LISBON, Nov 2 (Reuters) – Plans by central banks to launch digital currencies should not a risk to different cryptocurrencies as they might validate blockchain expertise and construct belief amongst sceptics, the CEO of the world’s largest crypto trade, Binance, stated on Wednesday.

Most main central banks, together with the U.S. Federal Reserve, the Financial institution of England and the European Central Financial institution, are learning the potential launch of a digital model of their currencies, dubbed CBDC. learn extra

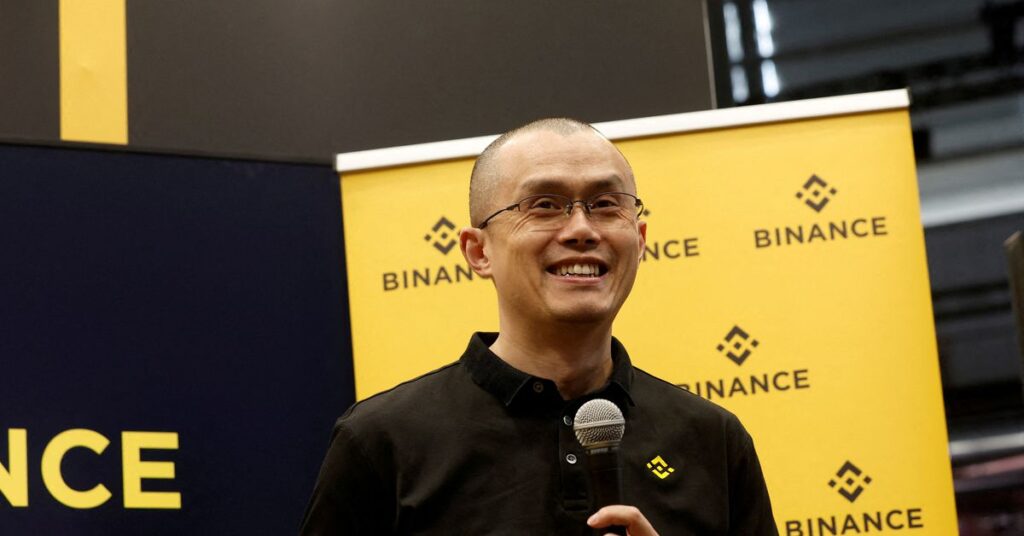

“Is it (CBDC) a risk to Binance or different crypto-currencies? I don’t suppose so. I very a lot suppose that the extra we have now, the higher,” Changpeng Zhao informed a information convention throughout Europe’s largest tech convention, the Net Summit, in Lisbon.

He stated the blockchain expertise behind cryptocurrencies must be obtainable for CBDC and adopted by governments.

“It’s going to validate the blockchain idea, in order that anyone who nonetheless has issues concerning the expertise, will say: ‘OK, our authorities is utilizing the expertise now’,” Zhao stated.

“So, all these issues are good,” he stated, including that CBDC would nonetheless be completely different from native crypto as “cryptocurrency is a deflationary asset”.

Nonetheless, he stated, lately cryptocurrency has been extremely correlated with the inventory market, with each belongings correcting sharply as central banks hike rates of interest to manage report inflation.

“In principle they need to be inversely correlated, however right now they go the identical method, primarily as a result of most people who commerce on crypto (belongings) additionally commerce shares,” he stated.

“When the Fed raises rates of interest, and the inventory market crashes, they need additional cash, so that they promote crypto. It’s because the person base remains to be very extremely correlated,” he stated.

Reporting by Sergio Goncalves and Catarina Demony; enhancing by Andrei Khalip and Elaine Hardcastle

: .