very own chips, Arm employs a distinct mannequin wherein it licenses its know-how to different firms to permit them to design their very own chips primarily based on its know-how. By its licenses, it collects royalties on the variety of chips shipped which have included its know-how. This income stream may final years and even many years.

Extra lately, the corporate has been shifting clients to a subscription mannequin, the place they’ll get a wider vary of use of its mental property. Whether or not via royalties or subscriptions, Arm has a really high-margin, largely recurring income stream.

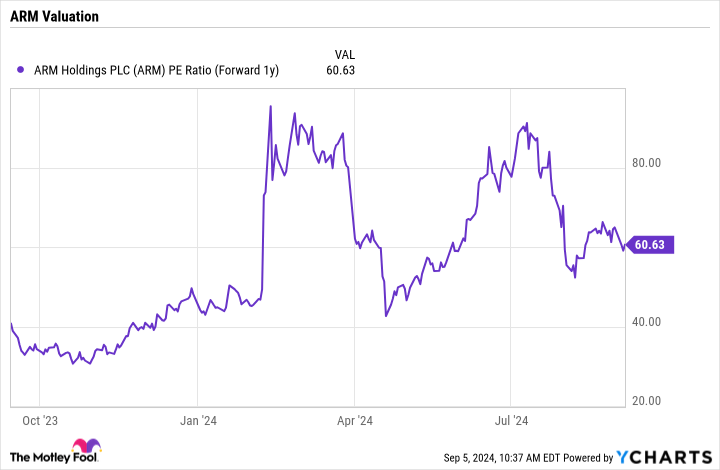

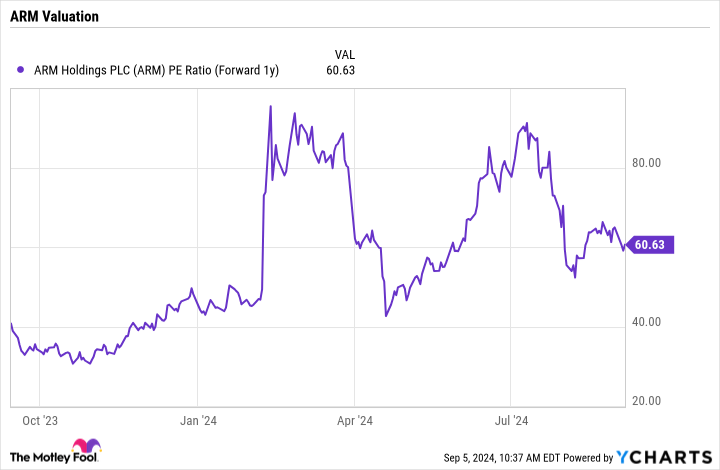

Based mostly on 2025 analyst estimates, Arm inventory trades at a ahead P/E of simply over 60.5 instances. Whereas that isn’t low cost on the floor, it is down from increased ranges, and Arm has one of the vital enticing and long-tail enterprise fashions within the semiconductor area.

Do you have to make investments $1,000 in Arm Holdings proper now?

Before you purchase inventory in Arm Holdings, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 finest shares for traders to purchase now… and Arm Holdings wasn’t certainly one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $630,099!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of September 3, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Geoffrey Seiler has positions in Alphabet. The Motley Idiot has positions in and recommends ASML, Alphabet, Amazon, Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Broadcom and Intel and recommends the next choices: quick November 2024 $24 calls on Intel. The Motley Idiot has a disclosure coverage.

3 Shares Exterior of Nvidia to Purchase Amid the Tech Promote-Off was initially revealed by The Motley Idiot