Some traders are on edge that the Federal Reserve could also be overtightening financial coverage in its bid to tame scorching inflation, as markets look forward to a studying this coming week from the Fed’s most well-liked gauge of the price of dwelling within the U.S.

“Fed officers have been scrambling to scare traders virtually on daily basis just lately in speeches declaring that they are going to proceed to lift the federal funds price,” the central financial institution’s benchmark rate of interest, “till inflation breaks,” mentioned Yardeni Analysis in a observe Friday. The observe suggests they went “trick-or-treating” earlier than Halloween as they’ve now entered their “blackout interval” ending the day after the conclusion of their November 1-2 coverage assembly.

“The mounting concern is that one thing else will break alongside the way in which, like all the U.S. Treasury bond market,” Yardeni mentioned.

Treasury yields have just lately soared because the Fed lifts its benchmark rate of interest, pressuring the inventory market. On Friday, their speedy ascent paused, as traders digested studies suggesting the Fed might debate barely slowing aggressive price hikes late this 12 months.

Shares jumped sharply Friday whereas the market weighed what was seen as a possible begin of a shift in Fed coverage, even because the central financial institution appeared set to proceed a path of enormous price will increase this 12 months to curb hovering inflation.

The inventory market’s response to The Wall Road Journal’s report that the central financial institution seems set to lift the fed funds price by three-quarters of a proportion level subsequent month – and that Fed officers might debate whether or not to hike by a half proportion level in December — appeared overly enthusiastic to Anthony Saglimbene, chief market strategist at Ameriprise Monetary.

“It’s wishful considering” that the Fed is heading towards a pause in price hikes, as they’ll most likely depart future price hikes “on the desk,” he mentioned in a cellphone interview.

“I believe they painted themselves right into a nook after they left rates of interest at zero all final 12 months” whereas shopping for bonds underneath so-called quantitative easing, mentioned Saglimbene. So long as excessive inflation stays sticky, the Fed will most likely preserve elevating charges whereas recognizing these hikes function with a lag — and will do “extra harm than they wish to” in making an attempt to chill the financial system.

“One thing within the financial system might break within the course of,” he mentioned. “That’s the danger that we discover ourselves in.”

‘Debacle’

Greater rates of interest imply it prices extra for corporations and shoppers to borrow, slowing financial development amid heightened fears the U.S. faces a possible recession subsequent 12 months, in line with Saglimbene. Unemployment might rise because of the Fed’s aggressive price hikes, he mentioned, whereas “dislocations in forex and bond markets” might emerge.

U.S. traders have seen such financial-market cracks overseas.

The Financial institution of England just lately made a shock intervention within the U.Ok. bond market after yields on its authorities debt spiked and the British pound sank amid considerations over a tax reduce plan that surfaced as Britain’s central financial institution was tightening financial coverage to curb excessive inflation. Prime minister Liz Truss stepped down within the wake of the chaos, simply weeks after taking the highest job, saying she would go away as quickly because the Conservative occasion holds a contest to switch her.

“The experiment’s over, if you’ll,” mentioned JJ Kinahan, chief govt officer of IG Group North America, the guardian of on-line brokerage tastyworks, in a cellphone interview. “So now we’re going to get a distinct chief,” he mentioned. “Usually, you wouldn’t be comfortable about that, however for the reason that day she got here, her insurance policies have been fairly poorly acquired.”

In the meantime, the U.S. Treasury market is “fragile” and “weak to shock,” strategists at Financial institution of America warned in a BofA World Analysis report dated Oct. 20. They expressed concern that the Treasury market “could also be one shock away from market functioning challenges,” pointing to deteriorated liquidity amid weak demand and “elevated investor danger aversion.”

Learn: ‘Fragile’ Treasury market is liable to ‘giant scale pressured promoting’ or shock that results in breakdown, BofA says

“The concern is {that a} debacle just like the latest one within the U.Ok. bond market might occur within the U.S.,” Yardeni mentioned, in its observe Friday.

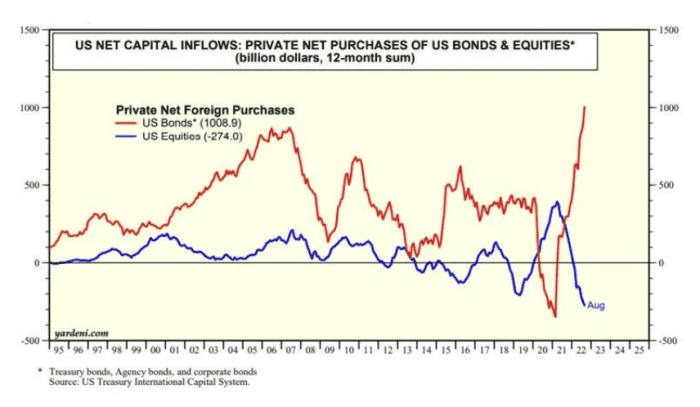

“Whereas something appears doable lately, particularly scary situations, we wish to level out that even because the Fed is withdrawing liquidity” by elevating the fed funds price and persevering with quantitative tightening, the U.S. is a secure haven amid difficult instances globally, the agency mentioned. In different phrases, the notion that “there isn’t any different nation” wherein to speculate aside from the U.S., might present liquidity to the home bond market, in line with its observe.

