(Bloomberg) — All bets seem like off on how excessive yields can rise on this planet’s largest bond market.

Whereas solely the two-year reached a brand new multiyear excessive this week — on Friday after October labor market knowledge have been stronger than anticipated — extra bloodletting appears inevitable within the Treasury market.

Federal Reserve Chair Jerome Powell reiterated on Wednesday, after the central financial institution’s sixth coverage charge improve this 12 months, to a variety of three.75% to 4%, that there’s no finish in sight so long as inflation stays elevated. Swaps merchants responded by pricing in a peak charge greater than 5%.

“The information must be very unhealthy to shift the Fed from their present path,” stated George Goncalves, head of US macro technique at MUFG. So “the danger/reward profile for, and the skew for the bond market, has shifted to one in every of additional weak spot.”

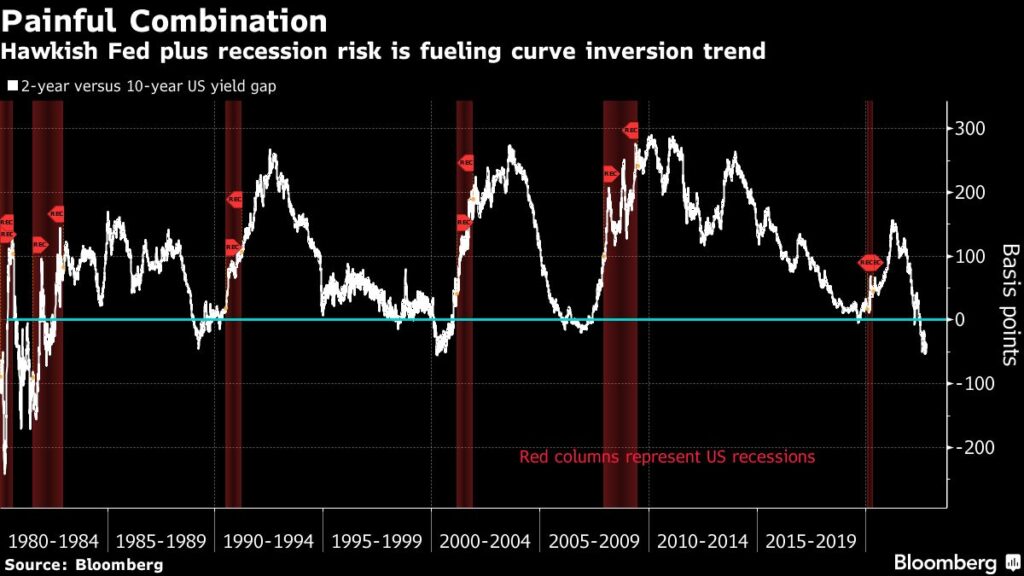

For the second, traders stay satisfied that the Fed is on a course that in the end will carry the financial system to its knees. That’s obvious within the distinction between two-year and longer-maturity Treasury yields.

The 2-year exceeded the 10-year Treasury yield by as a lot as 62 foundation factors this week, the deepest inversion because the early Nineteen Eighties when then-Fed Chair Paul Volcker was relentlessly elevating charges to rein in hyper inflation. Curve inversions have a monitor document of previous financial downturns by 12 to 18 months.

The inversion has scope to extend to as a lot as 100 foundation factors if the market begins pricing in a terminal charge of 5.5% in response to future inflation readings, Ira Jersey, chief US interest-rate strategist at Bloomberg Intelligence, says.

The 2-year peaked this week close to 4.80%, whereas the 10-year has but to exceed 4.34% within the present cycle, and ended the week at 4.16%.

All yields are prone to exceed 5% because the Fed continues to tighten monetary situations, stated Ben Emons, world macro strategist with Medley World Advisors.

“Now it’s concerning the final vacation spot” of the coverage charge, stated Michael Gapen, head of US economics at Financial institution of America Corp., whose forecast for the terminal stage is a variety of 5%-5.25%. “The chance is that they in the end need to do greater than we’re all considering and it takes longer to get inflation beneath management.”

Cash-market merchants stay cut up over whether or not the Fed’s subsequent assembly in December will lead to a fifth consecutive three-quarter-point charge improve or a smaller half-point transfer. Powell this week reiterated that the tempo of will increase is prone to gradual in some unspecified time in the future, probably as quickly as in December. However with inflation knowledge for October and November slated for publication within the interim, it’s too quickly to say.

October shopper costs on Thursday are anticipated to indicate deceleration. The 6.6% year-on-year improve in costs excluding meals and power in September was the largest since 1982, and it pushed the anticipated peak within the Fed’s coverage charge above 5% for the primary time.

The inflation knowledge ought to dominate a holiday-shortened week through which there could also be upward stress on yields from the resumption of Treasury debt gross sales together with 10-year and 30-year new points. The auctions, additionally together with a brand new 3-year be aware, are the primary in a 12 months to not have been shrunk from the latest comparable ones.

The Bloomberg US Treasury index has misplaced practically 15% this 12 months. With shares additionally battered in 2022, traders within the in style 60/40 cut up between equities and high-quality bonds have misplaced about 20%, based on a Bloomberg index.

Hope springs everlasting although. Strategists at TD Securities Friday really useful beginning to purchase 10-year Treasuries, anticipating yields to say no as shoppers exhaust their financial savings and curb spending, whereas the Fed retains charge excessive.

“We’re bullish on mounted revenue,” stated Gene Tannuzzo, world head of mounted revenue at Columbia Threadneedle Investments. “There was an necessary reset for the asset class, particularly if yields can relaxation at the next stage. Quite a lot of tightening is priced in.”

What to Watch

-

Financial calendar

-

Nov. 8: NFIB small enterprise optimism

-

Nov. 9: MBA mortgage functions; wholesale inventories

-

Nov. 10: CPI; weekly jobless claims

-

Nov. 11: U. of Michigan sentiment and inflation expectations

-

-

Fed calendar:

-

Nov. 7: Boston Fed President Susan Collins; Cleveland Fed President Loretta Mester; Richmond Fed President Thomas Barkin

-

Nov. 9: New York Fed President John Williams; Barkin

-

Nov. 10: Fed Governor Christopher Waller; Dallas Fed President Lorie Logan; Mester; Kansas Metropolis Fed President Esther George

-

-

Public sale calendar:

-

Nov. 7: 13-, 26-week payments

-

Nov. 8: 3-year notes

-

Nov. 9: 10-year notes; 17-week payments

-

Nov. 10: 30-year bonds; 4-, 8-week payments

-

Extra tales like this can be found on bloomberg.com

©2022 Bloomberg L.P.