In a file, the Bruhat Bengaluru Mahanagara Palike (BBMP) has collected a staggering Rs 4,930 crore in property taxes for the 2024-25 monetary 12 months. This marks a rise of roughly 25 per cent from the Rs 3,918 crore collected in 2023-24, and a considerable rise for the reason that property tax hike in 2016.

With this, the BBMP has achieved 94 per cent of its income goal for the 2024-25 monetary 12 months, falling in need of simply Rs 280 crore. For the 2025-26 monetary 12 months, the civic physique goals to cross the Rs 6,000-crore mark in property tax assortment.

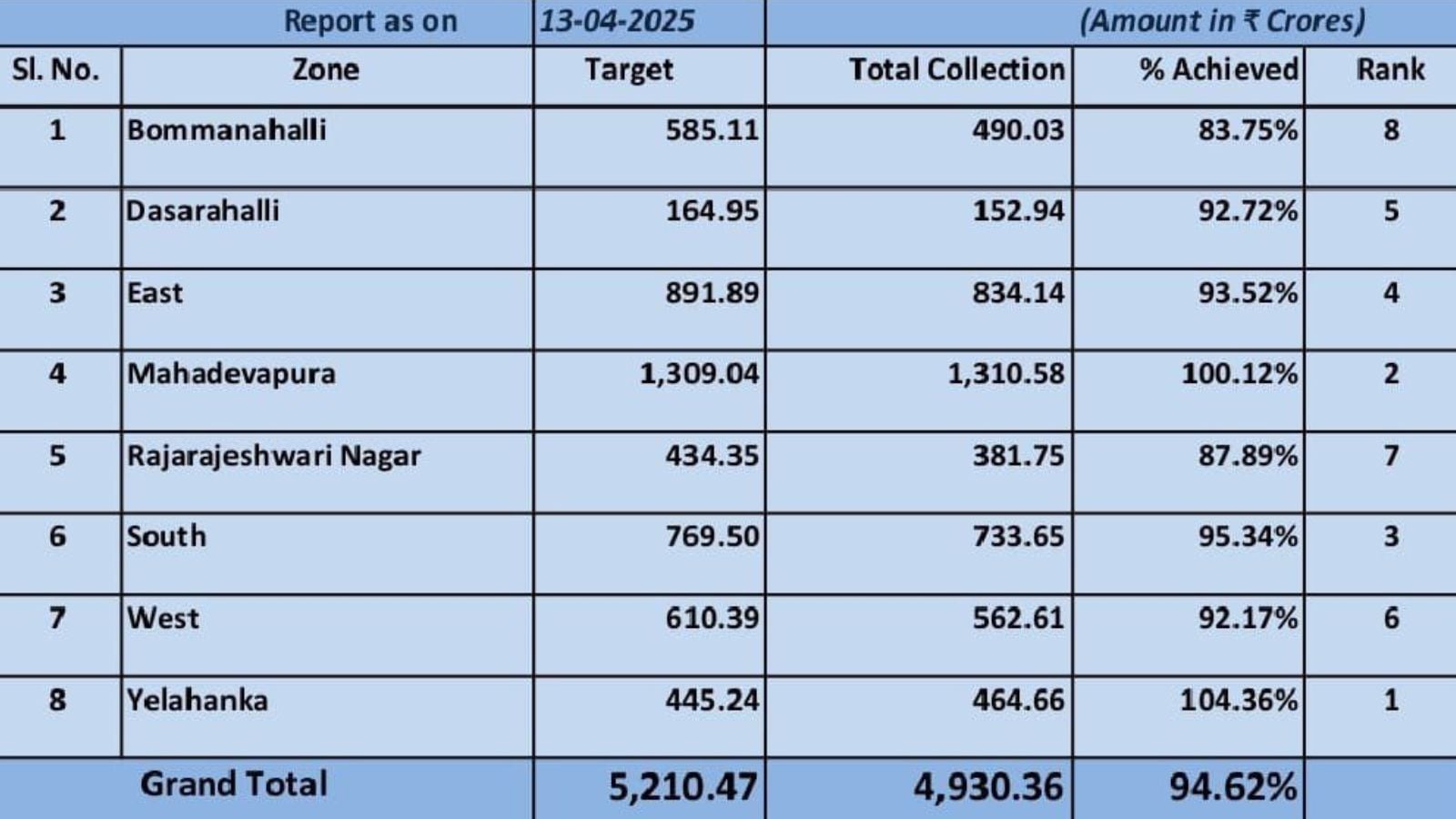

In accordance with the BBMP, Yelahanka carried out the most effective, gathering Rs 19 crore greater than its goal. The zone generated a income of Rs 464 crore in opposition to the goal of Rs 445 crore. Yelahanka and Mahadevapura are the one two zones to exceed the goal.