YARDENI RESEARCH NOTE DATED OCT. 21, 2022

“I simply don’t suppose this financial system works” if the yield on the 10-year Treasury

TMUBMUSD10Y,

observe begins to strategy anyplace shut to five%, mentioned Rhys Williams, chief strategist at Spouting Rock Asset Administration, by cellphone.

Ten-year Treasury yields dipped barely a couple of foundation level to 4.212% on Friday, after climbing Thursday to their highest price since June 17, 2008 based mostly on 3 p.m. Jap time ranges, in line with Dow Jones Market Information.

Williams mentioned he worries that rising financing charges within the housing and auto markets will pinch shoppers, resulting in slower gross sales in these markets.

Learn: Why the housing market ought to brace for double-digit mortgage charges in 2023

“The market has roughly priced in a gentle recession,” mentioned Williams. If the Fed have been to maintain tightening, “with out paying any consideration to what’s happening in the true world” whereas being “maniacally centered on unemployment charges,” there’d be “a really massive recession,” he mentioned.

Traders are anticipating that the Fed’s path of unusually giant price hikes this 12 months will finally result in a softer labor market, dampening demand within the financial system underneath its effort to curb hovering inflation. However the labor market has up to now remained sturdy, with an traditionally low unemployment price of three.5%.

George Catrambone, head of Americas buying and selling at DWS Group, mentioned in a cellphone interview that he’s “pretty nervous” concerning the Fed probably overtightening financial coverage, or elevating charges an excessive amount of too quick.

The central financial institution “has instructed us that they’re knowledge dependent,” he mentioned, however expressed considerations it’s counting on knowledge that’s “backward-looking by at the very least a month,” he mentioned.

The unemployment price, for instance, is a lagging financial indicator. The shelter element of the consumer-price index, a measure of U.S. inflation, is “sticky, but additionally notably lagging,” mentioned Catrambone.

On the finish of this upcoming week, traders will get a studying from the personal-consumption-expenditures-price index, the Fed’s most well-liked inflation gauge, for September. The so-called PCE knowledge will likely be launched earlier than the U.S. inventory market opens on Oct. 28.

In the meantime, company earnings outcomes, which have began being reported for the third quarter, are additionally “backward-looking,” mentioned Catrambone. And the U.S. greenback, which has soared because the Fed raises charges, is creating “headwinds” for U.S. corporations with multinational companies.

Learn: Inventory-market traders brace for busiest week of earnings season. Right here’s the way it stacks up up to now.

“Due to the lag that the Fed is working underneath, you’re not going to know till it’s too late that you simply’ve gone too far,” mentioned Catrambone. “That is what occurs whenever you’re transferring with such pace but additionally such dimension, he mentioned, referencing the central financial institution’s string of enormous price hikes in 2022.

“It’s loads simpler to tiptoe round whenever you’re elevating charges at 25 foundation factors at a time,” mentioned Catrambone.

‘Tightrope’

Within the U.S., the Fed is on a “tightrope” because it dangers over tightening financial coverage, in line with IG’s Kinahan. “We haven’t seen the total impact of what the Fed has executed,” he mentioned.

Whereas the labor market seems sturdy for now, the Fed is tightening right into a slowing financial system. For instance, current house gross sales have fallen as mortgage charges climb, whereas the Institute for Provide Administration’s manufacturing survey, a barometer of American factories, fell to a 28-month low of fifty.9% in September.

Additionally, hassle in monetary markets might present up unexpectedly as a ripple impact of the Fed’s financial tightening, warned Spouting Rock’s Williams. “Anytime the Fed raises charges this shortly, that’s when the water goes out and you discover out who’s obtained the showering go well with” — or not, he mentioned.

“You simply don’t know who’s overlevered,” he mentioned, elevating concern over the potential for illiquidity blowups. “You solely know that whenever you get that margin name.”

U.S. shares ended sharply increased Friday, with the S&P 500

SPX,

Dow Jones Industrial Common

DJIA,

and Nasdaq Composite every scoring their greatest weekly proportion beneficial properties since June, in line with Dow Jones Market Information.

Nonetheless, U.S. equities are in a bear market.

“We’ve been advising our advisors and shoppers to stay cautious by means of the remainder of this 12 months,” leaning on high quality property whereas staying centered on the U.S. and contemplating defensive areas comparable to healthcare that may assist mitigate danger, mentioned Ameriprise’s Saglimbene. “I believe volatility goes to be excessive.”