(Bloomberg) — Shares made small good points whereas currencies have been combined in Asia on Monday amid cautious buying and selling and lowered liquidity with many markets closed for holidays.

Most Learn from Bloomberg

Benchmark fairness indexes for mainland China, Japan, India and South Korea climbed lower than 1%. Different markets together with Hong Kong, Singapore and Australia have been shut.

Urge for food for danger taking was damped by considerations over China’s skill to manage after abandoning its Covid Zero coverage. This was most evident in a drop within the Australian greenback, which is especially delicate to the outlook for demand in China.

Amid a brand new wave of infections, China’s Nationwide Well being Fee mentioned it could cease publishing each day case numbers for the coronavirus, complicating the duty for buyers attempting to evaluate the financial impression.

The yen superior versus the greenback as merchants thought of the opportunity of the Financial institution of Japan elevating rates of interest subsequent 12 months after final week’s shock adjustment to its 10-year yield goal. The euro was little modified.

Figures on Friday confirmed Japan’s key inflation gauge additional accelerated to the quickest tempo since 1981, which can help extra bets for a shift from the BOJ.

In the meantime, shares on Wall Avenue ended Friday’s session with good points as buyers digested knowledge displaying that US inflation is continuous to ease and the Federal Reserve’s price hikes are serving their function.

That supplied a level of help for Asian markets, although the S&P 500 and the tech-heavy Nasdaq 100 nonetheless suffered their third week of losses.

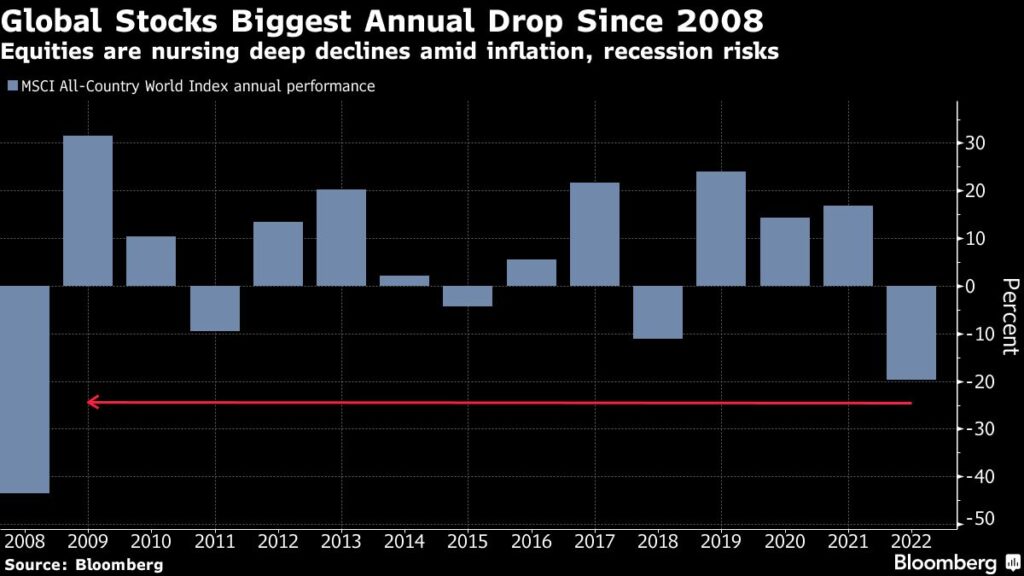

Trying throughout all of the 12 months for international equities, 2022 has been the worst annual efficiency in additional than a decade.

“The Fed has been telling us they will tighten monetary situations till a recession or one thing ‘breaks’,” Stephen Innes, managing associate at SPI Asset Administration, wrote in a be aware. “This isn’t an important place to personal speculative belongings, particularly the long-duration selection telling me in instances like this, money itself is the very best on the cash put.”

There will likely be no money buying and selling on Monday of Treasuries, which ended a holiday-shortened session decrease on Friday. The benchmark 10-year yield climbed probably the most final week since early April, ending Friday round 3.75%.

Information on Friday confirmed the Federal Reserve’s carefully watched measure of inflation cooling and shopper spending stagnating. Customers’ year-ahead inflation expectations additionally dropped this month to the bottom since June 2021, a survey by the College of Michigan confirmed.

Elsewhere in markets, Bitcoin was little modified under $17,000 on Monday because the crypto world continued to reel from the collapse of FTX.

In commodities, every little thing from oil to gold and copper rose on Friday. Oil posted a considerable weekly acquire as Russia mentioned it might lower crude manufacturing in response to the worth cap imposed by the Group of Seven on its exports, highlighting dangers to international provides within the new 12 months.

Key occasions this week:

-

China industrial earnings, Tuesday

-

US wholesale inventories, Tuesday

-

BOJ abstract of opinions of Dec. 19-20 assembly, Wednesday

-

US preliminary jobless claims, Thursday

-

ECB publishes financial bulletin, Thursday

Among the most important strikes in markets:

Shares

-

Japan’s Topix rose 0.1% as of 12:49 p.m. Tokyo time

-

South Korea’s Kospi rose 0.2%

-

The Shanghai Composite rose 0.7%

-

India’s Nifty 50 rose 0.2%

-

The S&P 500 closed 0.6% greater on Friday whereas the Nasdaq 100 rose 0.3%

Currencies

-

The euro was little modified at $1.0623

-

The Japanese yen rose 0.3% to 132.48 per greenback

-

The offshore yuan rose 0.2% to six.9881 per greenback

-

The Australian greenback fell 0.3% to $0.6702

Cryptocurrencies

-

Bitcoin rose 0.3% to $16,880.74

-

Ether rose 0.1% to $1,219.8

Bonds

Commodities

-

West Texas Intermediate crude rose 2.7% to $79.56 a barrel on Friday

-

Spot gold rose 0.3% to $1,798.20 an oz. on Friday

This story was produced with the help of Bloomberg Automation.

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.