Shares like Nvidia have gotten many of the consideration over the previous 18 months, however nothing goes up eternally on Wall Avenue. Finally, the inventory’s huge transfer is over, and it is time to discover the following huge winner.

These three Motley Idiot contributors got down to do exactly that.

Palantir Applied sciences (NYSE: PLTR), Affirm (NASDAQ: AFRM), and MercadoLibre (NASDAQ: MELI) emerged as prime concepts. These corporations have compelling progress potential but are nonetheless early sufficient to make traders a ton of cash over the approaching years.

Take into account shopping for and holding these three up-and-coming prime tech shares for the following 5 years.

Palantir’s glorious yr continues

Jake Lerch (Palantir Applied sciences): There’s one title that instantly involves thoughts once I take into consideration rising tech shares I need to purchase and maintain: Palantir Applied sciences.

First off, Palantir actually is firing on all cylinders. Just lately, information broke that Palantir will be a part of the S&P 500. And whereas I am personally excited since I predicted that Palantir would be a part of the benchmark index, it is even higher for the corporate, because the announcement despatched Palantir shares hovering by 14%. Shares of Palantir have now greater than doubled yr so far, that means that when Palantir formally joins the index on Sept. 23, it should doubtless turn out to be the index’s second-best performing inventory — trailing solely Nvidia.

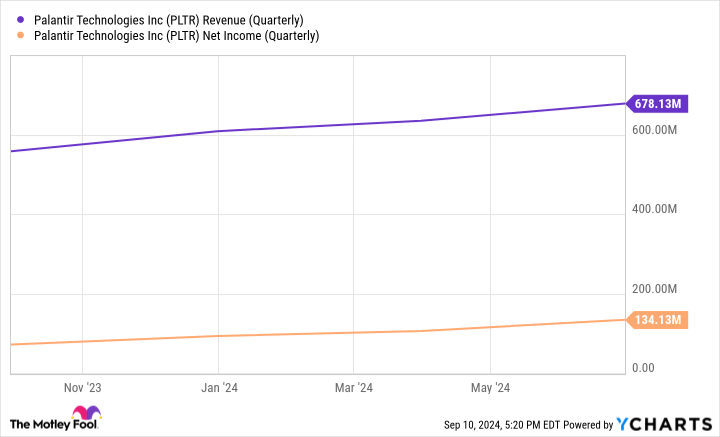

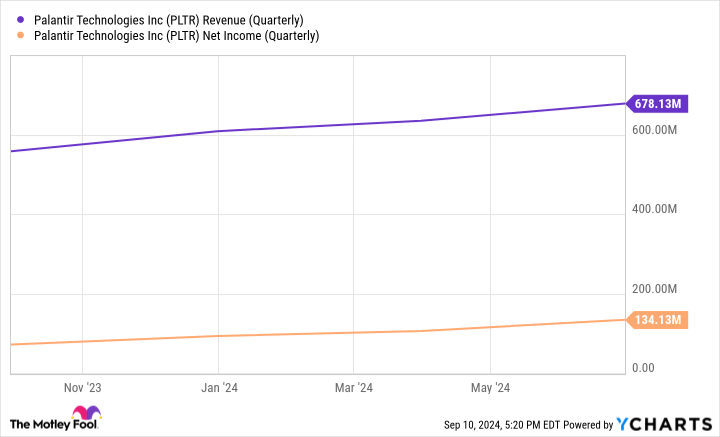

This distinctive inventory efficiency is because of Palantir’s implausible progress. In its most up-to-date quarter (the three months ended on June 30), the corporate reported $678 million in income, up 27% from a yr earlier. It additionally reported $134 million in web earnings, representing a year-over-year enchancment of 87%.

Equally, Palantir’s buyer depend and free money move are surging. The corporate has closed greater than 27 offers value greater than $10 million as demand for its AI-powered platform continues to rise.

In brief, a wonderful 2024 has led to Palantir’s inclusion within the S&P 500. That may quickly make this once-unknown inventory a family title. Nevertheless, there’s nonetheless time for traders to get their fingers on Palantir’s inventory. As of this writing, Palantir’s inventory has but to reclaim its all-time excessive of $45, set again in 2021.

Contemplating how effectively the corporate is executing, traders might look again on 2024 as a good time to spend money on Palantir inventory.

Affirm’s Purchase Now, Pay Later Apple partnership might make shareholders some huge cash

Justin Pope (Affirm): Purchase now, pay later firm Affirm jumps off the web page as an apparent long-term winner. The corporate makes use of algorithms to lend cash one transaction at a time, serving to debtors keep away from working up a steadiness. Affirm is so assured that its prospects pays them again that the corporate does not cost late charges.

Such a consumer-friendly enterprise mannequin (the corporate makes cash on curiosity and service provider charges) has constructed an 18.7 million consumer base. Customers can store straight via the Affirm app or use the Affirm Card, which hyperlinks to their checking account and lets customers break up purchases into purchase now, pay later loans.

