(Bloomberg) — China’s economic system continued to gradual in December as the large Covid-19 outbreak unfold throughout the nation, with exercise slumping as extra folks keep residence to try to keep away from getting sick or to get well.

Most Learn from Bloomberg

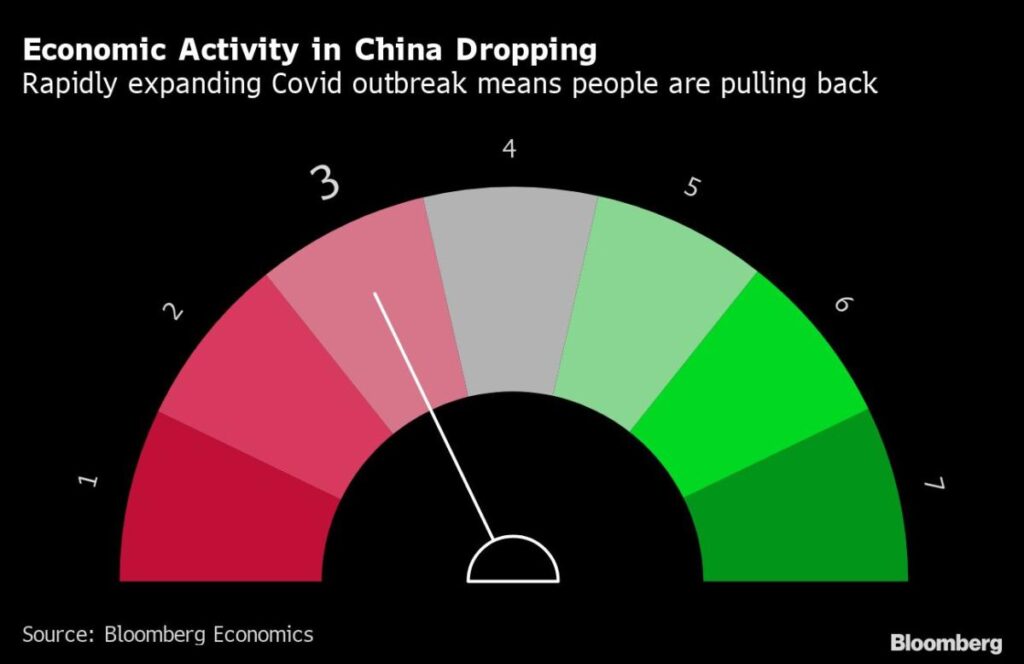

Bloomberg’s combination index of eight early indicators confirmed a contraction in exercise in December from an already weak tempo in November and the outlook is grim for the brand new yr.

Though there’s no dependable information on the extent of the unfold of the virus or the variety of sick and lifeless now, it had reached each province earlier than the top of intensive and common testing. The canceling of virtually all home restrictions now means the virus can flow into freely.

Even earlier than the curbs had been lifted, China’s economic system was struggling, with a stoop in client spending deepening and industrial output rising the slowest for the reason that spring lockdowns.

The scenario was even worse for retailers and eating places in Beijing than it was throughout the nation as an entire, with retail gross sales within the metropolis dropping virtually 18% in November as each instances and restrictions within the capital elevated.

Nonetheless although folks are actually free to maneuver round there’s been little rebound in motion to this point this month, in line with high-frequency information on subway and highway utilization.

The three.6 million journeys made on the Beijing subway final Thursday had been 70% under the extent on the identical day in 2019, and visitors congestion on the town’s streets was solely 30% of the extent in January 2021, in line with BloombergNEF. Different main cities akin to Chongqing, Guangzhou, Shanghai, Tianjin and Wuhan are seeing an identical drop.

That appears to be impacting residence and automobile gross sales, which each fell within the first weeks of this month. Automobile gross sales had been supported by authorities subsidies and had been a vibrant spot for client spending this yr, however started dropping final month as customers pulled again. That in flip hit industrial output, with manufacturing of automobiles dropping for the primary time since Could, when many factories had been pressured to shut.

Nonetheless in contrast to within the spring when it was the Covid Zero coverage which induced a scarcity of automobile components and shuttered some vegetation, now it’s the virus itself which is impacting manufacturing, with corporations having to cope with extra employees getting sick.

The unfold of the virus throughout China has undermined the preliminary euphoria seen within the inventory and commodity markets on the reopening. The Shanghai Composite Index has fallen again close to the extent it was at simply earlier than authorities began enjoyable curbs on Nov. 11 and has dropped for the previous two weeks.

The value of iron ore was additionally headed for a modest weekly drop as a surge in Covid instances clouded the near-term demand outlook and undermined the impact of latest bulletins of assist for the real-estate sector. Chinese language metal mills are presently decreasing manufacturing, Guangfa Futures stated in a observe, with information from an trade affiliation displaying output falling and stockpiles rising in the midst of this month.

The drop in markets mirrors the poor confidence amongst small companies, which was in contractionary territory for a 3rd straight month in December, in line with Customary Chartered Plc. Though there was a small enchancment from November, the primary indexes nonetheless confirmed smaller corporations weren’t optimistic in regards to the present scenario or the long run.

The manufacturing sector noticed some enchancment, with an increase in new orders, gross sales and manufacturing from November “doubtless reflecting the optimistic influence of the comfort of Covid management,” the agency’s economists Hunter Chan and Ding Shuang wrote within the report.

Nonetheless, “companies SMEs continued to face headwinds from weak client sentiment amid rising Covid instances,” they wrote in a report final week.

There’s little excellent news for Chinese language corporations abroad, with the drop in world commerce extending into December, in line with early Korean information. That implies that China’s exports could fall for a 3rd straight month.

The virtually 27% drop in Korean exports to China within the first 20 days of this month reveals the weak point of Chinese language demand for semiconductors, which has been falling because of a stoop in home and abroad demand for smartphones and different units.

Early Indicators

Bloomberg Economics generates the general exercise studying by aggregating a three-month weighted common of the month-to-month adjustments of eight indicators, that are based mostly on enterprise surveys or market costs.

-

Main onshore shares – CSI 300 index of A-share shares listed in Shanghai or Shenzhen (by way of market shut on the twenty fifth of the month).

-

Whole ground space of residence gross sales in China’s 4 Tier-1 cities (Beijing, Shanghai, Guangzhou and Shenzhen).

-

Stock of metal rebar, used for reinforcing in building (in 10,000 metric tons). Falling stock is an indication of rising demand.

-

Copper costs – Spot worth for refined copper in Shanghai market (yuan/metric ton).

-

South Korean exports – South Korean exports within the first 20 days of every month (year-on-year change).

-

Manufacturing facility inflation tracker – Bloomberg Economics-created tracker for Chinese language producer costs (year-on-year change).

-

Small and medium-sized enterprise confidence – Survey of corporations carried out by Customary Chartered.

-

Passenger automobile gross sales – Month-to-month consequence calculated from the weekly common gross sales information launched by the China Passenger Automobile Affiliation.

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.