Yogi Bera would remind us that predictions are tough, particularly in regards to the future – and that pearl of knowledge is extra related than ever in immediately’s oil markets. As a tough proxy for the worth of crude, gasoline costs on the pump pulled again this summer season, and are beginning to head again up now. The newest upward strain on oil got here from Saudi Arabia, which introduced a 2 million barrel per day reduce in OPEC’s manufacturing.

However that was just one issue. A lot of the oil market is getting pushed round by unpredictable forces, and OPEC’s function is hardly the biggest. The Center East is chronically unstable, with unrest in Iran and ongoing conflicts in Iraq and Syria; Western nations are sanctioning Russia in response to the invasion of Ukraine; provide chain points, together with availability of tankers, proceed to disrupt buying and selling patterns; and the worldwide financial system, going through recessionary pressures, is more and more weak to excessive inflation, which in flip is pushed largely by vitality costs.

It is sufficient to make your head spin. However for those who attempt to predict the place costs will go, it’s higher to guess up than down proper now. World demand for fossil fuels, particularly oil and gasoline, continues to be sturdy – and as lengthy that holds, there’ll proceed to be some upward strain on oil costs.

For buyers, a sector with elevated product value potential presents a chance – to search out the businesses that stand to realize as costs go up. And proper now, wanting on the oil trade for funding agency BTIG, analyst Gregory Lewis sees simply such a gap within the oilfield companies (OFS) firms. These are corporations that provide assist to the exploration & manufacturing firms and the drilling firms – all the pieces from drilling expertise to wastewater removing to specialised engineering experience on pumps and piping.

In Lewis’ view, the oilfield service corporations can supply buyers over 40% upside for the yr forward. We’ve pulled up the most recent knowledge from TipRanks on two of his picks; mixed with Lewis’ feedback, that knowledge might make clear simply the place these firms are headed.

Helix Power Options Group (HLX)

The primary oilfield companies firm in our sights occupies a specialist area of interest in a specialist sector – Helix focuses on offshore actions, providing assist by the total lifecycle of offshore oil and gasoline fields. Helix’s companies embody undersea robotics, effectively intervention, subsea trenching and cable burial, and seabed clearing actions. Whereas Helix has traditionally labored with the hydrocarbon trade, in recent times the corporate has expanded its companies to succeed in the offshore renewable vitality section.

Helix organizes its operations by each enterprise section and geography. The corporate’s segments embody effectively intervention, robotics, and manufacturing amenities; geographically, the corporate operates in deep water within the Gulf of Mexico and the North Sea, in addition to Brazil, West Africa, and within the Asia-Pacific area.

The corporate earlier this week reported its 3Q22 monetary outcomes, and confirmed a pointy improve in prime line revenues. For the quarter ending September 30, Helix had revenues of $272.55 million, up 50% year-over-year and a powerful 67% sequentially. For the primary three quarters of the yr, Helix reported greater than $585 million in whole revenues, for a y/y achieve of 15%. Helix reported a diluted EPS lack of 12 cents per share in Q3, a outcome that was comparatively flat from the 13-cent loss reported within the year-ago quarter, and significantly better than the 20-cent EPS loss reported in Q2.

In his protection of this inventory, analyst Lewis notes the energy of the trade behind Helix, writing: “We’re within the early innings of the present up-cycle for offshore O&G companies which seems to be to be tightening sooner than ordinary due to demand overlap from offshore wind.”

“Our base case assumption is that HLX is ready to make the most of a cyclical restoration in OFS over the subsequent few years with further tailwinds coming from the worldwide buildout of offshore wind,” Lewis added.

With this bullish stance in thoughts, Lewis upgrades HLX from Impartial to Purchase, and units a $10 value goal that implies a 44% upside on the one-year time-frame. (To observe Lewis’ monitor document, click on right here)

Lewis is hardly the one bull on the subject of Helix; this inventory has 4 current analyst evaluations on file, and they’re all constructive – for a unanimous Robust Purchase consensus ranking. Shares in Helix are priced at $6.94 and their common value goal, of $8, suggests a 15% upside for the subsequent yr. (See HLX inventory evaluation on TipRanks)

Transocean Ltd. (RIG)

We’ll proceed our have a look at oilfield companies with Transocean, the world’s main contractor for offshore drilling companies on oil and gasoline wells. Transocean’s specific specialty is drilling companies in ultra-deepwater and harsh environments; the corporate has operations off the continental shelf within the Gulf of Mexico, for instance. Transocean’s fleet of drilling rigs – all of which it owns or has partial possession pursuits in – consists of 37 cellular offshore items. These embody 27 ultra-deepwater floaters and 10 harsh setting floaters. The corporate is working to develop its fleet by the development of two ultra-deepwater drillships.