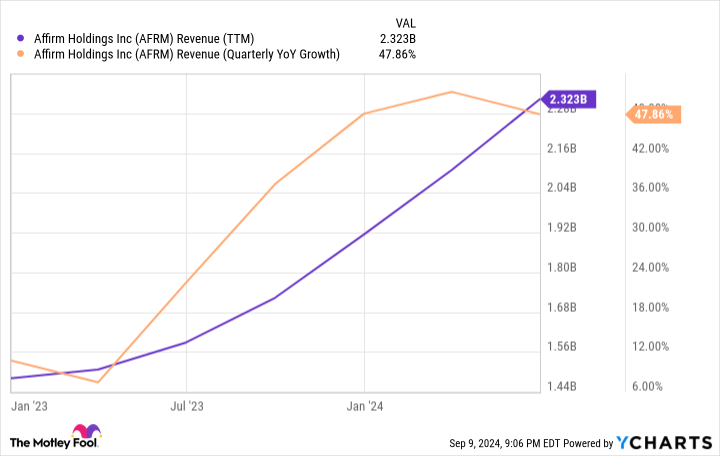

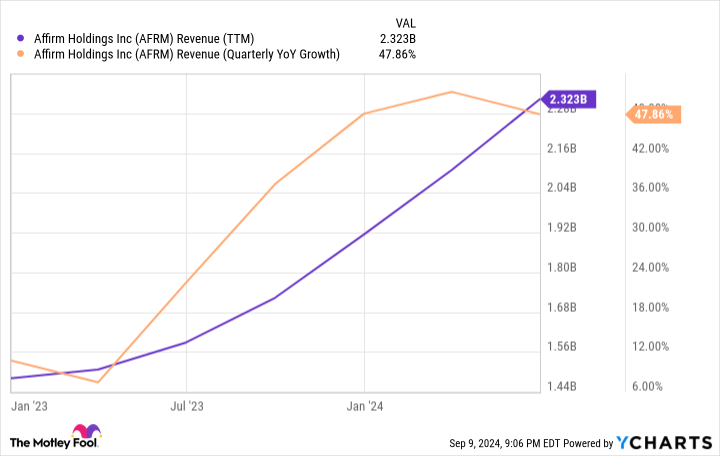

Greater than 300,000 retailers work with Affirm, together with partnerships with big retailers like Amazon and Shopify. This has helped Affirm speed up its income progress since early final yr to just about 50%:

Now, Affirm is taking it up a notch. In June, Apple introduced it could finish its purchase now, pay later product and use Affirm as a substitute. Affirm will combine straight into Apple Pay, exposing Affirm to the estimated 153 million iOS customers in america.

Because the Apple deal provides to its already-blazing progress, Affirm ought to develop leaps and bounds over the following 5 years. The inventory is down 77% from its 2021 highs, however it’s onerous to see that lasting; the corporate lately turned its first working revenue and may make strides towards bottom-line profitability over the approaching years.

Stellar progress and bettering financials might pressure Wall Avenue to view the inventory in a brand new gentle, making Affirm a rising star with big-time funding potential.

Those that missed Amazon might have a second likelihood with this inventory

Will Healy (MercadoLibre): Many traders missed the burgeoning e-commerce alternative in Amazon because it remodeled itself from an internet bookseller to a tech conglomerate pushed by e-commerce and the cloud.

Nevertheless, as Amazon grew, many traders missed the explosive progress of the e-commerce big south of the border, MercadoLibre. MercadoLibre’s addressable market stretches from Tijuana to Tierra del Fuego, and like Amazon, it started as an internet vendor. Nonetheless, the distinctive enterprise challenges of Latin America compelled it into different companies.

Not like the U.S., Latin America is a cash-based society the place a whole bunch of thousands and thousands of customers lack a checking account or bank card. To unravel this downside, it created Mercado Pago to develop digital monetary devices that may allow on-line procuring. The idea was so profitable that MercadoLibre opened it to prospects and companies who didn’t store on its e-commerce web site.

Likewise, success and transport choices are restricted in Latin America. Thus, the corporate shaped Mercado Envios to satisfy orders and ship merchandise. Within the course of, it launched same-day and next-day transport in areas the place it didn’t beforehand exist.

At a market cap of round $100 billion, it’s a small fraction of Amazon’s $1.9 trillion measurement. Nonetheless, that smaller measurement makes sooner progress simpler, a lot in order that the income for the primary half of 2024 grew 39% yearly to $9.4 billion.

Additionally, maintaining a lid on expense progress helped the corporate earn $875 million within the first six months of 2024, an 89% enhance in web earnings from year-ago ranges.

Extra traders have taken discover of the inventory, and consequently, it has risen by greater than 40% over the past 12 months and trades close to report highs.

Regardless of this success, it sells at a P/E ratio of 73. Nonetheless, due to its large revenue progress, its PEG ratio is slightly below 0.9. That metric arguably makes MercadoLibre a fairly priced inventory traders ought to think about whereas it nonetheless has a relatively small market cap.

Must you make investments $1,000 in Palantir Applied sciences proper now?

Before you purchase inventory in Palantir Applied sciences, think about this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Palantir Applied sciences wasn’t certainly one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $729,857!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of September 9, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Jake Lerch has positions in Amazon, MercadoLibre, and Nvidia. Justin Pope has positions in Affirm. Will Healy has positions in MercadoLibre, Palantir Applied sciences, and Shopify. The Motley Idiot has positions in and recommends Amazon, Apple, MercadoLibre, Nvidia, Palantir Applied sciences, and Shopify. The Motley Idiot has a disclosure coverage.

The Subsequent Large Factor? 3 Rising Tech Shares to Purchase and Maintain for the Subsequent 5 Years was initially printed by The Motley Idiot