Mahadevapura zone collected the very best quantity, Rs 1,310.58 crore, barely exceeding its goal by Rs 1.54 crore. Regardless of the very best assortment, it ranks second because of the greater proportion of assortment achieved by Yelahanka. South zone collected Rs 733 crore however fell in need of its goal by Rs 35.85 crore, attaining 94.62 per cent of its goal, properly over the typical proportion.

With this, the BBMP has achieved 94 per cent of its income goal for the 2024-25 monetary 12 months, falling in need of simply Rs 280 crore.

With this, the BBMP has achieved 94 per cent of its income goal for the 2024-25 monetary 12 months, falling in need of simply Rs 280 crore.

East zone, which collected Rs 834 crore, missed its goal by Rs 57.75 crore. Dasarahalli had the bottom goal at Rs 165 crore in addition to lowest assortment amongst zones at Rs 152 crore. In the meantime, Rajarajeshwari Nagar missed its goal by Rs 52.60 crore, with the second-lowest proportion of assortment achieved at 87.89 per cent, displaying weaker efficiency. With Rs 490 crore in assortment, Bommanahalli achieved the bottom proportion of property tax assortment, lacking its goal by Rs 95.08 crore, indicating vital underperformance.

Total, civic officers largely attributed the excessive fee of assortment to its initiatives just like the One-Time Settlement (OTS) scheme, property attachments (81,644 properties), and door-to-door campaigns which contributed to the robust general assortment of 94.62 per cent.

“Zones like Yelahanka and Mahadevapura could have benefited extra from these efforts, presumably resulting from higher compliance or extra industrial properties paying beneath OTS,” a BBMP official famous.

Story continues beneath this advert

In the meantime, officers noticed that the decrease proportion of property tax assortment by Bommanahalli and Rajarajeshwari Nagar zones may very well be resulting from decrease compliance charges, fewer high-value properties and challenges in restoration, together with authorized disputes and unregistered properties. Buoyed by Yelahanka’s success fee at 104.36 per cent, the BBMP is ready to copy its methods in different zones, akin to higher group engagement and stricter enforcement.

Merging strong waste administration price with property tax

Whereas the civic company has generated file property tax income, the introduction of Stable Waste Administration (SWM) Consumer Payment from April 1 will possible bolster its revenues additional.

The BBMP launched a compulsory SWM price from this month to fund waste administration, with residential charges based mostly on built-up space starting from Rs 10 monthly for properties as much as 600 sq ft (Rs 120 per 12 months) to Rs 400 monthly for properties of 4,000 sq ft or extra (Rs 4,800 per 12 months), whereas mid-sized properties pay Rs 100–Rs 200 monthly.

Industrial properties face an SWM price of Rs 12 per kg of waste, up from Rs 5 per kg, and this price is added to annual property tax payments, aiming to generate Rs 685–750 crore yearly for Bengaluru Stable Waste Administration Restricted (BSWML). The SWM price will increase the tax burden by 20–35 per cent, elevating issues about transparency and waste clearance effectivity, and from 2025-26, it’ll absolutely merge with property tax, with a deliberate 5 per cent annual improve.

No new parking tax launched

Story continues beneath this advert

Opposite to some media stories, BBMP clarified that there isn’t any new parking tax, as property tax on parking areas has existed for many years, and their current draft proposal goals to cut back and standardise these charges to encourage the creation of parking areas. At present, parking areas are taxed at 50 per cent of the property’s Unit Space Worth (UAV) fee, with industrial areas averaging Rs 7 per sq ft (as much as Rs 12.50) and residential averaging Rs 2.1 per sq ft, however the proposed charges would decrease this to a flat Rs 3 per sq ft for industrial/non-residential and Rs 2 per sq ft for residential properties.

In accordance with the civic physique, this discount goals to decrease the tax burden and simplify calculations, however it might minimize BBMP’s parking tax income by roughly Rs 40 crore from the Rs 211 crore collected in 2024-25, in a deliberate loss to profit residents.

The draft proposal confronted pushback, significantly on residential charges, main BBMP to re-examine the residential parking tax for additional discount based mostly on public suggestions, although the proposal stays unimplemented, pending authorities approval.

“Misinformation in some media stories wrongly labelled this as a ‘new tax’, creating confusion, when the intent is to cut back prices,” the BBMP famous in its press assertion launched on Monday.