(Bloomberg) — Wall Avenue is discovering a purpose to maintain plowing into the bond market, even with a Federal Reserve that’s nonetheless removed from declaring victory in its struggle in opposition to inflation.

Most Learn from Bloomberg

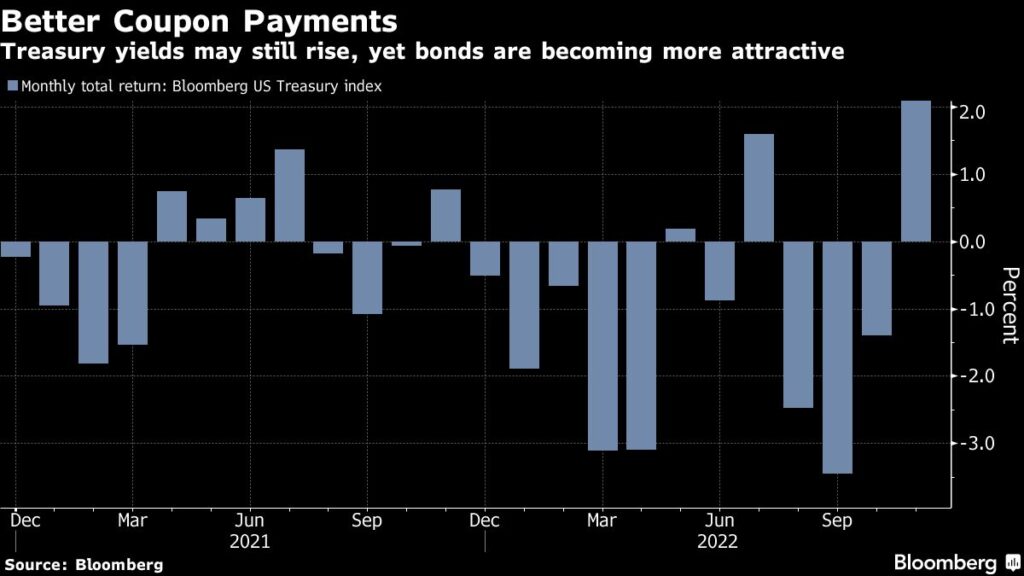

The selloff that hit traders with record-setting losses through the first 10 months of the yr additionally introduced a stark finish to an period of rock-bottom curiosity funds on Treasuries by driving yields to the best in over a decade.

These coupon funds, now over 4% on not too long ago issued 2-year and 10-year notes, have change into giant sufficient to lure in patrons and are seen as offering a buffer in opposition to future value declines. The resilience of the economic system can be strengthening the case: If the Fed must tighten financial coverage a lot that it units off a recession, Treasuries will doubtless rally as traders search someplace to cover.

“The coupon is turning into a extra significant supply of return now,” stated Jack McIntyre, a portfolio supervisor at Brandywine World Funding Administration. “The bond math is popping right into a tailwind.”

The bond market gained assist Wednesday when Fed Chair Jerome Powell indicated that the central financial institution its more likely to gradual the tempo of its charge hikes on the Dec. 13-14 assembly.

The feedback added gas to a rally that started earlier in November after the speed of consumer-price inflation slowed. That despatched a Bloomberg index of Treasuries to a more-than 2% achieve for the month, the primary advance since July and the largest since March 2020, when the beginning of the Covid pandemic within the US spurred a rush into the most secure property.

Powell’s tempering of his hawkish tone boosted demand from traders looking for to lock in present yield ranges or shut out brief bets in opposition to bonds.

The continued shopping for drove two-year Treasury yields from as excessive as 4.55% on Wednesday to as little as 4.18% early Friday, earlier than yields edged up after a stronger-than-expected November jobs report. Additional out the curve, 5- and 10-year yields continued to dip and are holding on the lowest ranges since September.

McIntyre cautioned that the market’s unstable experience will not be over, saying indicators of persistently excessive inflation may restrict the dimensions of future rallies or push yields again up.

“Whereas inflation is coming down, it’s bought a protracted approach to go,” he stated. “We don’t know when and whether or not we want a significant recession to attain that.”

However the response Friday within the face of still-rapid employment and wage progress reveals the underlying assist the market has gotten from the surge in charges over the previous yr. That’s steadily pushed up the coupon funds on the bonds the Treasury Division sells at public sale.

“The development of upper charges is unquestionably not going to go away in a single day,” stated Kathryn Kaminski, chief analysis strategist and portfolio supervisor at AlphaSimplex Group, whose public mutual fund is net-short fastened revenue and up greater than 34% this yr. “However we have now seen volatility regularly rising all year long. So the relative power of the bearish sign relative to volatility has change into much less sturdy.”

Furthermore, there have been further indicators of weakening progress and easing inflationary pressures. The patron value gauge focused by the Fed rose at a slower-than-anticipated tempo in October, a report out Thursday confirmed.

Within the coming week, traders will watch information on the service economic system, producer costs, and inflation expectations for additional indicators of how charge hikes are affecting the economic system. Fed coverage makers gained’t be talking forward of the mid-December assembly, when the central financial institution will replace its financial projections.

Expectations that tighter financial coverage will gradual the economic system have pushed the longest-dated bonds to the largest good points since early November, with 30-year yields falling once more Friday. However short-dated securities have additionally superior over the previous month, highlighting the enchantment of the upper coupon funds to traders seeking to eke out a return till they mature.

“We do hear that advisers on the retail aspect are joyful to place shoppers right into a 4% yielding funding for the following two years,” stated Scott Solomon, affiliate portfolio supervisor at T. Rowe Value.

What to Watch

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.