WTI and Brent crude oil costs fell for a 3rd straight session on Tuesday, with the U.S. benchmark now at its lowest degree in a yr. Entrance-month Nymex crude for January supply closed the day -3.5% to $74.25/bbl, its lowest in practically a yr, whereas February Brent crude completed -4% to $79.35/bbl, its weakest shut since January 3. It’s now clear that the broader market selloff and worries about extra aggressive financial tightening by the Federal Reserve have overshadowed any constructive impact from the brand new worth cap on Russian oil gross sales.

Oil merchants have been anxiously ready to see how the worth cap on Russian oil will have an effect on the market, however the measure is but to affect costs.

In the meantime, information launched on Monday confirmed the U.S. ISM service sector index climbed barely to 56.5% in November from 54.4% in October, which “triggered purple flashing indicators the Federal Reserve might hold rates of interest increased for longer, growing the percentages of a U.S. recession and fewer vitality use,’’ Stephen Innes, managing accomplice at SPI Asset Administration, has informed Morningstar. The ISM surveys non-manufacturing (or providers) corporations’ buying and provide executives. The providers report measures enterprise exercise for the general economic system; above 50 signifies progress, whereas beneath 50 signifies contraction.

Bearish Oil Worth Sentiment

So, simply how bearish has sentiment turn into within the oil markets?

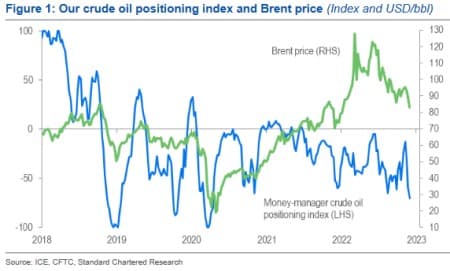

In line with commodity analysts at Normal Chartered, speculative positioning in crude oil has been unremarkable via most of 2022, however has modified in latest weeks. The analysts have revealed that their proprietary crude oil money-manager positioning index that compares internet longs throughout the 4 most important New York and London-based crude contracts relative to open curiosity and historic norms is presently extra detrimental than these for all different commodities they monitor. StanChart says that In latest months, crude oil has remained near the underside of the rating of metals and vitality by way of implied constructive speculative choice, whereas gasoline has been near the highest.

StanChart’s crude oil index presently stands at -70.3, the bottom since mid-April

2020 (a couple of week earlier than WTI costs settled at a detrimental worth). The index has now fallen

by 57.4 over the previous three weeks marking the biggest three-week fall since February

2020, simply earlier than the short-term collapse of the OPEC+ settlement.

Supply: Normal Chartered

Nonetheless, StanChart says the scenario this time round may be very totally different from what it was throughout the historic oil worth collapse of 2020, which is prone to restrict the draw back on oil costs. For one, the analysts observe that oil market fundamentals are much more supportive this time than they had been in early 2020; demand isn’t about to break down resulting from a pandemic and no worth wars by producers are current in the intervening time.

The specialists say that oil costs are caught within the backwash from top-down macro trades with each constructive and detrimental information on the financial entrance triggering selloffs.

In line with StanChart, detrimental U.S. financial information factors are triggering an oil worth selloff resulting from recessionary fears; nonetheless, constructive information factors are, satirically, having an identical impact because of the strengthening of the U.S. greenback.

Additional, sentiment had been buoyed by hopes of China reopening, however as timescales dragged many merchants have most popular to wager extra within the metals markets as a substitute.

Fortunately for the oil bulls, the commodity specialists say the brand new shorts are comparatively weak and can quickly be lined, serving to to shore up oil, although within the short-term the market is prone to intensify the detrimental.

Relating to the worth cap on Russian sea-borne oil, StanChart has predicted that it’ll have little impact on oil costs. The analysts observe that China, India, and Turkey are the three key swing

customers of Russian oil and none has but prompt that they might contemplate signing as much as the cap. With out the participation of these three nations, the quantity of Russian oil prone to transfer topic to the cap would probably be small even when Russia agreed to promote oil below these phrases (which it has repeatedly mentioned it is not going to).

The large query right here by way of market affect is then whether or not Russia can transport oil to its main customers (together with offering ample insurance coverage) with out utilizing EU or different G7 providers. StanChart says that Russia has acquired a big sufficient ‘shadow’ tanker fleet since its invasion of Ukraine that it will probably use to maneuver a lot of the displaced volumes; nonetheless, the analysts observe that the insurance coverage side is prone to trigger vital points. This has led analysts to foretell that Russian crude output is prone to fall by 1.44 million barrels per day in 2023 because of a progressive scarcity of high-quality gear and a scarcity of entry to worldwide service firms as time goes by.

By Alex Kimani for Oilprice.com

Extra Prime Reads From Oilprice.com:

Learn this text on OilPrice.com