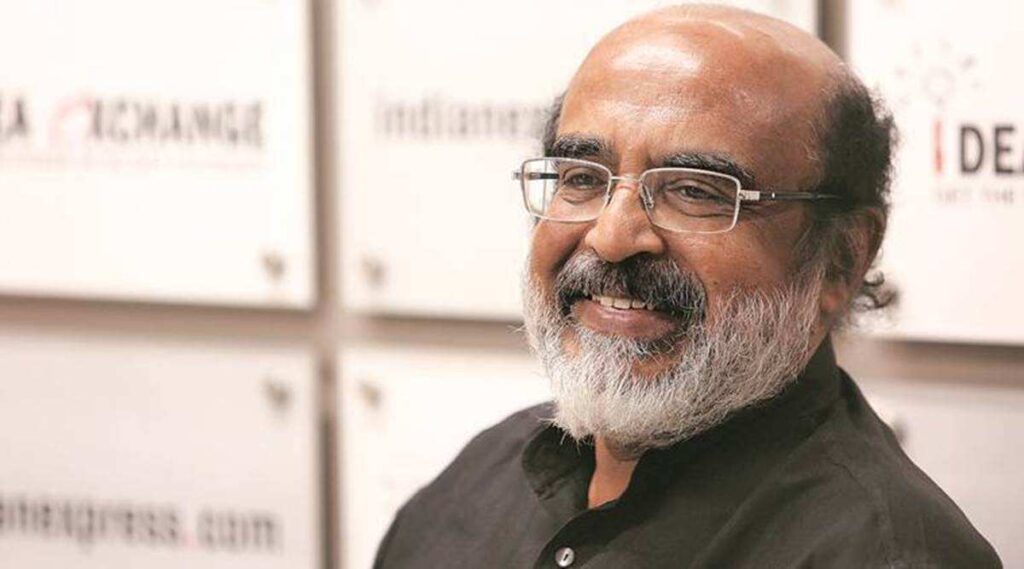

States are usually not being given federal flexibility and there are efforts to undermine the federal construction, former Kerala Finance Minister Thomas Isaac stated, including that federalism must be a subject of nationwide discourse.

“Each alternative is made to undermine the federal system…it’s a horrible scenario,” Isaac stated through the fifth LC Jain Memorial Lecture on ‘The Challenges of Federalism: Negotiating Centre State Tensions’.

He stated the Centre’s fiscal deficit has fluctuated between 3.5 and 6 per cent since 2005-06.

“States are usually not alleged to borrow past 3 per cent of the GSDP. The federal government has by no means complied with it…from 2005-06, central authorities’s fiscal deficit has fluctuated from 3.5-6 per cent. That is the fundamental asymmetry. No rule or legislation, the Centre must comply however states are compelled to,” he added.

Talking in regards to the lack of federal flexibility for states beneath the Items and Providers Tax (GST) regime, Isaac stated levy of compensation cess might have continued for 2 extra years.

“It will probably have some federal flexibility…when the calamity of floods got here, Kerala requested and was permitted to have a 1 per cent cess on SGST (state GST). Nothing occurred to the structure of GST. See, you may give federal flexibility by allowing states…(some states could) need extra faculties, they need to break FRBM Act, those that don’t need to do it, don’t do it however even that little bit of flexibility is just not there.

“The compensation has stopped…it’s a tax collected from sin items like tobacco…you’ll be able to proceed for additional two years…earlier there have been negotiations, now that’s not (the case),” he stated.

Beneath GST, as per the Items and Providers Tax (Compensation to States) Act, 2017, the states had been assured compensation on the compounded charge of 14 per cent from the bottom yr 2015-16 for losses arising as a result of implementation of the taxation regime for 5 years since its rollout. The compensation regime resulted in June 2022.