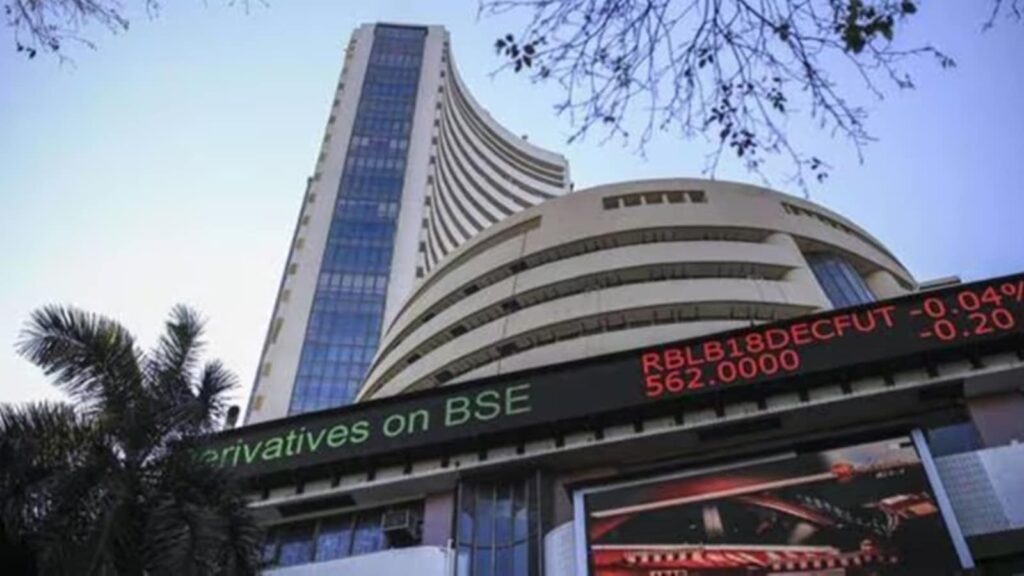

Indian indices continued their upward motion for the seventh consecutive session on Wednesday, with the Sensex reclaiming 80,000-level for the primary time in nearly 4 months. The positive aspects in markets have been pushed by shopping for in info know-how, auto and pharma shares.

The BSE’s 30-share Sensex gained 0.65 per cent, or 520.9 factors, to shut at 80,116.49, after a niche of almost 4 months. The broader Nifty50 rose 0.67 per cent, or 161.7 factors, to shut at 24,328.95.

“The Indian fairness market sustained its constructive momentum, pushed by higher final result from the newest set of IT outcomes and optimistic forward-looking feedback,” mentioned Vinod Nair, head of analysis, Geojit Investments Ltd.

Whereas US-China commerce tensions seem like easing, a rally in US tech shares has additional bolstered total world market sentiment, Nair mentioned.

After an preliminary uptick, the Nifty drifted decrease; nonetheless, a rebound within the latter half pared the losses and helped the index shut at 24,328.95, mentioned Ajit Mishra – SVP, analysis, Religare Broking Ltd.

“A blended pattern throughout sectors stored merchants engaged, with IT and auto performing properly, whereas banking and financials witnessed some profit-taking,” he mentioned.

The broader indices additionally traded choppily however ultimately posted positive aspects within the vary of 0.44 per cent to 1.18 per cent.

Story continues beneath this advert

Among the many <sturdy>sectoral indices, Nifty IT rose 4.34 per cent, Nifty Pharma gained 1.4 per cent and Nifty Auto ended 2.38 per cent up.

Financial institution Nifty snapped its profitable streak and closed 0.5 per cent decrease at 55,370.05.

The NSE corporations that gained essentially the most on Wednesday included HCL Applied sciences (7.74 per cent), Tech Mahindra (4.76 per cent), Tata Motors (4.44 per cent), Wipro (3.87 per cent) and Infosys (3.75 per cent).

In accordance with Nair, the blended home This fall earnings and uptick in crude costs, together with the latest outperformance of the home market, can set off some consolidation within the close to time period.

Story continues beneath this advert

“We keep our constructive outlook on the Nifty and advocate persevering with with a ‘purchase on dips’ method, citing sturdy help across the 23,700–23,800 zone,” Mishra mentioned.

On the identical time, a give attention to stock-specific alternatives could possibly be extra rewarding in case the index enters a consolidation part, so align your positions accordingly, he mentioned.

© The Indian Categorical Pvt Ltd