One of the vital outstanding themes of financial coverage over the previous couple of years is an intense scrutiny on rates of interest — and for good purpose. In 2022 and 2023, the Federal Reserve hiked rates of interest 11 occasions in an effort to stifle abnormally excessive ranges of inflation.

Though inflation nonetheless persists, the present degree of two.9% has materially cooled from its excessive factors through the summer season of 2022. The present image surrounding unemployment knowledge and inflation tendencies has many economists forecasting that charge cuts could lastly be on the horizon. Even Fed Chair Jerome Powell strongly urged that adjustments in coverage have been imminent in a speech he gave in Jackson Gap, Wyoming a few weeks in the past.

There are various varieties of companies that would profit from reductions in rates of interest. Particularly, I have been wanting intently at enterprise growth firms (BDCs). Let’s break down the ins and outs of BDCs and take a look at the ultra-high-yield BDC inventory I’ve on my radar proper now.

What are enterprise growth firms?

BDCs are fairly attention-grabbing. At their core, they’re capital suppliers to early-stage companies searching for funding to get their operations off the bottom. Moreover, some BDCs, resembling Ares Capital, provide extra refined financing options — making them interesting to bigger public firms as nicely.

You could be questioning if a BDC is only a fancy time period for a financial institution. Properly, not precisely.

BDCs have an uncommon company construction in that 90% of taxable earnings is distributed to shareholders on an annual foundation. For that reason, BDCs are usually a favourite for these searching for dividend earnings.

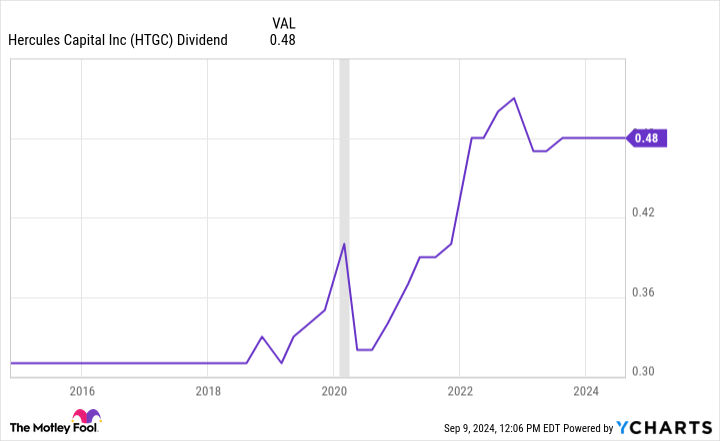

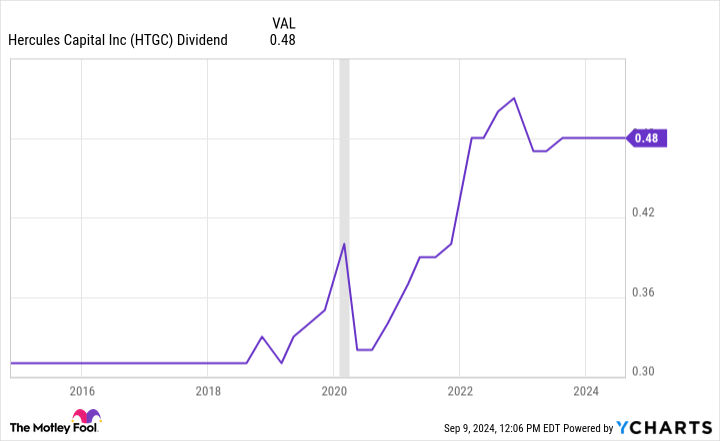

The chart beneath illustrates the dividend funds for Hercules during the last 10 years. For essentially the most half, Hercules has not solely persistently paid a dividend, however it’s additionally raised its quarterly and supplemental-dividend funds. The notable exception was a short reduce to the supplemental dividend in early 2020 in the beginning of the COVID-19 pandemic (seen within the grey-shaded column).

Nonetheless, not all BDCs are created equal — removed from it. Many BDCs give attention to particular sectors, making the chance profile of every portfolio vastly totally different. Furthermore, underwriting protocols range from one firm to the following. For that reason, it is crucial to have a look at the general efficiency of a BDC’s operation so as to gauge the power of its portfolio and get a way of its credit score controls.

And the BDC I’ve on my radar is…

One BDC that I believe is especially nicely positioned to profit from charge cuts is Hercules Capital (NYSE: HTGC). Hercules is a BDC that focuses on rising themes in expertise, life sciences, and inexperienced vitality. It focuses on enterprise debt, making high-yield loans to firms which have beforehand raised outdoors funding from enterprise capital or non-public fairness.

Contemplating that Hercules is lending cash to comparatively early-stage companies, chances are you’ll assume its danger profile is moderately excessive. However I do not fairly see it that method. One metric that I like to make use of to measure a BDC’s well being is web funding earnings (NII). NII will be useful when assessing an funding agency’s profitability. The desk beneath displays NII for Hercules during the last a number of years.

|

Class |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

Six Months Ended June 30, 2024 |

|---|---|---|---|---|---|---|---|

|

Internet Funding Earnings Per Share |

$1.19 |

$1.41 |

$1.39 |

$1.29 |

$1.48 |

$2.09 |

$1.01 |

Information supply: Hercules Investor Relations.

Since 2018, Hercules’ NII has persistently elevated, which I believe serves as a superb barometer of administration’s underwriting and portfolio administration. Furthermore, Hercules has persistently rewarded shareholders within the type of elevating dividend funds in tandem with its rising NII.

