Arizona is forging forward with its plan to divest its pension funds from BlackRock because of issues over the large funding agency’s push for environmental, social, and governance (ESG) insurance policies which have led different states to take comparable actions.

Arizona Treasurer Kimberly Yee mentioned in a press release launched Thursday that the state treasury’s Funding Threat Administration Committee (IRMC) started to evaluate the connection between the state’s pension fund and BlackRock in late 2021.

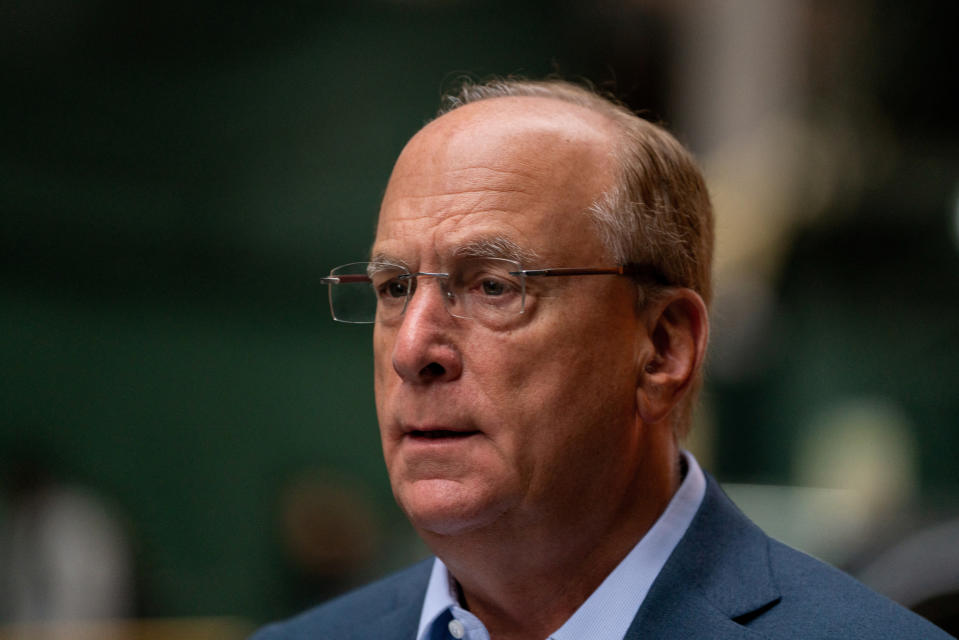

“A part of the overview by IRMC concerned studying the annual letters by CEO Larry Fink, which in recent times, started dictating to companies in the US to observe his private political views,” Yee wrote. “Briefly, BlackRock moved from a conventional asset supervisor to a political motion committee. Our inside funding crew believed this moved the agency away from its fiduciary responsibility on the whole as an asset supervisor.”

ESG FALLOUT: BLACKROCK CEO LARRY FINK SHOULD RESIGN, SAYS STATE TREASURER

In response to these findings, Yee famous that Arizona started to divest over $543 million from BlackRock cash market funds in February 2022 and “diminished our direct publicity to BlackRock by 97%” over the course of the yr. Yee added that Arizona “will proceed to cut back our remaining publicity in BlackRock over time in a phased in method that takes into consideration secure and prudent funding technique that protects the taxpayers.”

Though the state will proceed to carry some BlackRock inventory via shares in a passive index of the highest 1,500 American firms, Arizona can have “minimal direct publicity” to BlackRock amounting to “lower than 1 tenth of 1 % of our whole property beneath administration” as of the tip of November. Yee mentioned that Arizona intends to vote its shares within the index in an effort to “change the political activism of BlackRock.”

READ ON THE FOX BUSINESS APP

“We’ll proceed to battle again towards the harmful path of corporations pushing their social points and wokeism inside the funding area and return to conventional cash administration that places the individuals first,” Yee’s assertion concluded.

BLACKROCK’S ESG PUSH PUTS CEO LARRY FINK IN ACTIVIST CROSSHAIRS

BlackRock is at the moment the world’s largest asset supervisor with roughly $8 trillion beneath administration and is certainly one of a number of main monetary establishments which have led the cost for the adoption of ESG requirements in recent times. The ESG motion broadly seeks to promote a inexperienced power transition and left-wing social priorities via the monetary sector. Critics of the ESG motion argue that its concentrate on inexperienced investments runs opposite to the fiduciary accountability of corporations to pursue the very best returns for traders.

BlackRock pushed again towards criticisms of its funding technique in a press release to Fox Enterprise which learn partly: “Over the previous yr, BlackRock has been topic to campaigns suggesting we’re both ‘too progressive’ or ‘too conservative’ in how we handle our shoppers’ cash. We’re neither. We’re a fiduciary. We put our shoppers’ pursuits first and ship the funding selections and efficiency they want. We won’t let these campaigns sway us from delivering for our shoppers.”

The assertion added, “Within the U.S. alone, shoppers awarded BlackRock $84 billion of long-term internet inflows within the third quarter and $275 billion over the past twelve months.”

DESANTIS PRAISED FOR PULLING MONEY FROM BLACKROCK OVER ESG CONCERNS: ‘ILLEGAL LEFTIST SCAM’

The ESG insurance policies superior by BlackRock have drawn the ire of some traders and state policymakers alike.

Florida’s chief monetary officer introduced just lately that the state’s treasury is taking motion to take away about $2 billion in property from BlackRock’s stewardship earlier than the tip of this yr. In October, Louisiana and Missouri introduced they might reallocate state pension funds away from BlackRock, which amounted to roughly $1.3 billion in mixed property. Taken along with Arizona’s divestment, roughly $3.8 billion in state pension funds have been divested from BlackRock by these 4 states alone.

Moreover, North Carolina’s state treasurer has referred to as for BlackRock CEO Larry Fink’s resignation and the Texas legislature has subpoenaed BlackRock for monetary paperwork.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The funding agency has additionally taken warmth from activists who argue BlackRock is not doing sufficient to observe via with its ESG commitments. New York Metropolis Comptroller Brad Lander wrote to Fink in September citing an “alarming” contradiction between the corporate’s phrases and its deeds. Lander wrote, “BlackRock can not concurrently declare that local weather danger is a systemic monetary danger and argue that BlackRock has no position in mitigating the dangers that local weather change poses to its investments by supporting decarbonization in the actual financial system.”

BlackRock has insisted that its “position within the transition is as a fiduciary to our shoppers,” and “to assist them navigate funding dangers and alternatives, to not engineer a particular decarbonization final result in the actual financial system.”

Fox Enterprise’ Breck Dumas contributed to this story.