(Bloomberg) — Former Treasury Secretary Lawrence Summers warned that the Federal Reserve will most likely want to boost rates of interest greater than markets are at present anticipating, due to stubbornly excessive inflationary pressures.

Most Learn from Bloomberg

“We’ve got an extended option to go to get inflation down” to the Fed’s goal, Summers informed Bloomberg Tv’s “Wall Road Week” with David Westin. As for Fed policymakers, “I believe they’re going to wish extra will increase in rates of interest than the market is now judging or than they’re now saying.”

Curiosity-rate futures recommend merchants anticipate the Fed to boost charges to about 5% by Might 2023, in contrast with the present goal vary of three.75% to 4%. Economists anticipate a 50-basis level enhance on the Dec. 13-14 coverage assembly, when Fed officers are additionally scheduled to launch contemporary projections for the important thing charge.

“Six is definitely a state of affairs we will write,” Summers mentioned with regard to the height share charge for the Fed’s benchmark. “And that tells me that 5 isn’t a very good best-guess.”

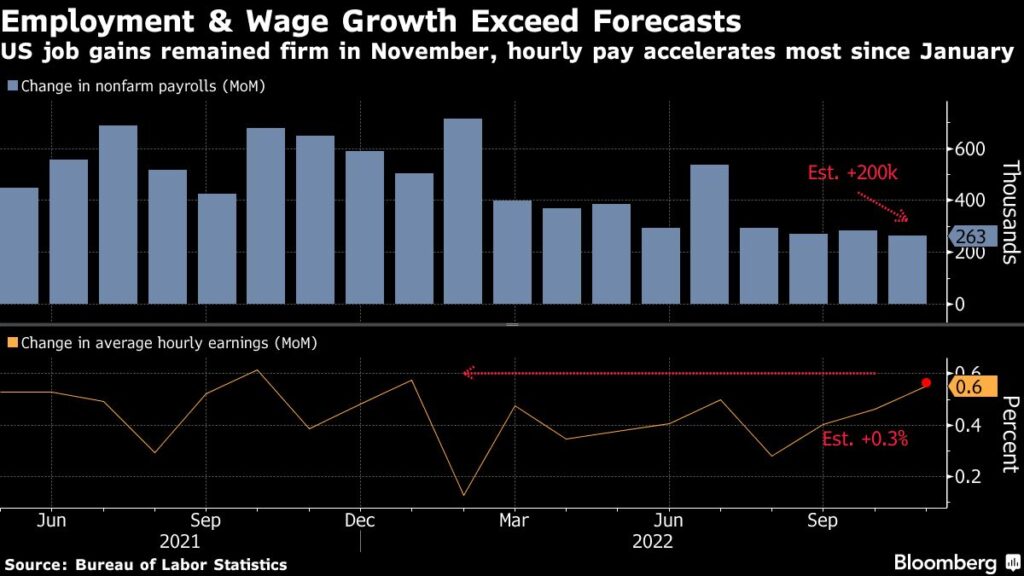

Summers was talking hours after the most recent US month-to-month jobs report confirmed an surprising bounce in common hourly earnings positive factors. He mentioned these figures showcased persevering with sturdy worth pressures within the financial system.

“For my cash, the most effective single measure of core underlying inflation is to take a look at wages,” mentioned Summers, a Harvard College professor and paid contributor to Bloomberg Tv. “My sense is that inflation goes to be somewhat extra sustained than what individuals are searching for.”

Learn Extra: Job Market Is Too Tight for Fed Consolation as Labor Pool Shrinks

Common hourly earnings rose 0.6% in November in a broad-based achieve that was the largest since January, and had been up 5.1% from a yr earlier. Wages for manufacturing and nonsupervisory staff climbed 0.7% from the prior month, essentially the most in nearly a yr.

Whereas a lot of US indicators have steered restricted affect so removed from the Fed’s tightening marketing campaign, Summers cautioned that change tends to happen immediately.

“There are all these mechanisms that kick in,” he mentioned. “At a sure level, customers run out of their financial savings after which you’ve a Wile E. Coyote sort of second,” he mentioned in reference to the cartoon character that falls off a cliff.

Within the housing market, there tends to be a sudden rush of sellers placing their properties in the marketplace when costs begin to drop, he mentioned. And “at a sure level, you see credit score drying up,” forcing reimbursement issues, he added.

“When you get right into a detrimental state of affairs, there’s an avalanche facet — and I believe now we have an actual threat that that’s going to occur in some unspecified time in the future” for the US financial system, Summers mentioned. “I don’t know when it’s going to come back,” he mentioned of a downturn. “However when it kicks in, I believe it’ll be pretty forceful.”

Inflation Goal

The previous Treasury chief additionally warned that “that is going to be a comparatively high-interest-rate recession, not just like the low-interest-rate recessions we’ve seen previously.”

Summers reiterated that he didn’t assume the Fed ought to vary its inflation goal to, say, 3%, from the present 2% — partly due to potential credibility points after having allowed inflation to surge so excessive the previous two years.

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.