Sam Bankman-Fried, the previous head of the huge cryptocurrency change FTX, mentioned he had a “unhealthy month” however didn’t intend to defraud anybody earlier than the corporate collapsed earlier this month.

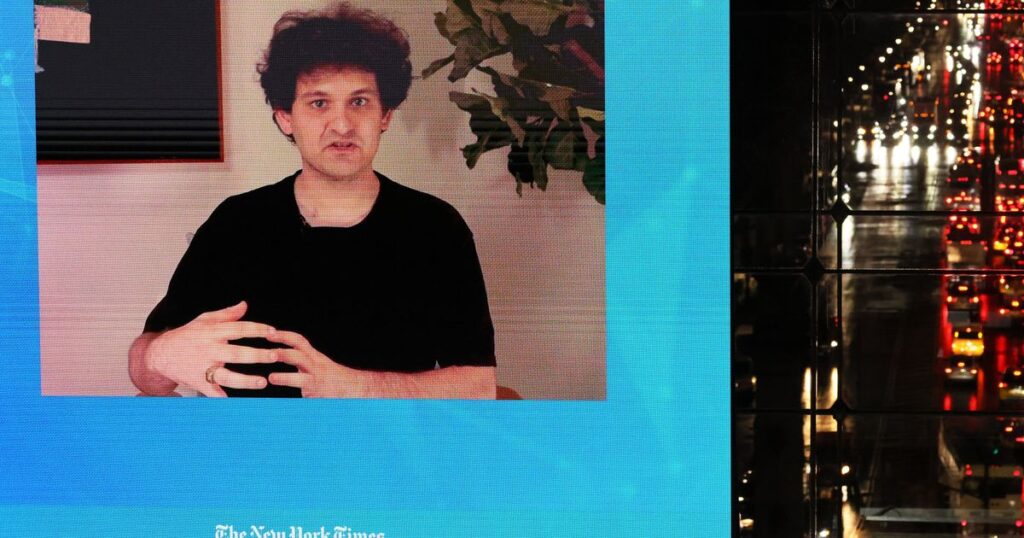

He spoke at The New York Instances DealBook Summit on Wednesday, saying he was talking out about his exceptional downfall in opposition to authorized recommendation.

“I didn’t attempt to commit fraud on anybody,” Bankman-Fried, showing by way of video convention from the Bahamas, advised the Instances summit. “I used to be enthusiastic about FTX a month in the past. … I considerably underestimated what the size of the market crash may appear to be and the velocity of it.”

The crypto world was shocked in November when FTX, valued at its peak at about $32 billion, successfully imploded in a single day, submitting for chapter and leaving greater than 1,000,000 collectors behind. Investigators are trying into allegations that FTX used billions of {dollars} in buyer funds to bankroll a sister firm, Alameda Analysis. These claims started to concern traders in latest weeks, setting off a financial institution run that led to the collapse and big questions on how a crypto darling may virtually disappear in lower than every week.

Chapter filings present FTX owes greater than $3 billion to collectors.

Bankman-Fried resigned from his function at FTX and mentioned Wednesday that he had “near nothing” left, a brisk fall from grace for the 30-year-old mogul who was as soon as hailed by philanthropists, lawmakers and traders as a technologic wunderkind. He personally donated tens of tens of millions of {dollars} to Democratic causes.

He mentioned Wednesday that he didn’t “knowingly” commingle funds between FTX and Alameda Analysis, saying that, regardless of working the corporate and founding the buying and selling agency, “I didn’t know what was happening.”

“Loads of the issues had been issues I realized over the past month,” Bankman-Fried advised the summit. “Look, I screwed up. I used to be the CEO of FTX. I say this repeatedly. Which means I had a accountability. We tousled huge.”

FTX’s downfall displays wider considerations concerning the crypto trade, which surged throughout the pandemic throughout a Wild West funding increase with little to no regulation. Treasury Secretary Janet Yellen lately mentioned the autumn of FTX was the trade’s “Lehman second,” saying crypto wanted oversight and was now sufficiently big to trigger “substantial hurt” to traders.

Bankman-Fried mentioned, whereas he was “shocked” by FTX’s collapse, he was centered on restoring funds to clients.

“I’ve an obligation to elucidate what occurred, and I’ve an obligation to attempt to assist,” he mentioned throughout the DealBook summit. “What issues right here is all the purchasers and stakeholders that obtained damage and to assist them out. What occurs to me shouldn’t be the necessary half.”