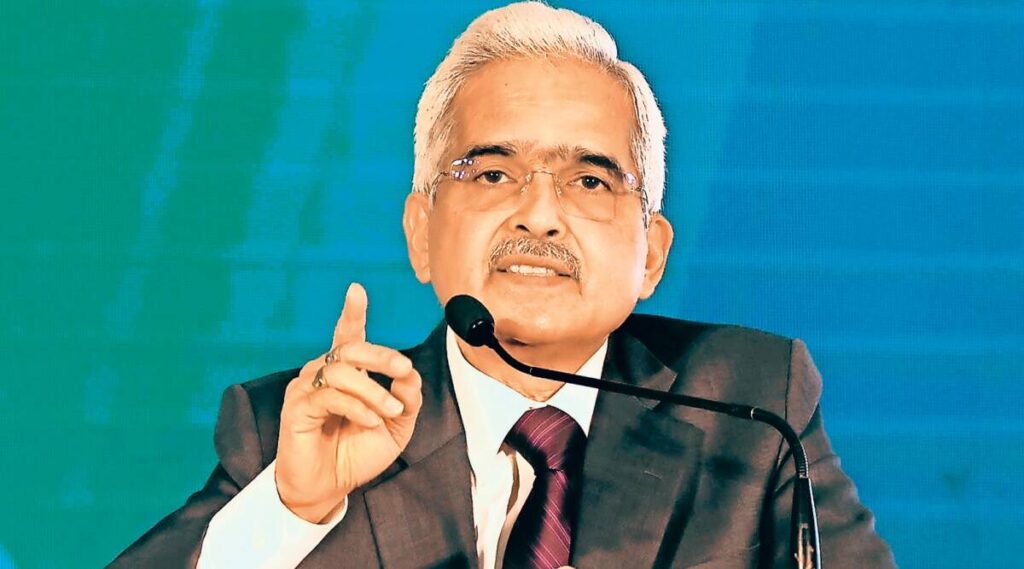

Reserve Financial institution of India (RBI) Governor Shaktikanta Das on Wednesday defended the central financial institution’s price actions saying it shunned rising the repo price originally of the 12 months on assumption that inflation will stay round 5 per cent in FY23 and in addition because it didn’t wish to upset the financial restoration course of.

The Governor’s rationalization got here a day forward of the particular Financial Coverage Committee’s (MPC) assembly on November 3 to resolve on the content material of the report the RBI has to ship to the federal government after it failed to keep up the inflation goal of 2-6 per cent for 3 consecutive quarters.

“A lot has been made concerning the RBI not having the ability to adhere to inflation goal, however I’d request you to only step again for a second and assume if we had began the method of tightening earlier, what would have been the counterfactual state of affairs. What you stop within the course of, doesn’t get the form of appreciation that it ought to get,” Das mentioned.

“We prevented a whole downward flip of our financial system. After recording a damaging progress within the 12 months 2020-21, India’s financial system bounced again in 2021-22 and sustained in 2022-23 and in addition subsequent 12 months. How was it attainable if we had prematurely began tightening?” Das mentioned whereas addressing an occasion organised by Ficci and Indian Banks Affiliation (IBA).

At first of 2022, after trying on the inflation trajectory, the RBI’s evaluation confirmed that the common CPI inflation throughout the 12 months 2022-23 shall be round 5 per cent. This projection factored in crude oil costs to be at $100 per barrel.

Even the skilled forecasters had projected the inflation to be between 4.5-5.2 per cent, he mentioned.

“So, we didn’t wish to upset the method of restoration. We wished the financial system to soundly land within the turbulent waters by means of which the financial system had been crusing by means of the interval of Covid. We wished the financial system to soundly land on the shores, attain the shores and, thereafter, attempt to pull down inflation,” the Governor mentioned.

However then on February 24, the Ukraine-Russia conflict began, which modified your entire image as crude, commodity and meals costs went up.

The buyer value based mostly inflation (CPI), or retail inflation, has remained above 6 per cent between January and September 2022.

“Within the course of, there was a slippage in our inflation focusing on, in our means to keep up inflation beneath 6 per cent. However it could have been very expensive for the financial system, the residents of the nation and we might have paid a excessive value,” Das mentioned.

He mentioned after the conflict began in February, RBI, in its April financial coverage, began specializing in inflation and introduced a lot of measures. It additionally held an off-cycle financial coverage assembly in Could during which it hiked the repo price by 40 foundation factors for the primary time in virtually 4 years.

“We needed to act and it was a damaging shock. But it surely was essential and necessary to do. And since we did that, as we speak I can say with confidence that this complete debate concerning the RBI behind the curve has ended and it’s no extra there,” Das said.

Since Could this 12 months, the RBI has hiked the repo price by 190 foundation factors to five.90 per cent.

In as we speak’s assembly, the MPC will resolve on the content material of the report it should ship to the federal government.

Within the report, the central financial institution should point out the remedial actions it proposes to take and an estimated time inside which the inflation goal shall be achieved following the well timed implementation of the proposed remedial actions. Following the MPC assembly, the RBI will ship the report back to the federal government.

Das reiterated that the RBI doesn’t have the privilege to launch a report back to the media which is being written as per the regulation.

“I don’t have the privilege, or the authority, or the posh, to launch it (the report) to the media earlier than even the addressee will get it. The primary proper of receiving the letter lies with the federal government,” he added.

The Governor, nevertheless, mentioned the content material of the letter shouldn’t be going to be perennially below wraps and shall be obtainable within the public area all through time.