(Bloomberg) — Shares and currencies whipsawed on Tuesday as traders gauged the well being of the Chinese language financial system and reassessed a nascent upswing in shares.

Most Learn from Bloomberg

US fairness futures fluctuated and European contracts fell after the region-wide Euro Stoxx 50 benchmark jumped 1.7% on Monday. Share markets throughout Asia seesawed in combined commerce that noticed Hong Kong and mainland China shares edge greater after early losses, whereas South Korean shares had been regular and Australian shares fell.

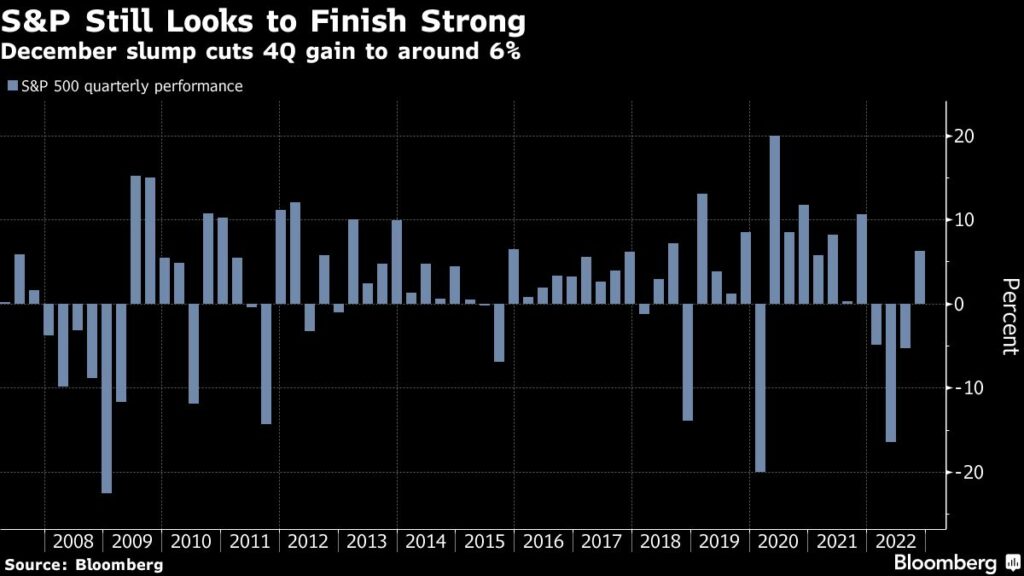

The stress dealing with shares adopted the sharp swings final yr that noticed 20% in worth wiped from international equities, the worst run for the reason that monetary disaster. Bonds misplaced 16% of worth, the most important decline since a minimum of 1990 for one main measure, as central banks hiked rates of interest to gradual inflation.

“We’re beginning the yr with tight monetary situations, a possible inflation pulse popping out of China and by extension meaning we’ll in all probability have to enter the beginning of this calendar yr comparatively cautious throughout the entire portfolio,” Marc Franklin, senior portfolio supervisor for Manulife Funding Administration, mentioned in an interview with Bloomberg Tv.

The yen strengthened as a lot as 1% in opposition to the dollar to the touch 129.52 per greenback — the best degree since Might. It gained in opposition to all its Group-of-10 friends, particularly the commodity currencies of Australia, New Zealand and Canada. The advance follows sustained efforts by the Financial institution of Japan to depress yields on authorities debt, with the stronger yen indicating that merchants imagine the central financial institution will likely be compelled to scale back its straightforward coverage settings.

Learn extra: As Roads Cut up in 2022 Shares, One Commerce Made All of the Distinction

The greenback traded flat and there was no money Treasuries buying and selling in Asia given Japanese markets are shut Tuesday. Gold surged about 1% to above $1,840 per ounce for the primary time since June.

China’s financial system triggered traders’ concern after it ended the yr in a serious stoop as enterprise and client spending plunged in December, with extra disruption seemingly within the first few months of the yr as Covid infections surge throughout the nation.

Elsewhere in markets, oil fluctuated whereas the value of US pure gasoline fell as hotter climate was anticipated to scale back demand for heating. A personal China buying managers index contracted for the fifth consecutive month. Different knowledge on the docket for Tuesday contains German unemployment claims.

Learn extra: Treasury Strategists Count on Decrease Yields, Steeper Curve in 2023

Among the predominant strikes in markets:

Shares

-

S&P 500 futures rose 0.1% as of two:06 p.m. Tokyo time

-

Nasdaq 100 futures had been little modified

-

South Korea’s Kospi index fell 0.1%

-

Hong Kong’s Grasp Seng Index rose 1.4%

-

China’s Shanghai Composite Index rose 0.5%

-

Australia’s S&P/ASX 200 fell 1.4%

-

Euro Stoxx 50 futures fell 0.6%

Currencies

-

The Bloomberg Greenback Spot Index fell 0.1%

-

The euro was little modified at $1.0670

-

The Japanese yen rose 0.9% to 129.60 per greenback

-

The offshore yuan rose 0.6% to six.8847 per greenback

Cryptocurrencies

-

Bitcoin fell 0.4% to $16,684.22

-

Ether fell 0.5% to $1,213.44

Bonds

Commodities

-

West Texas Intermediate crude fell 0.4% to $79.92 a barrel

-

Spot gold rose 0.9% to $1,841.09 an oz

This story was produced with the help of Bloomberg Automation.

–With help from Jason Scott and Tassia Sipahutar.

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.