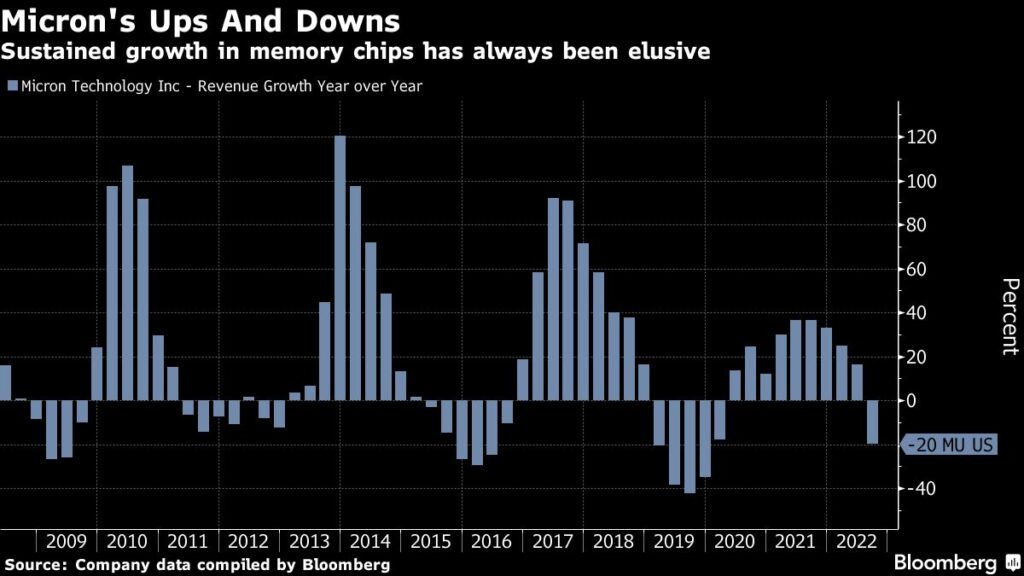

(Bloomberg) — Micron Expertise Inc., the biggest US maker of reminiscence chips, stated the worst business glut in additional than a decade will make it troublesome to return to profitability in 2023.

Most Learn from Bloomberg

The corporate on Wednesday introduced a bunch of cost-cutting measures, together with a ten% workforce discount, geared toward serving to it climate a fast drop in income. Micron additionally projected a steep gross sales decline and a wider loss than analysts had estimated for the present quarter.

Semiconductor makers are within the midst of plummeting demand for his or her merchandise lower than a 12 months after being unable to supply sufficient to fulfill orders. Customers have shelved purchases of private computer systems and smartphones amid rising inflation and an unsure economic system. Makers of these units, the primary consumers of reminiscence chips, at the moment are caught with stockpiles of elements and are slowing orders for brand spanking new inventory.

The business is experiencing its worst imbalance between provide and demand in 13 years, in response to Micron Chief Government Officer Sanjay Mehrotra. Stock ought to peak within the present interval, then decline, he stated. Prospects will transfer to extra wholesome stock ranges by concerning the center of 2023, and the chipmaker’s income will enhance within the second half of the 12 months, Mehrotra stated.

“Profitability can be challenged all through 2023 due to the oversupply that exists within the business,” he stated in an interview. “The speed and tempo of the restoration when it comes to profitability is determined by how briskly provide is introduced into line.”

Mehrotra stated a singular convergence of circumstances — the struggle in Ukraine, a surge in inflation, Covid and provide disruptions — has thrust the reminiscence chip business right into a repeat of previous cycles when costs plummeted and worn out income. Micron has responded aggressively to attempt to shortly get by way of the troublesome interval. One the downturn is over, the business will resume worthwhile progress helped by demand for synthetic intelligence computing and automation of varied industries, he stated.

Micron, which had already introduced manufacturing unit output reductions, is reducing its finances for brand spanking new vegetation and gear, and now expects to spend from $7 billion to $7.5 billion for the fiscal 12 months, a decline from an earlier goal of as a lot as $12 billion. The corporate is slowing the introduction of extra superior manufacturing methods and predicts that spending on new manufacturing will fall all through the business.

Not like different components of the chip sector, merchandise from Micron are constructed to business requirements, that means they are often swapped out for these of its rivals. As a result of reminiscence might be traded like a commodity, its makers are uncovered to extra pronounced worth swings.

Micron’s pledge to cut back output from its factories and sluggish enlargement tasks received’t ease the glut of chips accessible until rivals, together with Samsung Electronics Co. and SK Hynix Inc., comply with go well with. That step may help help costs however comes with the penalty of working costly vegetation at lower than full capability, one thing that may weigh closely on profitability.

Along with its deliberate workforce reductions, the corporate has suspended share repurchases, is reducing government salaries and can skip companywide bonus funds, executives stated on a convention name after its outcomes had been launched.

Micron stated gross sales can be about $3.8 billion within the fiscal second quarter. That compares with analysts’ common estimate of $3.88 billion, in response to knowledge compiled by Bloomberg. The corporate projected a lack of about 62 cents a share, excluding sure objects, within the interval ending in February, in contrast with a lack of 29 cents anticipated by analysts.

Within the three months ended Dec. 1, Micron’s income declined 47% to $4.09 billion. The corporate had a lack of 4 cents a share, excluding sure objects. That compares with a median estimate of a lack of 1 cent a share on gross sales of $4.13 billion.

Micron’s shares declined about 2% in prolonged buying and selling after closing at $51.19 in New York. The inventory has dropped 45% this 12 months, a worst decline than most chip-related equities. The Philadelphia Inventory Trade Semiconductor Index is down 33% in 2022.

Final month the corporate warned it was reducing manufacturing by about 20% “in response to market situations.” Boise, Idaho-based Micron had 48,000 staff as of Sept. 1, in response to filings.

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.