A possible bounce for overwhelmed down Tesla Inc. shares might be worthwhile for short-term merchants, however in all probability doesn’t argue for a long-term funding, a extensively adopted technical analyst stated in a Wednesday observe.

“I’ve little curiosity in TSLA proper now as an funding. It’s overvalued and run by a CEO who clearly has different priorities and who has successfully turn into public enemy primary to a lot of its potential buyer base,” stated Andrew Adams in a observe for Saut Technique, referring to Tesla

TSLA,

Chief Govt Elon Musk.

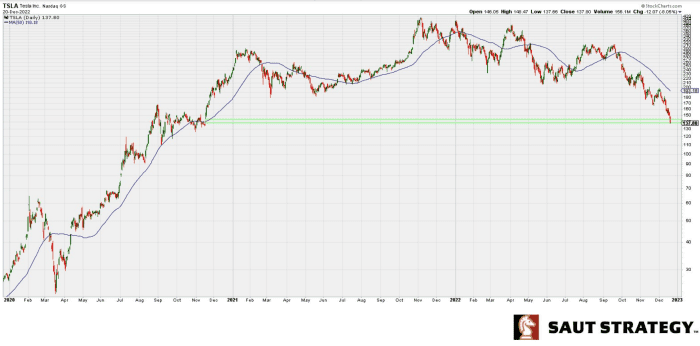

“Nonetheless, I don’t suppose there has ever been a time when sentiment on TSLA was worse and yesterday it principally crammed a spot from again in late 2020 round $136. Its 50-day transferring common is approach up at $193 so there may be room for a reversion to the imply transfer even when TSLA finally falls extra,” he wrote (see chart beneath).

Saut Technique

Learn: Tesla inventory closes decrease than $150 for first time in additional than two years as analysts say they will’t ignore Elon Musk’s Twitter ‘nightmare’ anymore

Tesla shares had been up 0.3% close to $138 in afternoon commerce, on observe to snap a three-day dropping streak. The corporate is planning one other spherical of layoffs for the primary quarter and is instituting a hiring freeze, Electrek reported on Wednesday, citing an individual accustomed to the matter.

See: Tesla inventory appears to interrupt dropping streak after report of hiring freeze, layoff plans

The choice, the report famous, would observe intensive development for the corporate and a 61% drop for Tesla shares n the 12 months up to now. The inventory has tumbled in latest months after Musk ultimately bought social-media platform Twitter Inc. Controversy adopted Musk’s takeover, prompting criticism that he isn’t spending sufficient time minding Tesla.

Tesla is likely one of the greatest year-to-date decliners within the S&P 500

SPX,

which is down practically 19% over the identical stretch.

Adams stated that one among his higher trades of 2022 “was mentioning Tesla as a brief again in September close to its response excessive,” a name that has been adopted by “reader after reader” asking the place they need to think about shopping for it once more.

“The actual fact that so many had been wanting to purchase it gave me pause, however I’ve now coated my brief and yesterday dipped [my] toe in on the lengthy aspect for a really small commerce solely,” he wrote. “Under $126 I’d have little interest in it, however I determine risking round $10 to doubtlessly make greater than that on a bounce is an efficient sufficient danger vs. reward.”