Why I see Hercules as a no brainer proper now

A discount to rates of interest may gain advantage Hercules in a number of methods.

Over time, it turns into much less interesting for founders to persistently elevate capital from enterprise capital (VC) corporations. As a result of VCs purchase fairness within the companies that they put money into, the chance value of every subsequent capital elevate is dilution to founders and even staff. In consequence, enterprise leaders are inclined to allocate capital prudently and cautiously, with the intention of reaching breakeven or constructive free money movement.

After all, decrease rates of interest (cheaper debt) may very well be notably interesting to venture-backed firms which have confirmed they’re not high-cash-burn operations however are nonetheless looking for entry to outdoors funding, resembling a time period mortgage or a revolving credit score facility. Since debt is non-dilutive, Hercules may very well be an attractive possibility in conditions like these, which may result in a brand new wave of demand for its companies.

I am not overly anxious about competitors from non-public credit score suppliers on this area, both. I believe Hercules gives a degree of flexibility that almost all conventional banks merely aren’t keen to supply. A middle-market enterprise could also be turned away from a financial institution or won’t be able to get as excessive of a mortgage because it’s searching for.

Hercules differentiates itself from these corporations by providing entry to bigger sources of capital, but concurrently protects itself by attaching covenants to its deal constructions. Furthermore, Hercules has a novel alternative to kind robust relationships with the VCs that again a lot of its portfolio firms. This can lead to repeat enterprise within the type of refinancing inside the portfolio or referral-deal movement.

For these causes, I am optimistic that Hercules will proceed producing robust development and be capable to preserve and lift its dividend funds over a long-run time horizon.

As well as, a discount to rates of interest can even end in extra capital that may in any other case be geared towards larger curiosity funds. This might not directly profit Hercules, as its portfolio firms may begin reaccelerating development initiatives, resulting in larger valuations over time.

Lastly, since firms typically borrow cash to fund large-dollar transactions, cheaper debt may encourage some companies to reevaluate extra strategic alternatives, resembling mergers and acquisitions. Such liquidity occasions may very well be useful for Hercules, as a few of its portfolio firms may find yourself turning into acquired by bigger enterprises. Furthermore, as a result of Hercules typically attaches warrants to its investments, I see the potential for rising acquisitions as notably profitable.

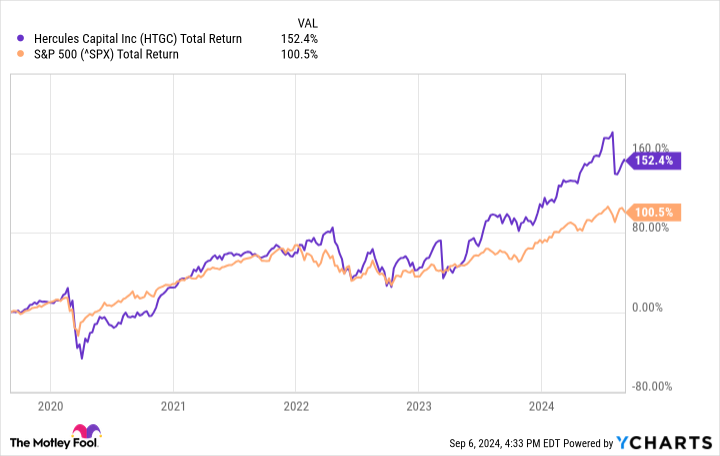

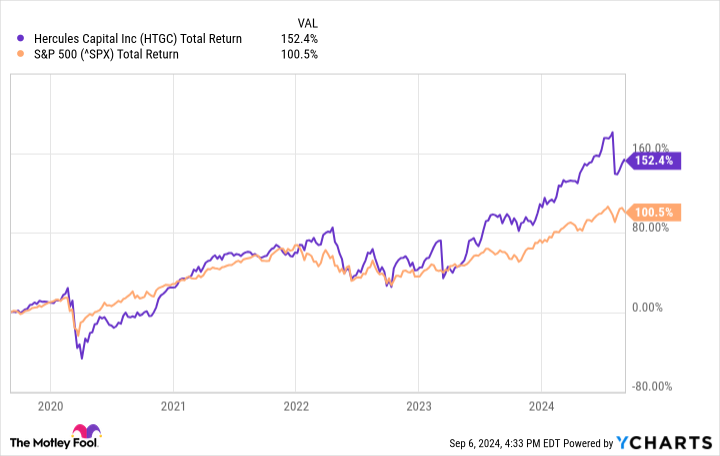

As of this writing, Hercules carries a dividend yield of 10.4% — almost 8 occasions the dividend yield of the SPDR S&P 500 ETF Belief. On prime of that, the inventory’s five-year complete return of 152% handily trounces that of the S&P 500.

Contemplating the inventory’s persistently robust efficiency, coupled with its ultra-high yield and place to profit from potential rate of interest cuts, I see Hercules as a no brainer alternative proper now.

Do you have to make investments $1,000 in Hercules Capital proper now?

Before you purchase inventory in Hercules Capital, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Hercules Capital wasn’t considered one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… if you happen to invested $1,000 on the time of our advice, you’d have $630,099!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of September 9, 2024

Adam Spatacco has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure coverage.

1 Extremely-Excessive-Yield Dividend Inventory You will Need to Have on Your Radar as Price Cuts Loom was initially revealed by The Motley Idiot