Within the 4 quarters from 2Q21 by 1Q22, Transocean noticed its prime line revenues slide whereas earnings losses grew deeper – however that pattern seems to be ending, and 2Q22 noticed higher information for the corporate. On the prime line, the second quarter introduced revenues of $692 million, up 18% from 1Q22. 12 months-over-year, the Q2 revenues had been up a extra modest 5.5%. On the underside line, the corporate’s web loss for 2Q22 was 10 cents per diluted share. This compares favorably to the 26-cent diluted EPS lack of 1Q22, and to the 18-cent per share web lack of 2Q21.

Transocean completed Q2 this yr with $2.28 billion in whole belongings, together with $729 million in money. The corporate’s web money from operations got here in at $40 million. Whereas that is down sharply from the $249 million of the year-ago quarter, it’s a sturdy turnaround from the $1 million money loss reported within the earlier quarter. Transocean’s whole unrestricted money and money equivalents was reported at $1.16 billion as of June 30.

In an necessary metric that bodes effectively for Transocean’s future, the corporate has a contract backlog – that’s, work that’s contracted for however not but begun – of $6.2 billion.

Checking in once more with BTIG’s Gregory Lewis, we discover that he sees Transocean in place to begin bettering its monetary outcomes. Noting “bettering dayrates within the floater market,” Lewis goes on to elucidate that it “will permit the corporate to recharter its rigs at greater ranges.” The analyst continued, “We observe Norwegian semi charges are additionally beginning to tick up (a core a part of RIG’s fleet). Backside line: we imagine we’re within the early innings of the continued offshore rig upcycle, which ought to present sturdy money flows and refinancing alternatives for RIG to enhance its steadiness sheet.”

To this finish, Lewis charges RIG shares a Purchase together with an $8 value goal, indicating potential for a sturdy 118% upside within the subsequent 12 months.

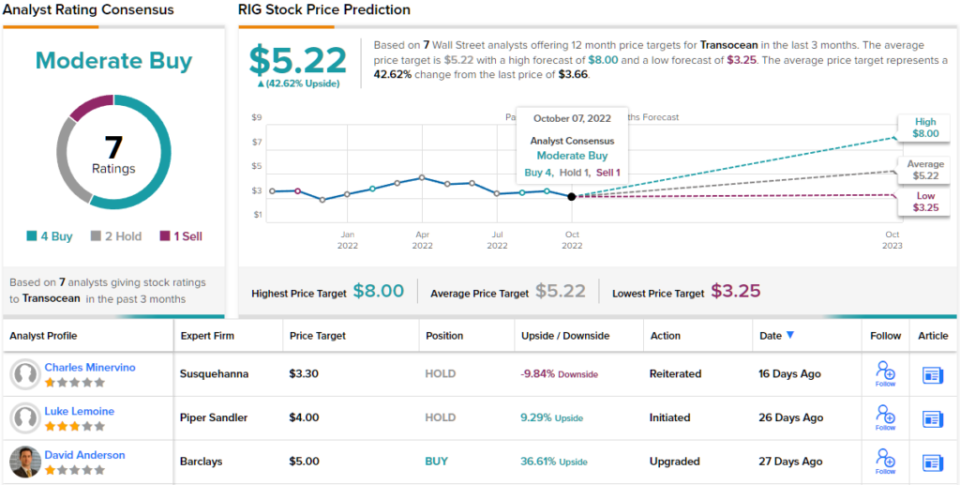

General, this deepwater oil subject companies agency has picked up 7 evaluations from the Road’s analysts, and these embody 4 Buys, 2 Holds, and single Promote, giving the inventory its Average Purchase consensus ranking. The shares have a median goal of $5.22, implying an upside of ~43% from the buying and selling value of $3.66. (See RIG inventory evaluation on TipRanks)

To search out good concepts for vitality shares buying and selling at enticing valuations, go to TipRanks’ Finest Shares to Purchase, a newly launched instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather necessary to do your personal evaluation earlier than making any funding.