Benzinga and Yahoo Finance LLC could earn fee or income on some objects by the hyperlinks under.

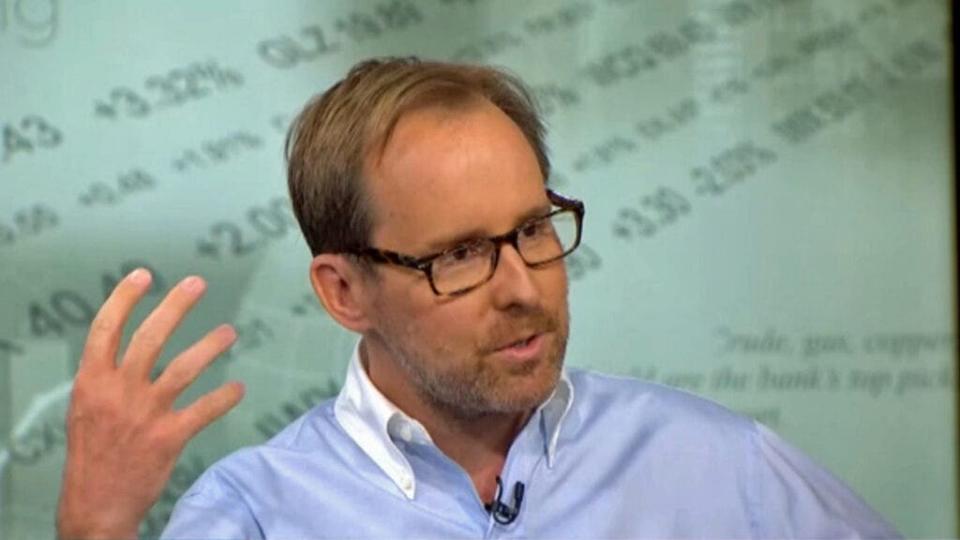

Mark Spitznagel, co-founder of Universa Investments, believes the inventory market is in a “Goldilocks section” following the Federal Reserve’s charge cuts and China’s stimulus measures. After a crash final month, the market surged to new highs, however Spitznagel warns this euphoria will not final in an interview with Bloomberg.

He predicts a looming recession and believes the present rally is just momentary.

Test It Out:

Spitznagel, identified for his deal with “tail-risk” hedging, which protects towards excessive, surprising market occasions, says the largest market bubble in historical past is about to burst. He foresees stagflation sooner or later, the place the Fed must act, however it will not be sufficient to avoid wasting the financial system.

Spitznagel has had success hedging by massive downturns available in the market, using out-of-the-money put choices as a method to “purchase insurance coverage” towards market routs. Shopping for places on the general market by the SPDR S&P 500 ETF Belief (NYSE:SPY) or comparable broad-exposure ETFs may very well be a method to shield towards market volatility.

Spitznagel stated that whereas the market would possibly proceed to soar within the quick time period, it’ll quickly exit the Goldilocks zone, doubtlessly by the tip of the yr. With the latest “uninversion” of the yield curve, Spitznagel feels the market is now in “black swan territory.”

Trending: This billion-dollar fund has invested within the subsequent massive actual property increase, this is how one can be part of for $10.

This can be a paid commercial. Rigorously contemplate the funding targets, dangers, fees and bills of the Fundrise Flagship Fund earlier than investing. This and different data might be discovered within the Fund’s prospectus. Learn them fastidiously earlier than investing.

What Is A Black Swan Occasion: A black swan occasion is an unpredictable occasion that results in market volatility. The COVID-19 market crash is a latest instance of a black swan occasion.

He additionally criticized conventional funding methods like diversification, calling them a “massive lie.” He argues that trendy portfolio principle has distracted buyers, usually making them poorer in the long term. As a substitute, he urges buyers to deal with how their portfolios will carry out in each good and dangerous markets.

In line with Spitznagel, the secret is to guard towards one’s personal tendencies, not simply market actions. Quite than fixating on what the market will do subsequent, buyers ought to take into consideration how they’re going to react in increase and bust eventualities to keep away from emotional errors like promoting on the low and shopping for on the excessive.

Questioning in case your investments can get you to a $5,000,000 nest egg? Converse to a monetary advisor in the present day. SmartAsset’s free device matches you up with as much as three vetted monetary advisors who serve your space, and you may interview your advisor matches without charge to resolve which one is best for you.

Maintain Studying:

This text Billionaire Investor Who Predicted 2000, 2008 Crashes Says Market Euphoria Will High Quickly, Warns Of ‘Black Swan Occasion’ initially appeared on Benzinga.com