Amazon’s inventory has tumbled sufficient over the previous week to do actual injury to its long-term chart — sufficient to warn buyers that it may nonetheless get so much worse.

However amid the market turmoil and issues over how inflation and fast-rising rates of interest would possibly damage the e-commerce big’s buyer base within the coming months, there are additionally a some technical tells that counsel the inventory could also be getting fairly near an enormous inflection level.

First, the dangerous information. Amazon.com Inc.

AMZN,

inventory has taken a historic beating for the reason that center of final week. And for the fifth straight session, the inventory erased an early intraday acquire of not less than 1% to sink into the crimson.

On Friday, it rallied as a lot as 3.5% mid-morning earlier than pulling a pointy U-turn to commerce down as a lot as 1.4% in afternoon buying and selling earlier than one other reversal took it up 1.9% to $90.98 on the shut. That late rally snapped a seven-day dropping streak by which it plunged 25.95%, which was the worst efficiency over any seven-day interval because it misplaced 26.04% in the course of the interval ending Nov. 19, 2008.

The sharp value weak spot comes at time of unfavorable elementary developments as effectively, as the corporate final week reported disappointing third-quarter income and a downbeat outlook for the vacation interval and mentioned it was pausing hiring for company jobs whereas it screens the outlook for the economic system.

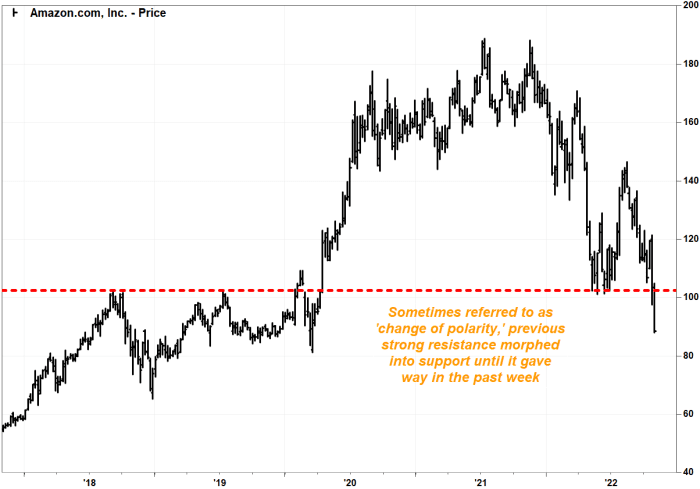

John Kosar, chief market strategist at Asbury Analysis, mentioned that the inventory has damaged under a key assist stage at $102.53 on the long-term weekly charts.

An outdated Wall Avenue adage says that earlier resistance, as soon as damaged, typically turns into assist. The stronger the resistance on the best way up, the stronger the assist on the best way down.

The pondering is that when buyers promote inventory at a sure value and the inventory subsequently rises above that value after which falls again to it, it turns into extra possible that those self same sellers will purchase that inventory again.

For Amazon, the assist Kosar refers to comes from the five-year weekly bar chart, with every bar depicting the week’s open, shut and buying and selling vary.

FactSet, MarketWatch

The $102.53 stage marked resistance on the excessive for the week ending Sept. 7, 2018, which was backed up a month later when the inventory peaked at $101.66 earlier than plummeting about 36% to the Dec. 28 weekly low of $65.35. The resistance beat again one other rally, because the inventory topped out at $101.79 in July 2019.

Resistance lastly gave manner in February 2020 and, following an preliminary pullback interval, sparked a rally that took the inventory as much as its file shut in July 2021.

After the postpandemic rally pale, earlier resistance handed two laborious checks of assist in Might and June of 2022, which led to an enormous bounce into August.

However the newest selloff proved an excessive amount of for assist to deal with.

With key assist damaged, “it clears the best way for a transfer all the way down to $81.30,” Kosar mentioned.

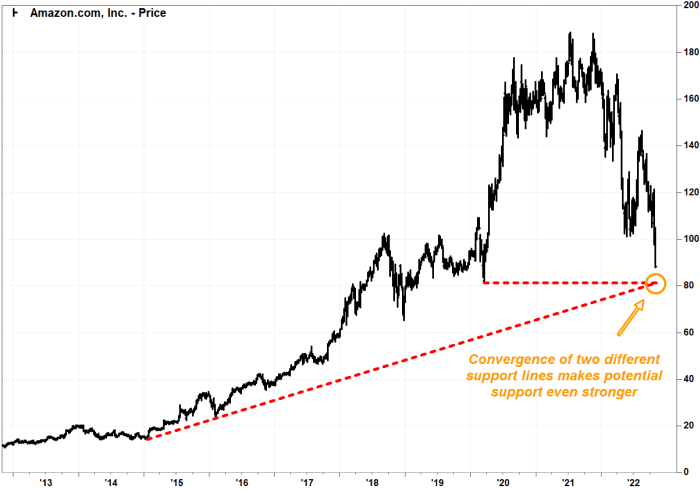

That’s the low for the week ending March 20, 2020, on the top of COVID-19 pandemic uncertainty and fears, and in addition the low of the pullback previous to the postpandemic surge.

