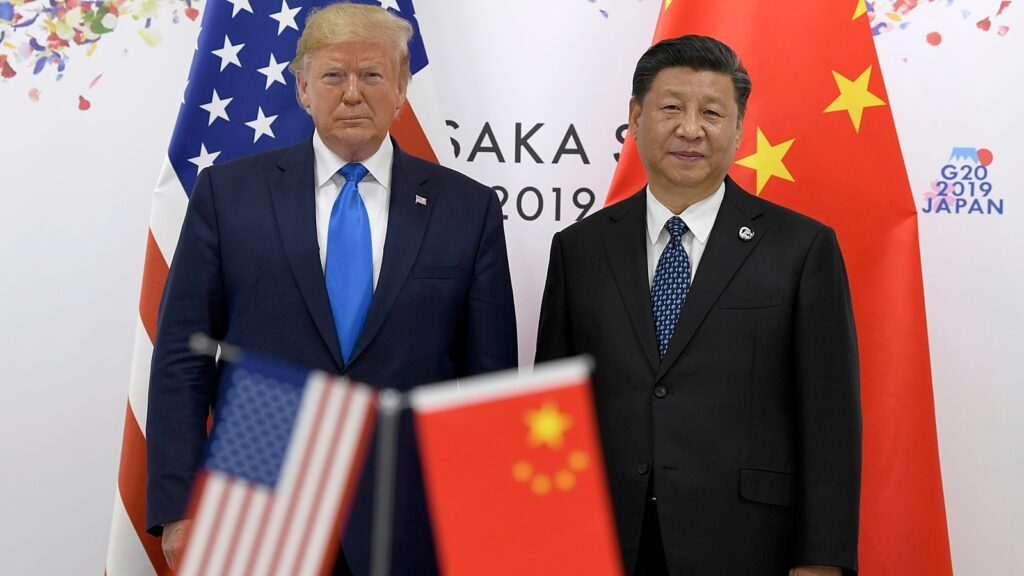

Within the unfolding “Mexican stand-off” between the USA and China, it’s more and more seemingly that Washington DC might again out. Indications of this had been clearly evident when US President Donald Trump claimed over the weekend that he had spoken straight with President Xi Jinping on the commerce challenge. Chinese language officers responded to this by categorically stating that no talks have taken place a few commerce conflict, with an official spokesperson saying that “China and the US haven’t held consultations or negotiations on the difficulty of tariffs. The US shouldn’t confuse the general public”.

Trump’s “liberation day” imposition of reciprocal tariffs towards the remainder of the world, which has now been whittled down right into a bilateral commerce conflict with China. Underneath this, the US at present has in place a 145 per cent tariff on Chinese language imports, China has slapped a retaliatory 125 per cent tariff on the US, alongside restrictions on exports of “uncommon earths” to the US. This beautiful a lot makes the state of affairs akin to an outright commerce embargo between the highest two economies of the world, and is ostensibly untenable in the long term. The sport of hen between the 2 international locations has to return to an finish. The query, although, is who will blink first? For all his bluster, Trump more and more seems to be to be the candidate.

Staying Energy

When it comes to persevering with with these tariffs, the US faces a number of disadvantages. The impression of Trump’s escalating commerce conflict with China has already begun to indicate up, with American port operators and air freight handlers reporting steep drops in imports from China, in line with a report by the Monetary Occasions. Retailers similar to Walmart and Goal have already warned of empty cabinets and better costs quickly.

So as to add gas to fireside, retail main Amazon was reported to be contemplating a plan to show the extra tariff on some merchandise together with the ultimate price on the web site. A CNN report Monday citing two senior White Home officers stated that as quickly as Trump learnt about this, he known as Bezos complaining about this plan. Later, when reporters requested Trump, he did acknowledge that he spoke with Bezos. Amazon has predictably determined to beat a retreat for now. However the prospect of spiralling inflation and empty retail cabinets is a ticking time-bomb for the Trump White Home, particularly the extra sane voice within the administration — Treasury Secretary Scott Bessant. There are additionally considerations of an extra unwinding of positions within the US bond market, which is a looming fear for this administration.

Between the US and China, it does appear that Beijing might have larger leverage and the endurance in managing an escalatory tariff spiral, not less than within the quick time period. In contrast to Trump, Chinese language President Xi Jinping will not be confronted with elections anytime quickly, there may be little or no inside opposition to his administration of the economic system at this cut-off date, and the nation is already in the midst of a stimulus package deal roll out that features a mixture of fiscal and financial measures.

Chinese language Resilience

Whereas there isn’t any denying that China has manipulated the worldwide manufacturing sector by way of unfair means and there are authentic grounds for difficult the nation’s stranglehold over manufacturing exports and its intent to weaponise commerce, Beijing has far larger endurance on this commerce stand-off with the US. Beijing additionally has the choice of stepping up its inside mission of deepening the nation’s home consumption market, one thing that may absorb a few of its export surpluses if the tariff conflict had been to be lengthy drawn out. It will probably proceed its fiscal stimulus package deal too effectively into the long run.

The US is at a drawback in all of this. There’s little firepower on the fiscal facet, besides the prospect of an extension of company tax concessions that Trump had promulgated in his final time period. Worryingly, there may be additionally an impending showdown that the Trump administration is prone to have with the US Federal Reserve on the difficulty of reducing rates of interest, which Federal Reserve Chair Jerome Powell has indicated is unlikely to occur anytime quickly.

Story continues beneath this advert

In accordance with Martin Wolf, chief economics commentator on the Monetary Occasions, China is prone to come out higher than America of their escalating commerce conflict. “The Individuals should be a lot cleverer than they’ve been to date (on this commerce conflict with China). I imply, a lot cleverer to keep away from ultimately dropping… China has large room for maneuver. America, alternatively… It’s politically fragile. The economic system seems to be considerably fragile now. The markets look fragile… This commerce conflict goes to break American enterprise very, very significantly. It’s going to make the provision chains in America extraordinarily fragile already, prone to break fairly various them. The availability shock right here might be actually fairly damaging”, he informed The Indian Specific

© The Indian Specific Pvt Ltd