The chairman of one in all Credit score Suisse’s latest and largest shareholders referred to as on the beleaguered financial institution to ship a swift overhaul and return to a “very secure, conservative Swiss banking posture.”

Saudi Nationwide Financial institution, the dominion’s largest lender and majority-owned by the Saudi authorities, introduced Wednesday that it was investing as much as $1.5 billion in Credit score Suisse — representing a stake of as much as 9.9%.

“We bought it on the flooring worth. I believe the financial institution has been battered,” Ammar Alkhudairy instructed CNBC’s Hadley Gamble on Sunday. “It is buying and selling at lower than 1 / 4 of ebook worth, of tangible ebook worth, which is, which is a steal. And it is 160-year-old model, the model has lots of worth.” The financial institution is reportedly set to grow to be the second-largest shareholder of Credit score Suisse, second to Harris Associates.

The Swiss lender posted a third-quarter internet lack of 4.034 billion Swiss francs ($4.09 billion) final week, considerably worse than analyst estimates, and introduced an enormous strategic overhaul. Shares are down round 55% this yr after a number of scandals, administration modifications and weak earnings releases.

Within the anticipated strategic shift, the financial institution vowed to “radically restructure” its funding arm to considerably minimize its publicity to risk-weighted property, that are used to find out a financial institution’s capital necessities. It additionally goals to chop its price base by 15%, or 2.5 billion Swiss francs, by 2025.

The SNB chairman cited Credit score Suisse’s funding banking unit because the Achilles’ heel of the corporate, accentuated by the present local weather of elevated market volatility.

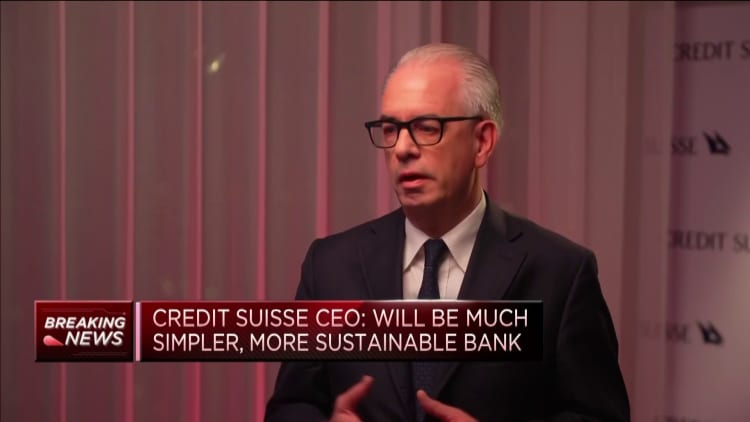

“The most important overhang for Credit score Suisse, over the previous couple of years … has been the volatility of the efficiency of their funding financial institution,” he instructed CNBC.

A Credit score Suisse Group AG financial institution department in Basel, Switzerland, on Tuesday, Oct. 25, 2022. Hundreds of job cuts, makes an attempt to boost contemporary capital and a revamp of its funding banking unit — all a part of a radical company-wide overhaul by Credit score Suisse.

Stefan Wermuth | Bloomberg | Getty Photographs

Alkhudairy added that the financial institution’s different three core companies, which is the retail enterprise in Switzerland, the personal wealth administration and asset administration are “very secure” enterprise streams which have delivered “predictable, sustainable returns.”

“So it is simply transferring again into a really secure, conservative Swiss banking posture, which we like,” he mentioned.

Within the brief to medium-term outlook, Alkhudairy mentioned he feels that a very powerful step for Credit score Suisse to undertake is to “get the risky enterprise out of the quarterly earnings,” and concentrate on personal wealth administration and increase the retail enterprise.

“I simply would urge them to not blink, to not hesitate and simply execute [the overhaul]. The faster the higher,” he mentioned.

No intention to intervene in administration

The funding comes on the heels of Crown Prince Mohammed Bin Salman’s encouragement of Saudi Arabia’s largest companies to actively make investments abroad and bolster its profile as a world investor. Saudi Arabia’s Public Funding Fund manages about $620 billion in property, and is integral to the crown prince’s ambitions.

Nevertheless, when requested in regards to the transfer by SNB to put money into the embattled Swiss financial institution, Alkhudairy denied that it was essentially associated to PIF, however quite an funding that was a “manifestation of the brand new Saudi Arabia.”

He added that Saudi Nationwide Financial institution doesn’t have any board seats at Credit score Suisse at present, and he would not see that altering sooner or later.

“We are going to help the financial institution as a large shareholder,” mentioned Alkhudairy. “There is no such thing as a intention in any technique to intervene within the administration, or take part within the administration.”

“Let me let me be clear, it is a monetary funding, the 9.9% was very nicely measured, as a result of when you get to 10%, you could have all types of regulatory and accounting points that that creep up, which we felt we’d not wish to get into. We haven’t any board seats for now, and we do not see us taking a board seat straight,” he mentioned.