FactSet, MarketWatch

Now for the excellent news.

Including to the significance of that assist, a rising trendline that begins on the January 2015 weekly low and connects with the January 2016 low extends to simply above $81.

The convergence of two various kinds of assist possible makes that stage a good stronger assist space than in the event that they have been separate.

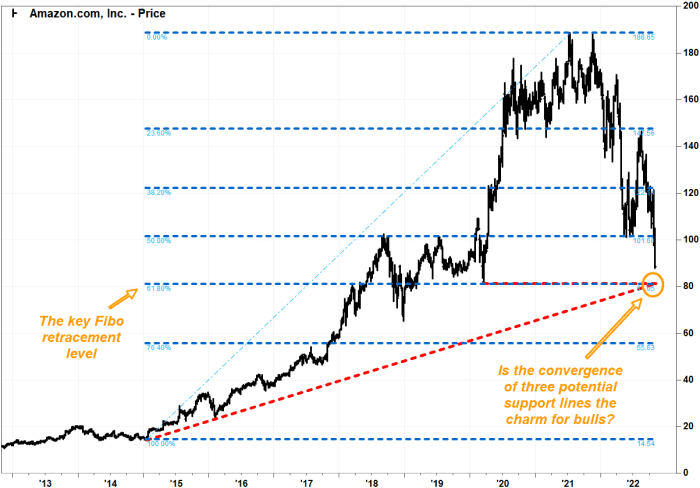

A 3rd chart level could be the attraction. The important thing 61.8% Fibonacci retracement of the uptrend rising off the January 2016 weekly low to the July 2021 all-time weekly excessive is available in at roughly the identical stage.

FactSet, MarketWatch

That retracement stage relies on the mathematical Fibonacci ratio of 1.618, which is also called the golden ratio given its prevalence in pure techniques. Many Fibonacci followers on Wall Avenue consider that the 61.8% retracement can act as an necessary chart stage, as a result of if it breaks, it suggests the prior development is not intact. Learn extra in regards to the significance of the Fibonacci ratio in chart evaluation.

“Fibo” ranges aren’t essentially areas of pure assist, however they’ll act as guideposts, which at a time of heightened uncertainty can present consolation for buyers. And the extra chart factors that come up at an identical stage, the extra seen they change into to potential patrons — notably, maybe, when the charts are exhibiting bullish technical divergence.

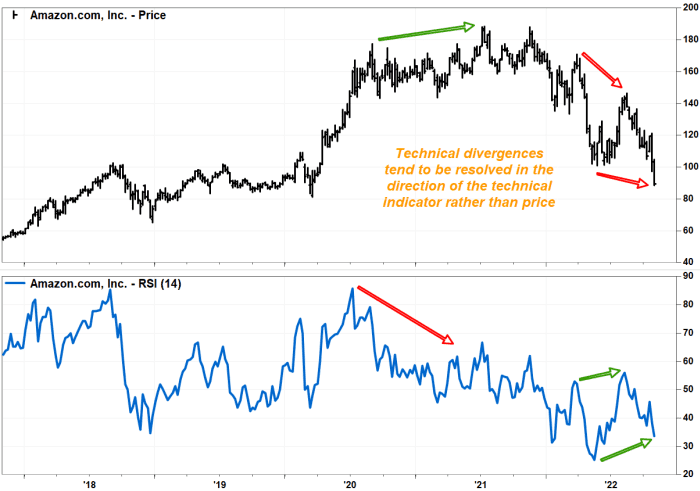

Whereas Amazon’s inventory value has been falling, making decrease highs and decrease lows, the relative power index (RSI) has been trending larger for the previous a number of months, making larger highs and better lows.

FactSet, MarketWatch

The RSI is an underlying momentum indicator that makes an attempt to depict how the magnitude of latest declines compares with latest positive factors. When an RSI is making a better low whereas costs are falling, it suggests it’s taking increasingly more vitality out of the bears to push costs decrease, and the bulls are increase power.

The bullish divergence seen in Amazon’s weekly chart can be categorised because the strongest, or “Class A,” divergence, as outlined by the CMT Affiliation.

Technical divergences aren’t good timing instruments, as they’ll final for lengthy intervals of time earlier than they’re lastly resolved. However they do are inclined to resolve themselves within the route of the technical indicator.

And so they can act as a warning to not promote right into a bounce, if and when one happens.

Amazon’s inventory has tumbled 45.4% yr thus far, whereas the Nasdaq Composite Index

COMP,

has shed 33.0% and the S&P 500 index

SPX,

has declined 20.9%.